Billerud (OM:BILL): Assessing Valuation After Q3 Earnings Reveal Decline in Sales and Profitability

Reviewed by Simply Wall St

Billerud (OM:BILL) has published its Q3 earnings, showing a drop in sales and a shift from profit to net loss compared to last year. The results signal ongoing challenges and will be closely watched by investors.

See our latest analysis for Billerud.

Billerud’s latest Q3 results add to a year marked by changing fortunes. After drifting lower for much of 2024, the stock has staged a modest rebound recently, gaining 3.5% over the past month and 6.3% over the last 90 days. However, the year-to-date share price return remains in negative territory at -14.5%. Over the longer term, total shareholder returns show a more persistent downtrend, with a -3.7% result in the past year and -32.1% over three years. This points to momentum that is still struggling to find sustainable footing.

If you’re weighing opportunities beyond the headlines, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading below analyst targets and recent losses weighing on sentiment, the key question is whether Billerud is undervalued at these levels or if the market has already priced in any rebound in performance.

Most Popular Narrative: 13.6% Undervalued

Billerud’s current share price of SEK87.95 sits well below the narrative’s fair value estimate of SEK101.8. This sets up a compelling debate about where future earnings and market shifts could take the stock next.

Strong and growing customer interest in the North American market for domestically produced, high-quality fiber-based packaging is leading to long-term customer relationships and recurring contracts. This trend could improve both revenue visibility and margin stability over the coming years.

Curious what assumptions make analysts place such a premium on Billerud’s turnaround? There is one dominant financial forecast underpinning this fair value, and it is a number you will want to see for yourself. Dig deeper to discover which bold projections justify this narrative’s optimism.

Result: Fair Value of SEK101.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand in Europe or execution risks in North America could quickly undermine Billerud’s path to stable growth and improved margins.

Find out about the key risks to this Billerud narrative.

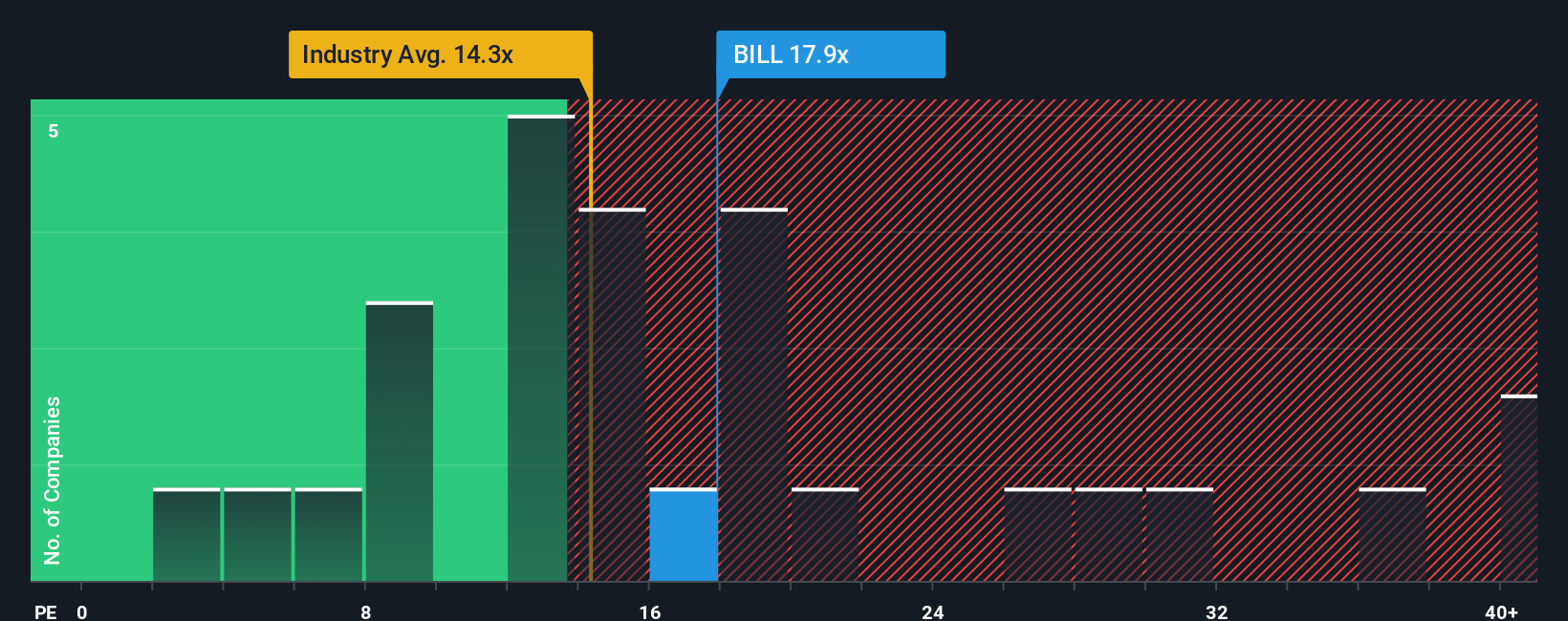

Another View: Multiples Tell a Different Story

Looking through the lens of earnings multiples, Billerud’s shares trade at 18x, which is more expensive than both the global industry average of 15.7x and the peer group average of 17.8x. While the fair ratio is 25.2x, the current gap highlights both valuation risk and potential upside if sentiment shifts. Does this premium reflect real opportunity, or could it limit future gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Billerud Narrative

If you see things differently or want to dig into the numbers on your own terms, you can craft a fresh perspective in under three minutes. Do it your way

A great starting point for your Billerud research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Stay ahead by checking out handpicked investment angles you might be missing. Don’t limit your research; these screens could reveal your next winning idea.

- Catch the next wave of innovation by reviewing these 26 AI penny stocks, which are driving the AI revolution with real-world applications and rapid growth potential.

- Maximize income potential by browsing these 22 dividend stocks with yields > 3%, which offer attractive yields above 3 percent for investors seeking stronger cash flows in any environment.

- Uncover hidden value with these 832 undervalued stocks based on cash flows, selected for their strong fundamentals and excellent pricing compared to future cash flow expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Billerud might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BILL

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives