- Sweden

- /

- Metals and Mining

- /

- OM:ALLEI

How Alleima’s Lower Earnings and Leadership Change Have Shifted Its Investment Story (OM:ALLEI)

Reviewed by Sasha Jovanovic

- Alleima AB (publ) recently announced its third-quarter and nine-month 2025 earnings, reporting sales of SEK 4,222 million and SEK 14,137 million respectively, both lower than the corresponding periods last year, along with a decrease in net income to SEK 85 million for the quarter and SEK 683 million for the nine months.

- This setback in earnings comes just days after the company named Christian Swartling as its new Executive Vice President and General Counsel, signaling leadership changes amid ongoing financial challenges.

- We'll explore how Alleima's recent earnings decline may shift expectations for its earnings recovery and longer-term growth outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Alleima Investment Narrative Recap

To be a shareholder in Alleima, you need to believe in the company’s capacity to recover earnings momentum by capitalizing on future infrastructure buildouts in nuclear, hydrogen, and renewables, and to effectively offset recent cyclicality in its core industrial segments. The latest earnings miss reinforces that weak demand in key end-markets remains the most important near-term catalyst, while persistent margin pressure due to raw material costs and currency volatility stands out as the major risk. The headline numbers, while disappointing, do not materially change this risk–reward balance for now.

Among recent news, the appointment of Christian Swartling as Executive Vice President and General Counsel is significant, given the ongoing macroeconomic and operational headwinds. Although it does not address short-term financial issues directly, it brings additional industrial legal expertise to Alleima’s management team, which could strengthen the company’s ability to handle complex regulatory and transactional challenges as it seeks to pivot toward higher-value and more resilient market segments.

However, investors should also be aware that despite the potential for demand to eventually rebound, ongoing margin pressure from input costs and FX effects remains a risk that could...

Read the full narrative on Alleima (it's free!)

Alleima's outlook anticipates SEK21.2 billion in revenue and SEK1.8 billion in earnings by 2028. This scenario is based on a 2.8% annual revenue growth rate and an increase in earnings of SEK0.7 billion from the current SEK1.1 billion.

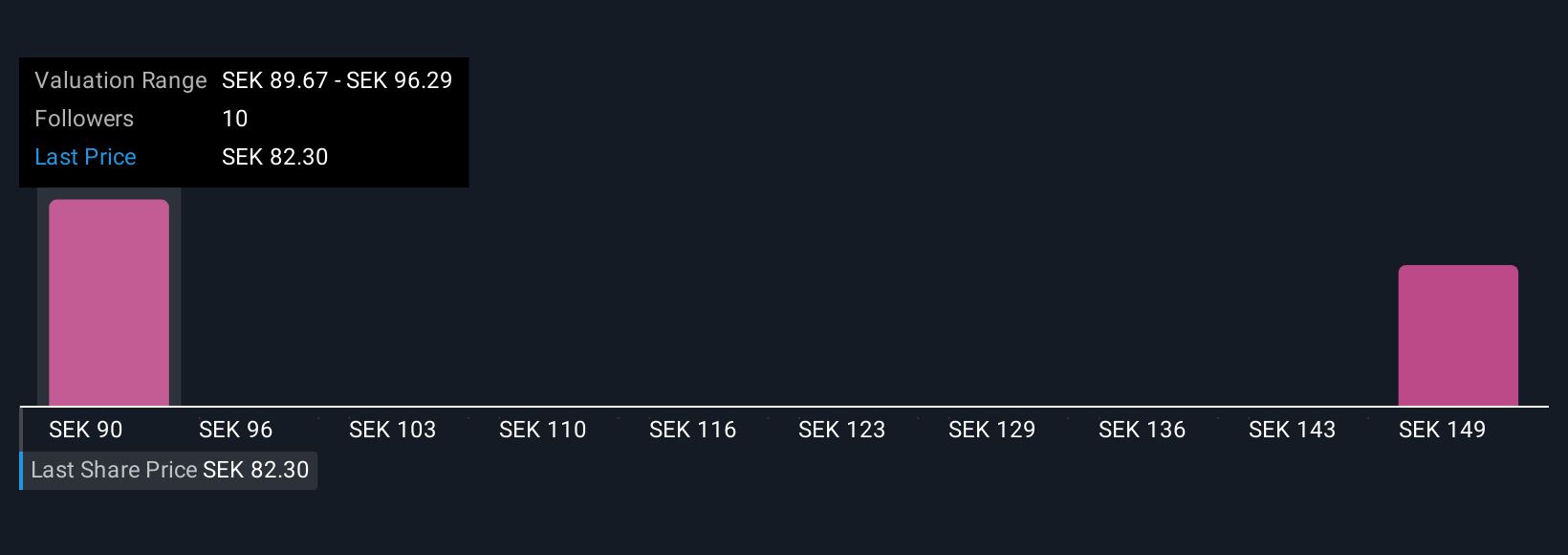

Uncover how Alleima's forecasts yield a SEK89.67 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate Alleima’s fair value between SEK89.67 and SEK155.37. With recent earnings volatility in focus, your outlook on margin risk or recovery can shape a very different view.

Explore 3 other fair value estimates on Alleima - why the stock might be worth as much as 86% more than the current price!

Build Your Own Alleima Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alleima research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alleima research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alleima's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALLEI

Alleima

Manufactures and sells stainless steels, special alloys, medical wires and components, and electric heating systems in Europe, North America, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives