As the European markets experience a modest rise, buoyed by expectations of interest rate adjustments from the U.S. Federal Reserve, investors are keenly observing shifts in economic policies and their potential impacts. For those considering investments in smaller or newer companies, penny stocks—despite their somewhat outdated label—remain an intriguing option due to their affordability and growth potential. In this context, we examine several European penny stocks that exhibit financial strength and could offer promising opportunities for growth.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.29 | €1.48B | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €233.2M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.14 | PLN110.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.99 | €40.46M | ✅ 3 ⚠️ 3 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.45 | RON16.57M | ✅ 2 ⚠️ 4 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.275 | €377.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.932 | €31.43M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 332 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

StoneBeach Group (NGM:SBG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: StoneBeach Group AB (publ) offers data security services in Sweden and internationally, with a market cap of SEK22.99 million.

Operations: The company generates SEK7.73 billion in revenue from its Security Software & Services segment.

Market Cap: SEK23M

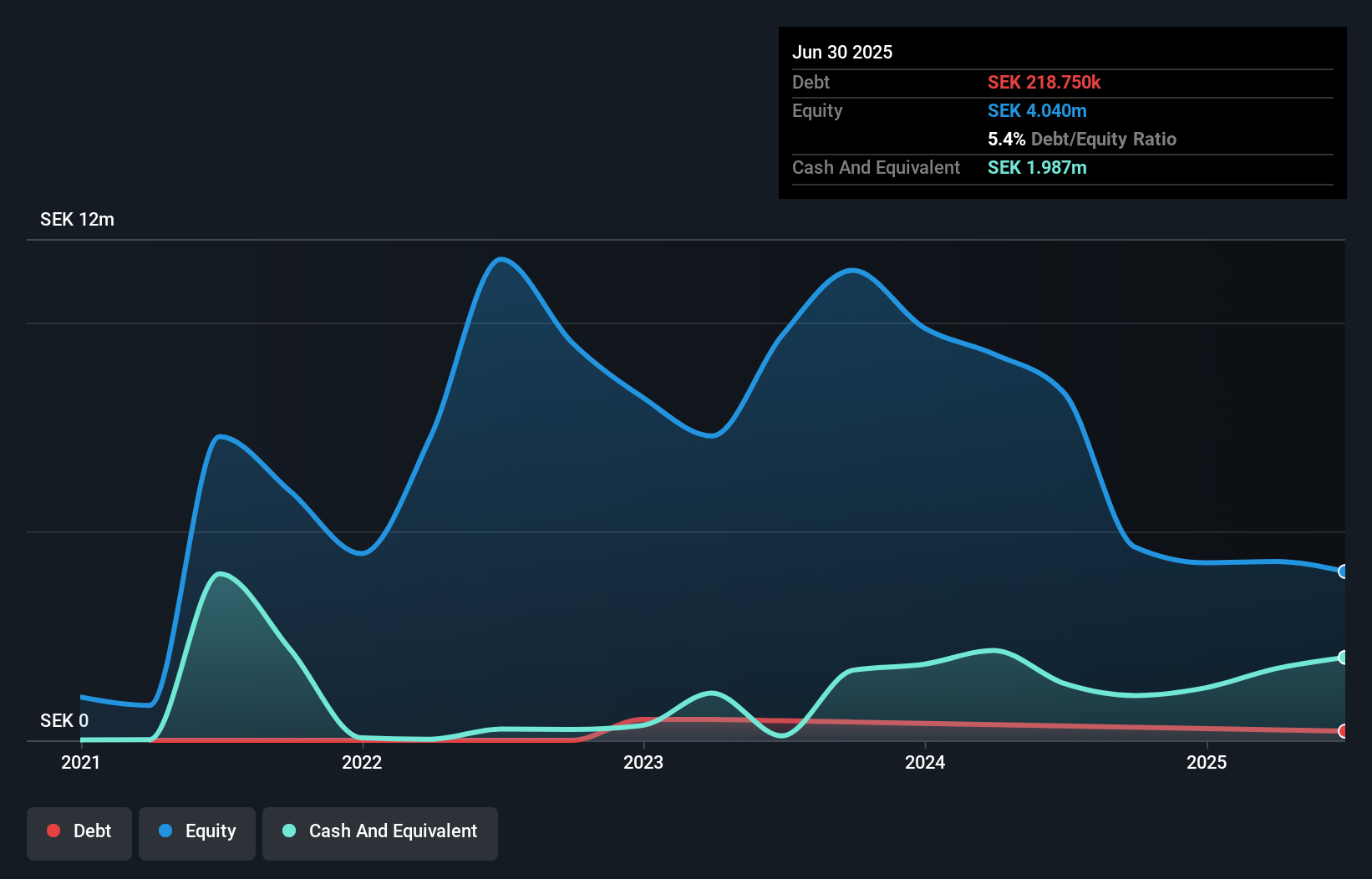

StoneBeach Group AB's recent earnings report shows a slight increase in revenue to SEK 2.08 million for Q2 2025, up from SEK 1.9 million the previous year. Despite being pre-revenue with less than US$1 million in annual revenue, the company has managed to reduce its net loss significantly over the past year. Although unprofitable, StoneBeach maintains a positive free cash flow and sufficient cash runway exceeding three years, indicating financial resilience amidst high share price volatility. The company's short-term assets comfortably cover both its short- and long-term liabilities without significant shareholder dilution or debt issues.

- Click here and access our complete financial health analysis report to understand the dynamics of StoneBeach Group.

- Explore historical data to track StoneBeach Group's performance over time in our past results report.

Alpcot Holding (OM:ALPCOT B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alpcot Holding AB (publ) operates a digital platform for personal finance in Sweden's financial industry, with a market cap of SEK177.05 million.

Operations: The company's revenue is derived from its Asset Management segment, generating SEK128 million.

Market Cap: SEK177.05M

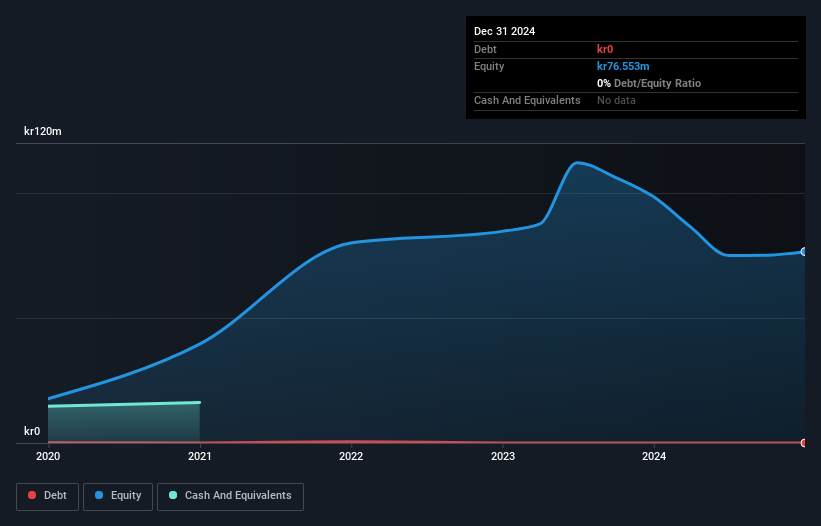

Alpcot Holding AB has transitioned to profitability over the past year, with earnings growth making direct industry comparisons challenging. Despite a low return on equity of 4.3%, the company benefits from high-quality earnings and a stable financial position, with short-term assets significantly exceeding liabilities. Alpcot's debt-free status further enhances its financial stability. Recent results for the first half of 2025 show a net income of SEK 2.83 million, marking an improvement from last year's loss, although Q2 still reported a net loss of SEK 10.3 million, reflecting ongoing challenges in achieving consistent profitability amidst management changes and market volatility.

- Jump into the full analysis health report here for a deeper understanding of Alpcot Holding.

- Review our historical performance report to gain insights into Alpcot Holding's track record.

NorCom Information Technology GmbH KGaA (XTRA:NC5A)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NorCom Information Technology GmbH & Co. KGaA develops and implements big data solutions both in Germany and internationally, with a market cap of €4.53 million.

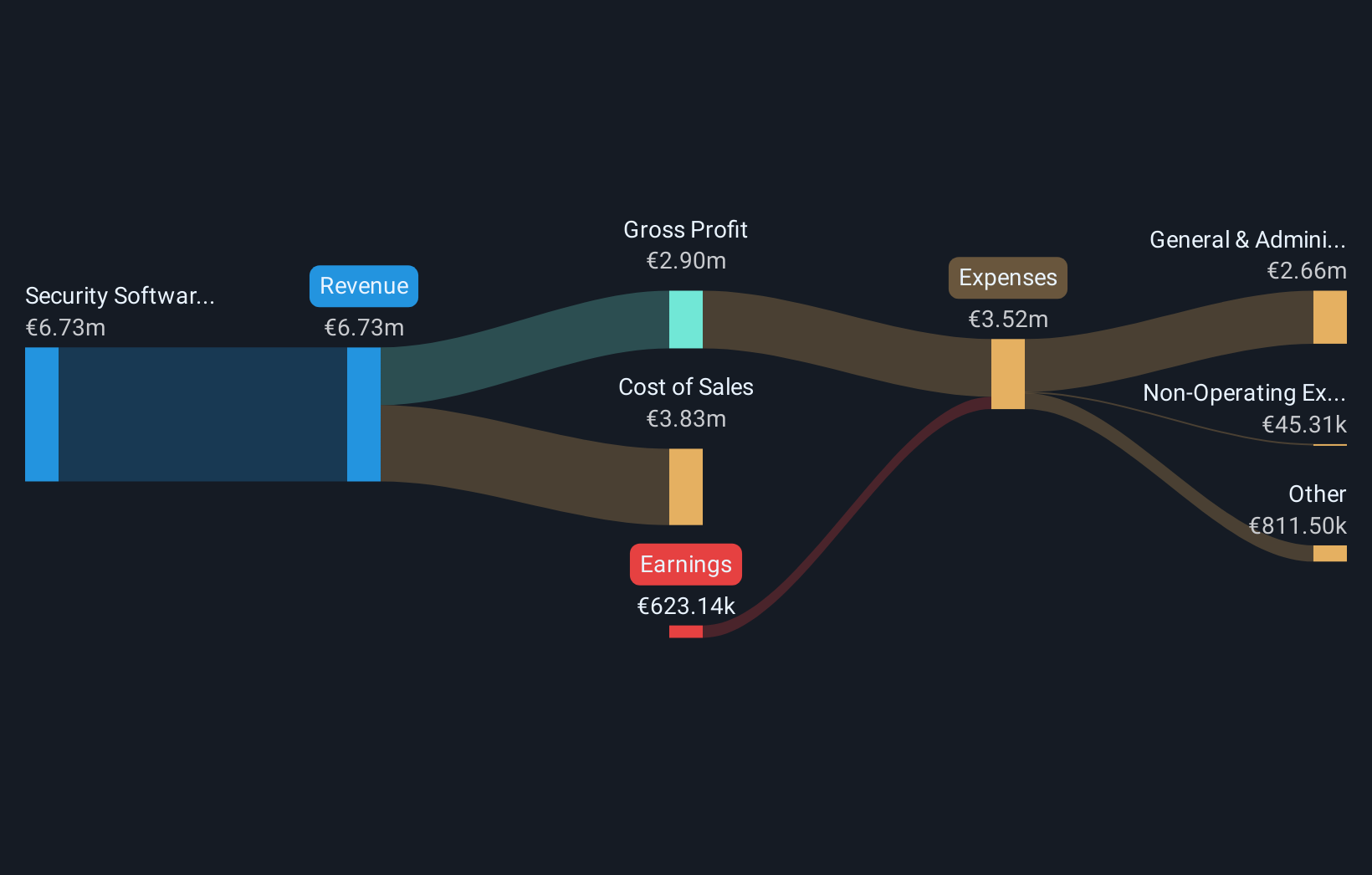

Operations: The company's revenue is derived entirely from its Security Software & Services segment, totaling €6.73 million.

Market Cap: €4.53M

NorCom Information Technology GmbH & Co. KGaA, with a market cap of €4.53 million, is experiencing financial challenges as evidenced by its recent earnings report for the half year ended June 30, 2025, which showed declining revenue of €3.23 million and a net loss of €0.60 million compared to the previous year. The company remains debt-free yet struggles with profitability and heightened share price volatility over recent months. Despite an experienced board and management team, NorCom's short-term assets do not fully cover its liabilities, posing liquidity concerns while it navigates an unprofitable landscape in the security software sector.

- Navigate through the intricacies of NorCom Information Technology GmbH KGaA with our comprehensive balance sheet health report here.

- Assess NorCom Information Technology GmbH KGaA's previous results with our detailed historical performance reports.

Summing It All Up

- Jump into our full catalog of 332 European Penny Stocks here.

- Want To Explore Some Alternatives? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:SBG

StoneBeach Group

Provides data security services in Sweden and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives