- Sweden

- /

- Entertainment

- /

- OM:EG7

Enad Global 7 AB (publ) (STO:EG7) May Have Run Too Fast Too Soon With Recent 31% Price Plummet

The Enad Global 7 AB (publ) (STO:EG7) share price has fared very poorly over the last month, falling by a substantial 31%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 62% loss during that time.

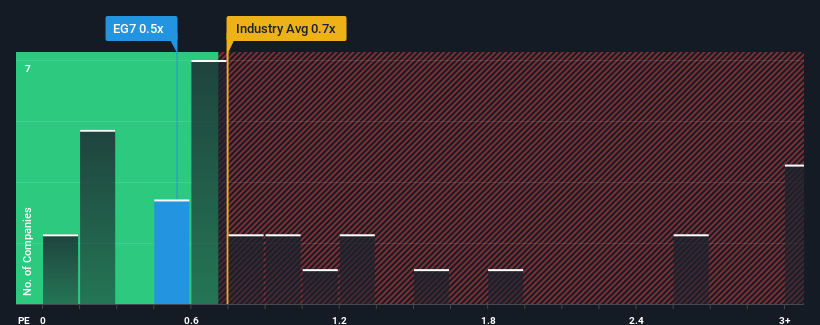

Although its price has dipped substantially, it's still not a stretch to say that Enad Global 7's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Entertainment industry in Sweden, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Enad Global 7

How Enad Global 7 Has Been Performing

Enad Global 7 could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Enad Global 7.How Is Enad Global 7's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Enad Global 7's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. This was backed up an excellent period prior to see revenue up by 231% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.4% as estimated by the sole analyst watching the company. Meanwhile, the broader industry is forecast to expand by 3.9%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Enad Global 7's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Enad Global 7's P/S

With its share price dropping off a cliff, the P/S for Enad Global 7 looks to be in line with the rest of the Entertainment industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that Enad Global 7 currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

You should always think about risks. Case in point, we've spotted 1 warning sign for Enad Global 7 you should be aware of.

If these risks are making you reconsider your opinion on Enad Global 7, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Enad Global 7 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EG7

Enad Global 7

Develops, publishes, markets, and distributes games in PC, console, and mobile platforms in Sweden, rest of Europe, North America, South America, Asia, Africa, and the Oceania.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)