- Sweden

- /

- Paper and Forestry Products

- /

- OM:BRG B

Should Bergs Timber (STO:BRG B) Be Disappointed With Their 39% Profit?

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market But Bergs Timber AB (publ) (STO:BRG B) has fallen short of that second goal, with a share price rise of 39% over five years, which is below the market return. Over the last twelve months the stock price has risen a very respectable 18%.

See our latest analysis for Bergs Timber

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, Bergs Timber became profitable. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

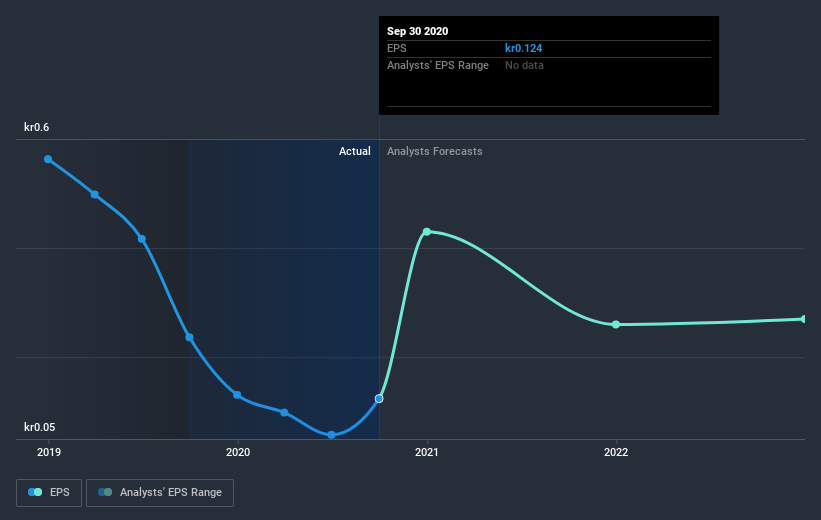

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Bergs Timber's key metrics by checking this interactive graph of Bergs Timber's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Bergs Timber's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Bergs Timber's TSR of 46% over the last 5 years is better than the share price return.

A Different Perspective

Bergs Timber provided a TSR of 18% over the year. That's fairly close to the broader market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 8% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand Bergs Timber better, we need to consider many other factors. For instance, we've identified 2 warning signs for Bergs Timber that you should be aware of.

Of course Bergs Timber may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading Bergs Timber or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bergs Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BRG B

Bergs Timber

Bergs Timber AB (publ) engages in development, production, and marketing of processed wood products in Sweden, Latvia, the United Kingdom, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026