There's No Escaping OrganoClick AB (publ)'s (STO:ORGC) Muted Revenues Despite A 33% Share Price Rise

Despite an already strong run, OrganoClick AB (publ) (STO:ORGC) shares have been powering on, with a gain of 33% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 2.5% isn't as impressive.

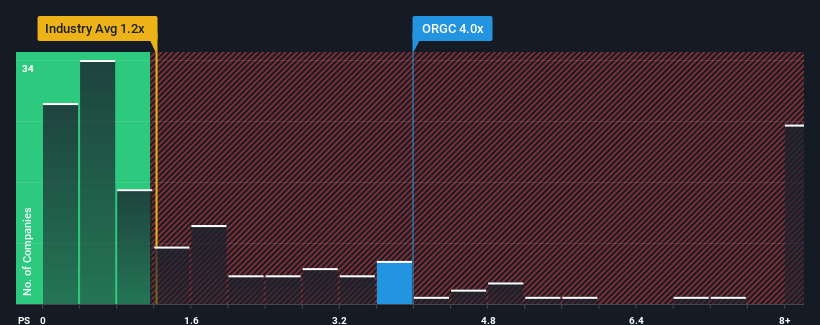

Although its price has surged higher, OrganoClick may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4x, considering almost half of all companies in the Chemicals industry in Sweden have P/S ratios greater than 8.8x and even P/S higher than 23x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for OrganoClick

What Does OrganoClick's P/S Mean For Shareholders?

OrganoClick could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on OrganoClick will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as OrganoClick's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.5% last year. This was backed up an excellent period prior to see revenue up by 35% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 26% each year over the next three years. That's shaping up to be materially lower than the 108% each year growth forecast for the broader industry.

With this in consideration, its clear as to why OrganoClick's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Even after such a strong price move, OrganoClick's P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that OrganoClick maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for OrganoClick that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ORGC

OrganoClick

A green chemical company, develops and markets biobased and biodegradable chemical products and material technologies for the treatment of nonwoven, technical textile, and wood in Sweden, Other Nordics, the Rest of Europe, Asia, North America, and Oceania.

Reasonable growth potential and fair value.

Market Insights

Community Narratives