Binero Group And 2 Other European Penny Stocks To Consider For Your Watchlist

Reviewed by Simply Wall St

The European market recently saw mixed performances, with the pan-European STOXX Europe 600 Index ending slightly lower as expectations for further interest rate cuts from the European Central Bank diminished. In such a climate, investors often look beyond major indices and consider alternative opportunities that might offer unique growth potential. Penny stocks, though an older term, continue to capture attention as they represent smaller or newer companies that can present significant opportunities when backed by strong financial health. Let's explore several penny stocks in Europe that stand out for their financial resilience and growth potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.484 | €1.21B | ✅ 5 ⚠️ 2 View Analysis > |

| DigiTouch (BIT:DGT) | €2.03 | €28.05M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 2 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.50 | SEK212.94M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.941 | €75.93M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €4.07 | €79.62M | ✅ 1 ⚠️ 5 View Analysis > |

| Faes Farma (BME:FAE) | €4.47 | €1.39B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.025 | €279.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.90 | €30.14M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 282 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Binero Group (OM:BINERO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Binero Group AB (publ) provides cloud and platform services across Sweden, Norway, Denmark, and Finland with a market cap of SEK286.30 million.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to SEK440.08 million.

Market Cap: SEK286.3M

Binero Group, with a market cap of SEK286.30 million, operates in the cloud and platform services sector across Scandinavia. Despite being unprofitable, it has shown revenue growth with half-year sales reaching SEK227.7 million from SEK204 million the previous year. However, it reported a net loss of SEK14.2 million compared to a profit previously. The company's debt to equity ratio increased to 48.5% over five years but maintains satisfactory net debt levels at 19.4%. Binero's short-term assets fall short of covering liabilities, and its board and management team are relatively inexperienced with average tenures under two years.

- Click to explore a detailed breakdown of our findings in Binero Group's financial health report.

- Gain insights into Binero Group's future direction by reviewing our growth report.

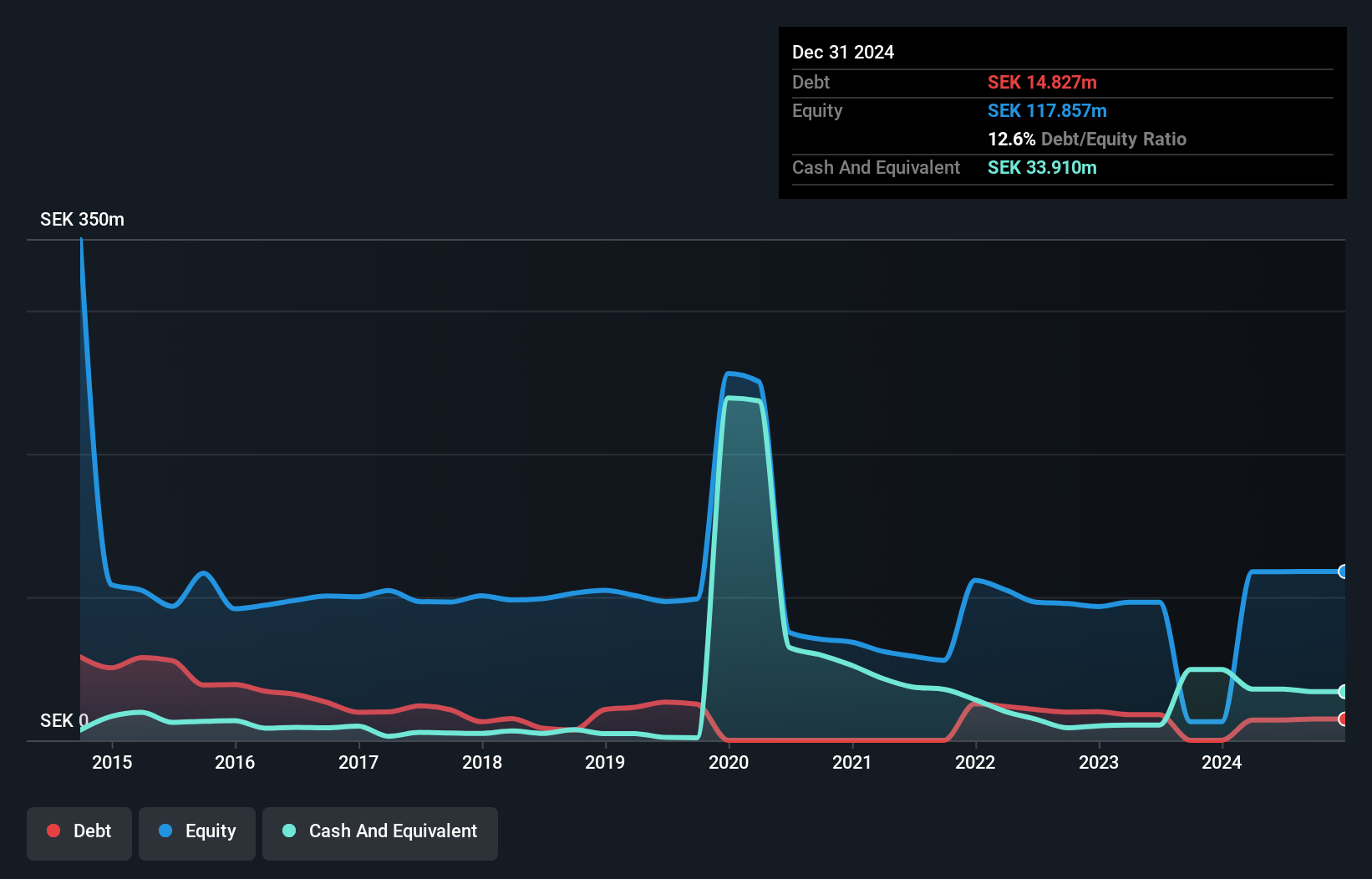

Catena Media (OM:CTM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Catena Media plc, with a market cap of SEK190.26 million, offers affiliation marketing services for online sports betting and casino operators in North America and Latin America.

Operations: The company generates revenue from two primary segments: Casino, which accounts for €31.34 million, and Sports, contributing €8.91 million.

Market Cap: SEK190.26M

Catena Media plc, with a market cap of SEK190.26 million, operates in the online sports betting and casino sectors across North America and Latin America. The company recently reported third-quarter revenue of €11.65 million, an improvement from €10.7 million a year ago, though it remains unprofitable with a net loss of €14.39 million for the quarter. Despite this, Catena Media is debt-free and has launched MRKTPLAYS.com to expand its affiliate network in North America, aiming for scalable growth through technology-driven solutions. However, both its board and management team are relatively inexperienced with average tenures under two years.

- Take a closer look at Catena Media's potential here in our financial health report.

- Understand Catena Media's track record by examining our performance history report.

