Solid Försäkringsaktiebolag (OM:SFAB) Margin Decline Challenges Bullish Value Narrative

Reviewed by Simply Wall St

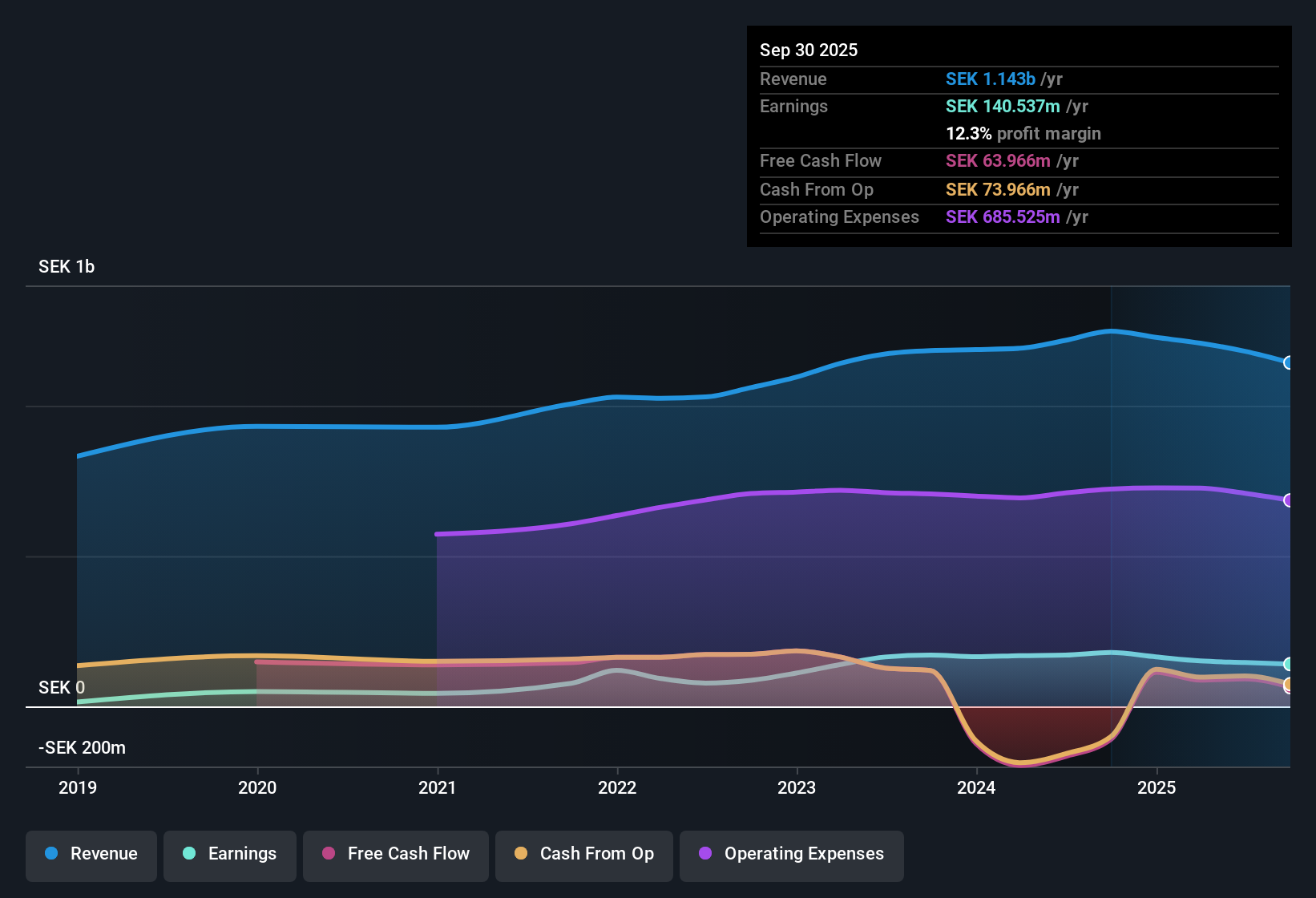

Solid Försäkringsaktiebolag (OM:SFAB) reported a net profit margin of 12.4%, down from 14% a year ago, indicating margin pressure over the recent period. Over the last five years, earnings have grown at an impressive 20.5% annual rate, but this year bucked the trend with negative earnings growth. With a Price-to-Earnings ratio of 9.3x, which is lower than both the European Insurance average of 12.5x and peers at 13.1x, and a share price of SEK75.7 still below an assessed fair value of SEK253.6, value-focused investors may see opportunity. However, questions about dividend sustainability and the near-term drop in profitability provide a note of caution as investors weigh the fundamentals.

See our full analysis for Solid Försäkringsaktiebolag.Next, we will put these earnings in context by comparing the reported figures to the key narratives that have shaped market sentiment for SFAB. This is where we see whether the latest numbers support or challenge prevailing views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Profit Growth Outpaces Market

- SFAB recorded a 20.5% compound annual growth rate in earnings over the past five years. This reflects an ability to consistently grow profits at a strong pace despite recent margin pressure.

- This supports the view that solid long-term profit expansion makes SFAB stand out against competitors, even as recent short-term profit momentum slowed.

- This five-year growth rate outpaces most sector peers and presents a case for resilience amid industry volatility.

- It is notable that, while this positive trend is clear, the latest year did not continue it due to negative growth. This raises reasonable questions about sustainability going forward.

Dividend Sustainability Moves Into Focus

- The company’s risk disclosures flagged concerns over dividend sustainability, which may weigh on its attractiveness to investors relying on steady income.

- This challenges the prevailing narrative that strong profit growth alone guarantees healthy dividends. Even with solid long-run gains, payout levels may not be immune to near-term financial headwinds.

- Some critics argue that a risk flag around dividends is not just academic. If payouts are cut or curtailed, SFAB could lose its appeal for income-oriented holders, especially following a year of negative earnings growth.

- However, the strong earnings track record suggests a buffer, making it unclear if this risk will materialize soon or simply temper the upside.

Share Price Sits Well Below DCF Fair Value

- SFAB’s share price of SEK75.7 is trading at a substantial discount to the DCF fair value of SEK253.60, highlighting a notable valuation gap based on fundamentals.

- This gap, combined with a low price-to-earnings ratio (9.3x compared to a peer average of 13.1x), creates a compelling narrative for value-focused investors and suggests room for future price appreciation.

- Additionally, sector-wide digital transformation and macroeconomic shifts may boost insurers that deliver on efficiency. This further amplifies interest in underappreciated value plays such as SFAB.

- Even as profitability dipped this year, both relative and intrinsic valuation signals remain firmly on the attractive side for now.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Solid Försäkringsaktiebolag's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

SFAB’s dip in earnings growth and flagged concerns around dividend sustainability raise questions about its near-term income reliability for investors.

If you want more consistent yields and fewer payout surprises, check out these 1979 dividend stocks with yields > 3% for income stocks with stronger dividend track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SFAB

Solid Försäkringsaktiebolag

Provides non-life insurance to private and business customers in Sweden, Denmark, Norway, Finland, and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives