- Sweden

- /

- Paper and Forestry Products

- /

- OM:SCA B

SCA (OM:SCA B): Assessing Valuation After Q3 Earnings Show Decline in Sales and Net Income

Reviewed by Simply Wall St

Svenska Cellulosa Aktiebolaget (OM:SCA B) just released its third quarter earnings, showing lower sales and net income compared to last year. This update is catching investor attention because it could impact the stock's short-term direction.

See our latest analysis for Svenska Cellulosa Aktiebolaget.

Following the earnings update, Svenska Cellulosa Aktiebolaget's share price has seen some modest improvement recently, with a 3.7% return over the last three months. However, the year-to-date share price return remains down and the total shareholder return over the past year sits at -7.7%. These moves suggest short-term momentum is stabilizing. Investors may still be watching for signs of a sustained turnaround or ongoing challenges tied to recent financial results.

If you’re weighing what else could be driving returns this season, now’s a good opportunity to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading below analyst targets and recent results showing both challenges and resilience, investors have to decide if Svenska Cellulosa Aktiebolaget offers a bargain right now or if expectations for future growth are already reflected in the price.

Most Popular Narrative: 8.7% Undervalued

The most widely followed narrative puts Svenska Cellulosa Aktiebolaget’s fair value at SEK139 compared to the last close of SEK127.05, highlighting a perceived opportunity just above current market levels. Investors are watching to see if the catalysts behind this estimate play out in coming quarters.

The push for decarbonization and the substitution of fossil-based products is opening new markets for SCA's biofuels, biochemicals, and renewable energy products. Early signs of improved margins in liquid biofuels and tailwinds from tightening EU emissions standards and mandates (like RED III) support the view that renewables will become a larger, higher-margin component of the business, positively impacting net earnings.

Curious about the numbers driving this bullish outlook? The secret sauce lies in a future margin leap and ambitious profit projections over the next few years. Wonder what big financial bets underpin that target? Dive into the full narrative to see how the story unfolds.

Result: Fair Value of $139 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential regulatory changes or a prolonged downturn in pulp markets could quickly alter the outlook and put pressure on future performance.

Find out about the key risks to this Svenska Cellulosa Aktiebolaget narrative.

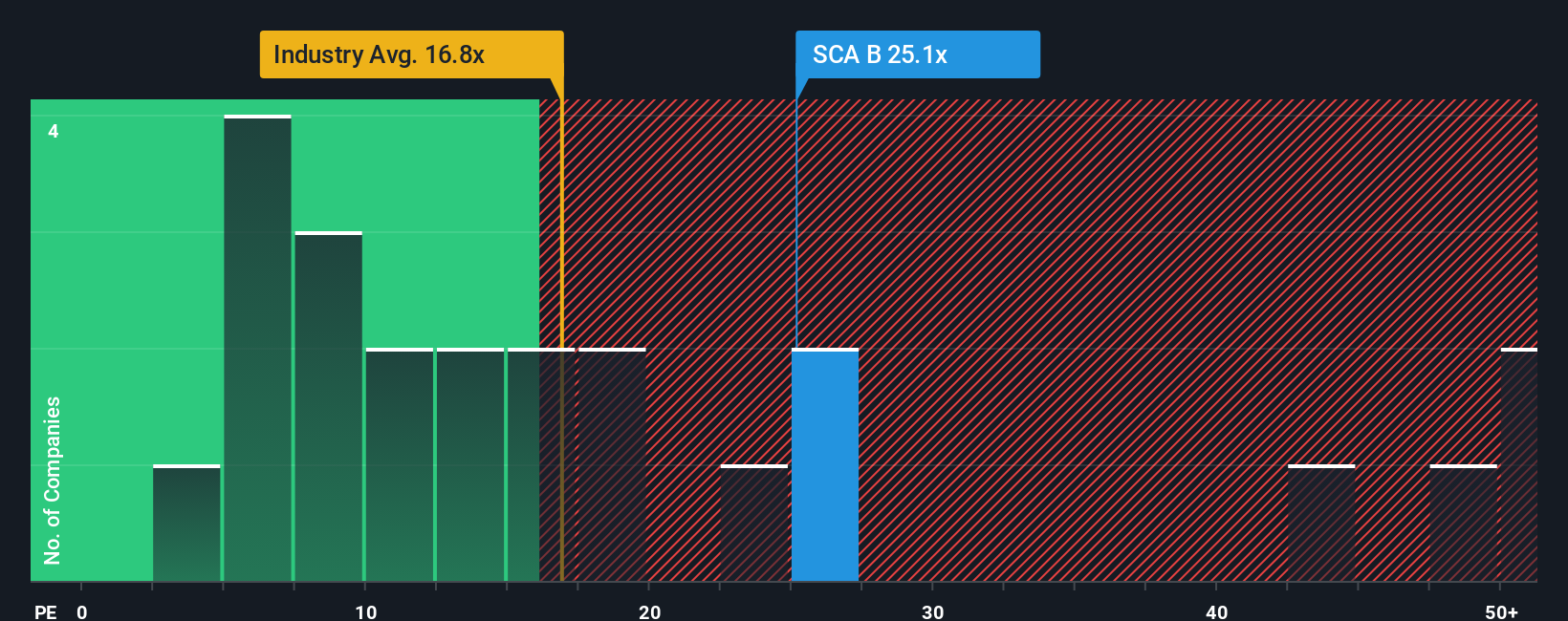

Another View: Multiples Suggest a Richer Price

Looking through a different lens, the company's price-to-earnings ratio is 25.2x. This is noticeably higher than both the industry average of 14.4x and its listed peers at 15.5x. It also sits above the fair ratio of 16.2x, pointing to a potentially pricey stock by this approach. Might the market be overvaluing its future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Svenska Cellulosa Aktiebolaget Narrative

If you'd rather chart your own course or dive deeper into the data, you can craft your own perspective in just a few minutes, so why not Do it your way

A great starting point for your Svenska Cellulosa Aktiebolaget research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to get ahead of the next big opportunity, step beyond the obvious and see what other investors are missing. With the right screeners, you can single out stocks that match your strategy and boost your confidence in every move.

- Target higher yields by checking out these 24 dividend stocks with yields > 3%, which offers robust payouts and consistent financial strength in today's market.

- Pinpoint companies riding the AI surge when you harness these 26 AI penny stocks, putting you at the leading edge of transformative tech investment.

- Lock in potential bargains by reviewing these 831 undervalued stocks based on cash flows, which the market has yet to fully appreciate, giving you a leg up on untapped value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SCA B

Svenska Cellulosa Aktiebolaget

A forest products company, develops, manufactures, and sells forest, wood, pulp, and containerboard products in Sweden, the United States, Germany, the United Kingdom, rest of Europe, Asia, and internationally.

Excellent balance sheet unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives