- Sweden

- /

- Construction

- /

- OM:NYAB

Billerud And 2 Other Swedish Stocks Possibly Trading Below Fair Value

Reviewed by Simply Wall St

The Swedish stock market has shown resilience amid recent economic fluctuations, with the pan-European STOXX Europe 600 Index ending the week 1.85% higher following an interest rate cut from the European Central Bank. As investors navigate these shifting conditions, identifying undervalued stocks can be a strategic approach to potentially capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK40.40 | SEK79.91 | 49.4% |

| Husqvarna (OM:HUSQ B) | SEK65.60 | SEK130.16 | 49.6% |

| QleanAir (OM:QAIR) | SEK27.00 | SEK51.47 | 47.5% |

| Biotage (OM:BIOT) | SEK183.70 | SEK361.21 | 49.1% |

| Stille (OM:STIL) | SEK222.00 | SEK439.82 | 49.5% |

| Lindab International (OM:LIAB) | SEK265.00 | SEK522.68 | 49.3% |

| Litium (OM:LITI) | SEK8.30 | SEK16.42 | 49.5% |

| Tourn International (OM:TOURN) | SEK8.26 | SEK16.50 | 49.9% |

| Mentice (OM:MNTC) | SEK27.50 | SEK50.98 | 46.1% |

| MilDef Group (OM:MILDEF) | SEK84.50 | SEK161.28 | 47.6% |

Let's dive into some prime choices out of the screener.

Billerud (OM:BILL)

Overview: Billerud AB (publ) is a global provider of paper and packaging materials with a market cap of SEK26.16 billion.

Operations: The company generates revenue from several segments, including SEK27.08 billion from Region Europe, SEK11.35 billion from Region North America, and SEK2.77 billion from Solution & Other (excluding currency hedging).

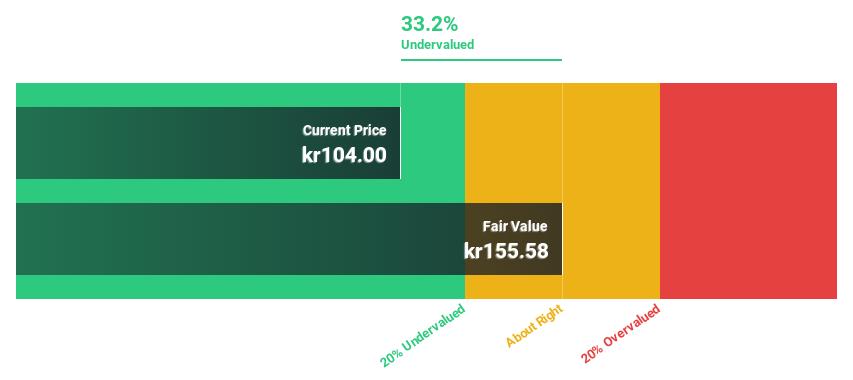

Estimated Discount To Fair Value: 32.5%

Billerud AB is trading 32.5% below its estimated fair value, with a discounted cash flow valuation of SEK 105.2 against an estimated fair value of SEK 155.85. Recent earnings show significant improvement, with Q2 net income at SEK 63 million compared to a net loss last year and six-month net income rising to SEK 376 million from SEK 158 million. Despite lower profit margins and unstable dividends, analysts forecast annual profit growth of 31.7%, outpacing the Swedish market's expected growth rate.

- Our growth report here indicates Billerud may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Billerud.

MilDef Group (OM:MILDEF)

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions and special electronics primarily for the security and defense sectors, with a market cap of SEK3.37 billion.

Operations: The company generates revenue of SEK1.11 billion from its Computer Hardware segment.

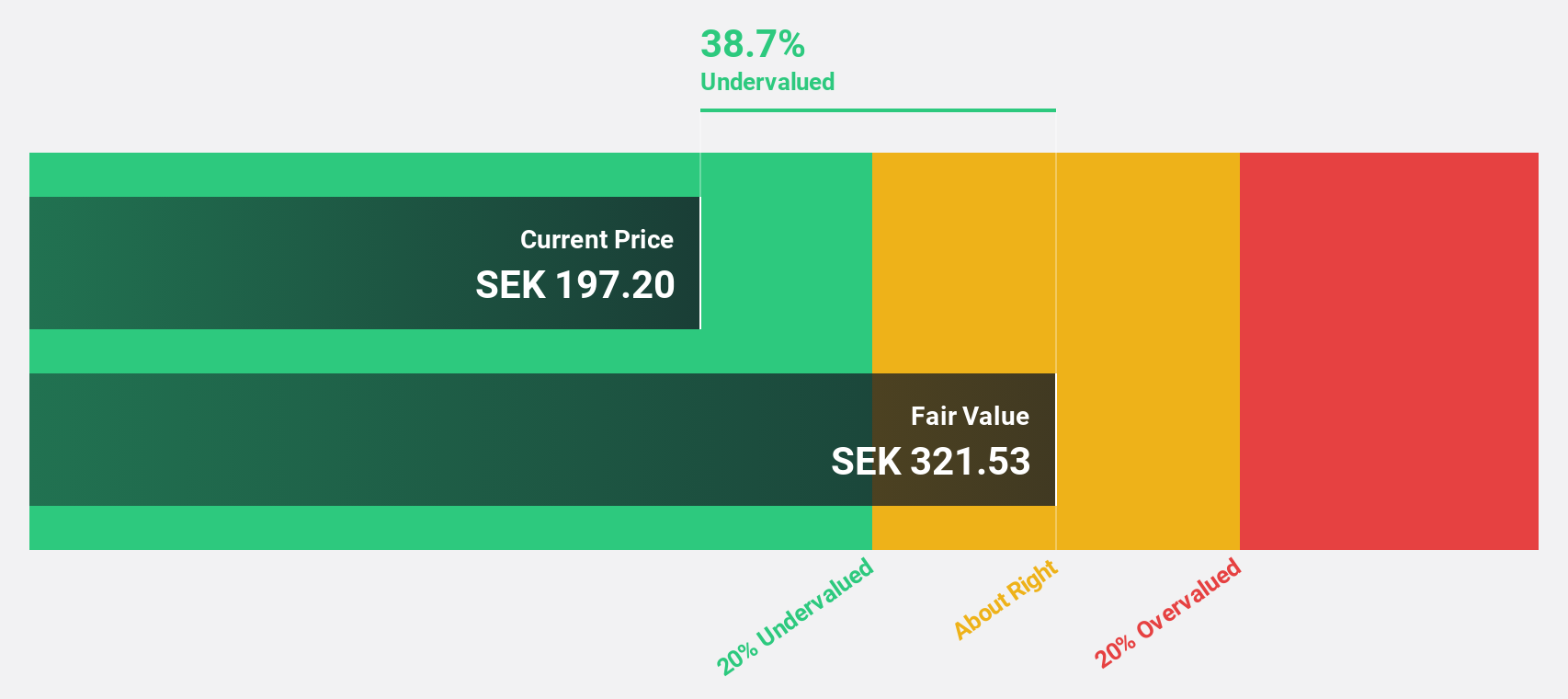

Estimated Discount To Fair Value: 47.6%

MilDef Group is trading at SEK 84.5, significantly below its estimated fair value of SEK 161.28, suggesting it may be undervalued based on cash flows. The company forecasts robust earnings growth of 47% annually over the next three years, outpacing the Swedish market's expected growth rate. Recent contracts with the Norwegian Defence Materiel Agency and BAE Systems Bofors bolster revenue prospects, though profit margins have declined from 6.2% to 3.9% year-over-year.

- Our earnings growth report unveils the potential for significant increases in MilDef Group's future results.

- Click to explore a detailed breakdown of our findings in MilDef Group's balance sheet health report.

Nyab (OM:NYAB)

Overview: Nyab AB (publ) offers engineering, construction, and maintenance services for energy, infrastructure, and industrial projects in Finland and Sweden with a market cap of SEK4.51 billion.

Operations: The company's revenue from Heavy Construction amounts to €308.95 million.

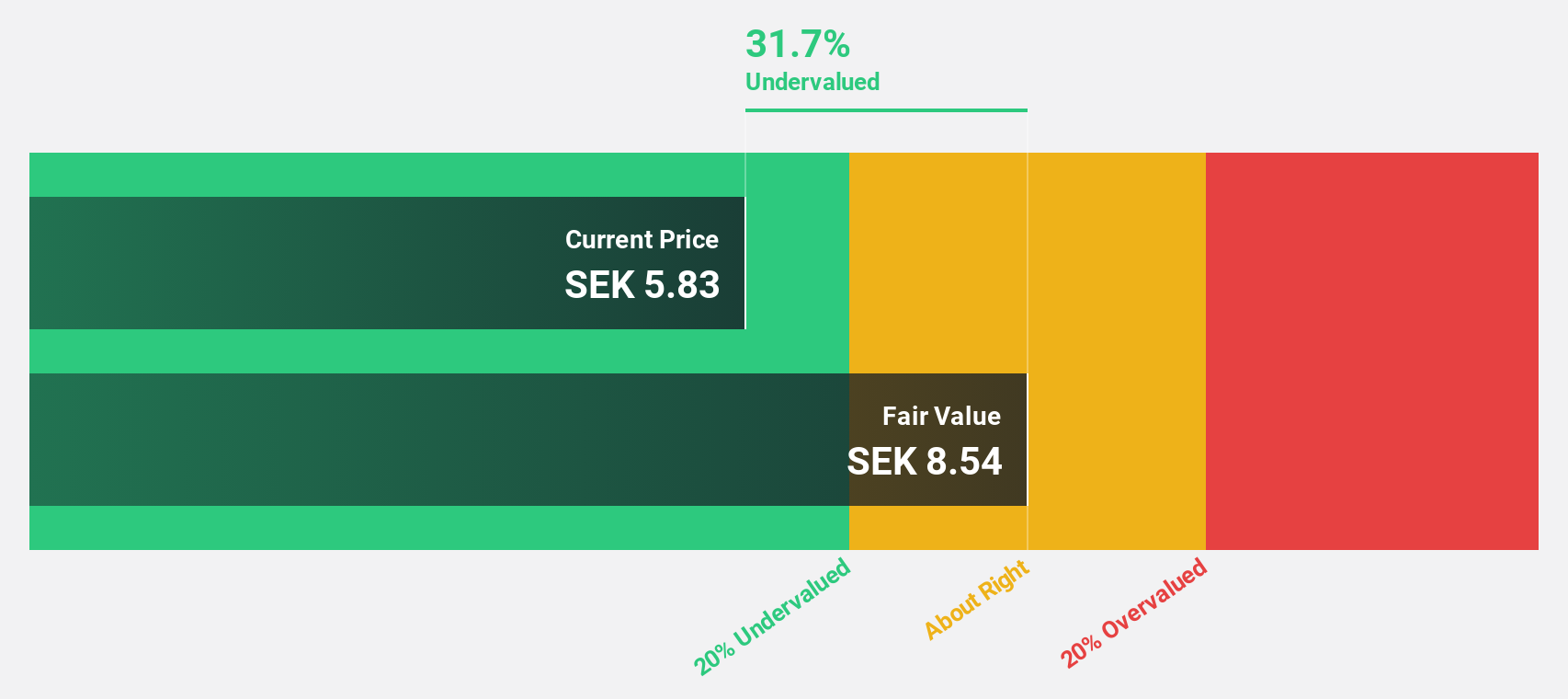

Estimated Discount To Fair Value: 38.1%

Nyab, trading at SEK 6.35, is significantly undervalued with a fair value estimate of SEK 10.25. Despite lower profit margins (2.9% vs. 7.4% last year), earnings are forecast to grow at 28.1% annually, outpacing the Swedish market's growth rate of 15.3%. Recent contracts, including a SEK 931 million project with Vattenfall and a two-year extension with Lulea Municipality worth over SEK 230 million, strengthen its order backlog and future cash flow prospects.

- Upon reviewing our latest growth report, Nyab's projected financial performance appears quite optimistic.

- Dive into the specifics of Nyab here with our thorough financial health report.

Taking Advantage

- Reveal the 42 hidden gems among our Undervalued Swedish Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nyab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NYAB

Nyab

Provides engineering, construction, and maintenance services to energy, infrastructure, and industrial construction projects for public and private sectors in Finland and Sweden.

Excellent balance sheet with reasonable growth potential.