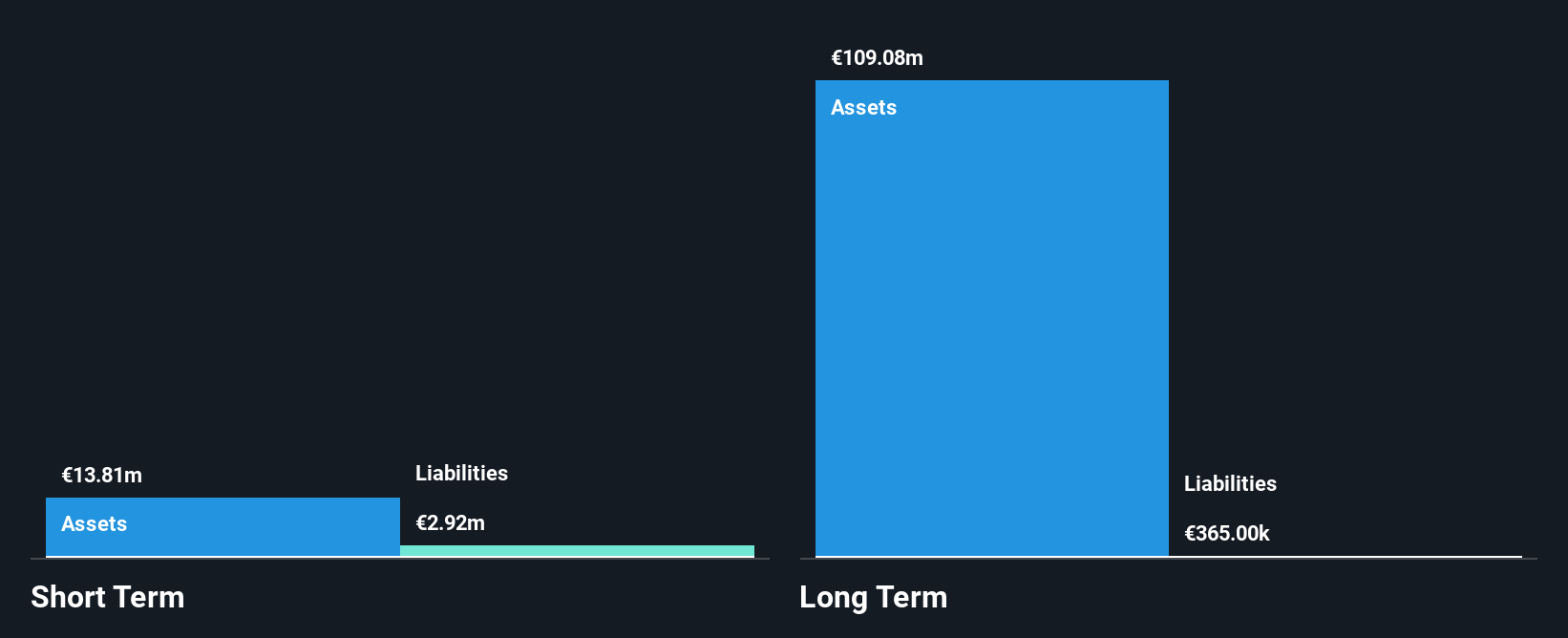

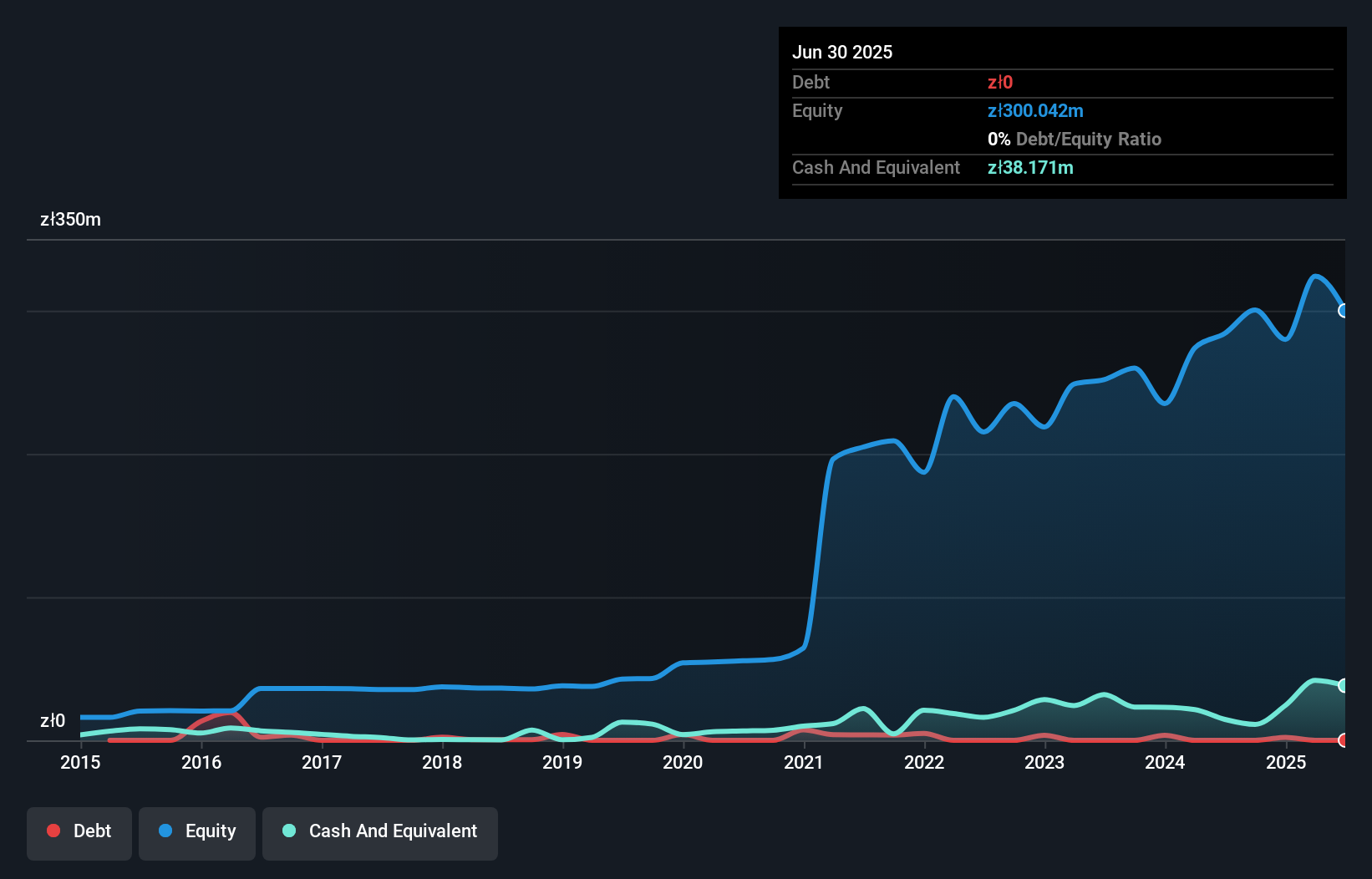

Hub.Tech (WSE:HUB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hub.Tech SA operates in the chemical industry in Poland with a market capitalization of PLN184.89 million.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to PLN212.80 million.

Market Cap: PLN184.89M

Hub.Tech SA, with a market cap of PLN184.89 million, operates in Poland's chemical industry and shows potential as a penny stock due to its solid financial footing. The company has no debt, ensuring interest payments are not a concern, and its short-term assets exceed both short- and long-term liabilities. Despite negative earnings growth over the past year and slightly lower profit margins compared to last year, Hub.Tech maintains high-quality earnings. Its board is experienced with an average tenure of 4.7 years, though recent earnings reports indicate slight revenue declines year-over-year for the second quarter of 2025.

- Get an in-depth perspective on Hub.Tech's performance by reading our balance sheet health report here.

- Assess Hub.Tech's previous results with our detailed historical performance reports.

Make It Happen

- Unlock our comprehensive list of 282 European Penny Stocks by clicking here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CTM

Catena Media

Provides affiliation marketing services for operators of online sports betting and casino platforms in North America and Latin America.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives