- Sweden

- /

- Metals and Mining

- /

- OM:BOL

Boliden's (STO:BOL) Upcoming Dividend Will Be Larger Than Last Year's

The board of Boliden AB (publ) (STO:BOL) has announced that it will be increasing its dividend on the 5th of May to kr10.50. Although the dividend is now higher, the yield is only 2.1%, which is below the industry average.

View our latest analysis for Boliden

Boliden's Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Based on the last payment, Boliden was paying only paying out a fraction of earnings, but the payment was a massive 99% of cash flows. While the business may be attempting to set a balanced dividend policy, a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Over the next year, EPS is forecast to expand by 55.2%. If the dividend continues on this path, the payout ratio could be 24% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

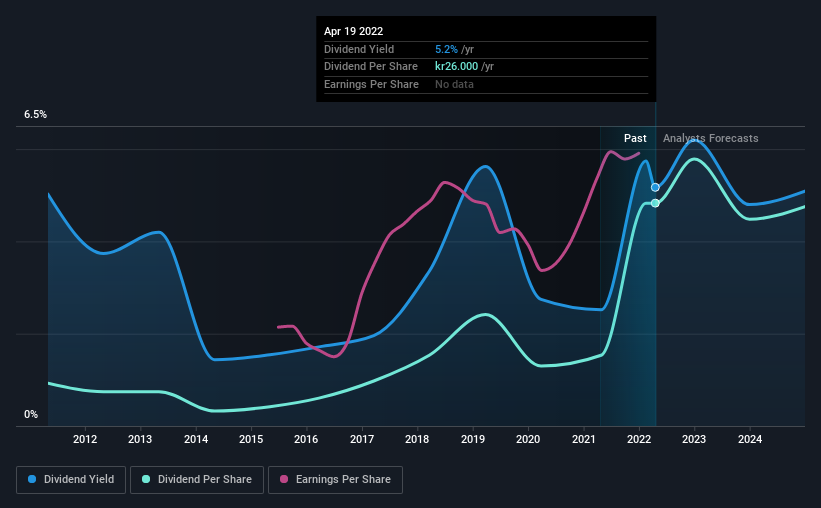

The company has a long dividend track record, but it doesn't look great with cuts in the past. The first annual payment during the last 10 years was kr5.00 in 2012, and the most recent fiscal year payment was kr26.00. This implies that the company grew its distributions at a yearly rate of about 18% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see Boliden has been growing its earnings per share at 15% a year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for Boliden's prospects of growing its dividend payments in the future.

Our Thoughts On Boliden's Dividend

In summary, while it's always good to see the dividend being raised, we don't think Boliden's payments are rock solid. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Boliden that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Boliden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BOL

Boliden

Engages in the extracting, producing, and recycling of base metals in Sweden, Finland, other Nordic region, Germany, the United Kingdom, Europe, North America, and internationally.

Undervalued with solid track record.