As global markets react to the recent U.S. election results, major indices like the S&P 500 and Nasdaq Composite have reached record highs, driven by investor optimism around potential economic growth and tax reforms. In this climate of market enthusiasm, dividend stocks can offer a compelling blend of income and stability; they are particularly attractive for investors seeking reliable returns amidst fluctuating economic policies and inflationary pressures.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

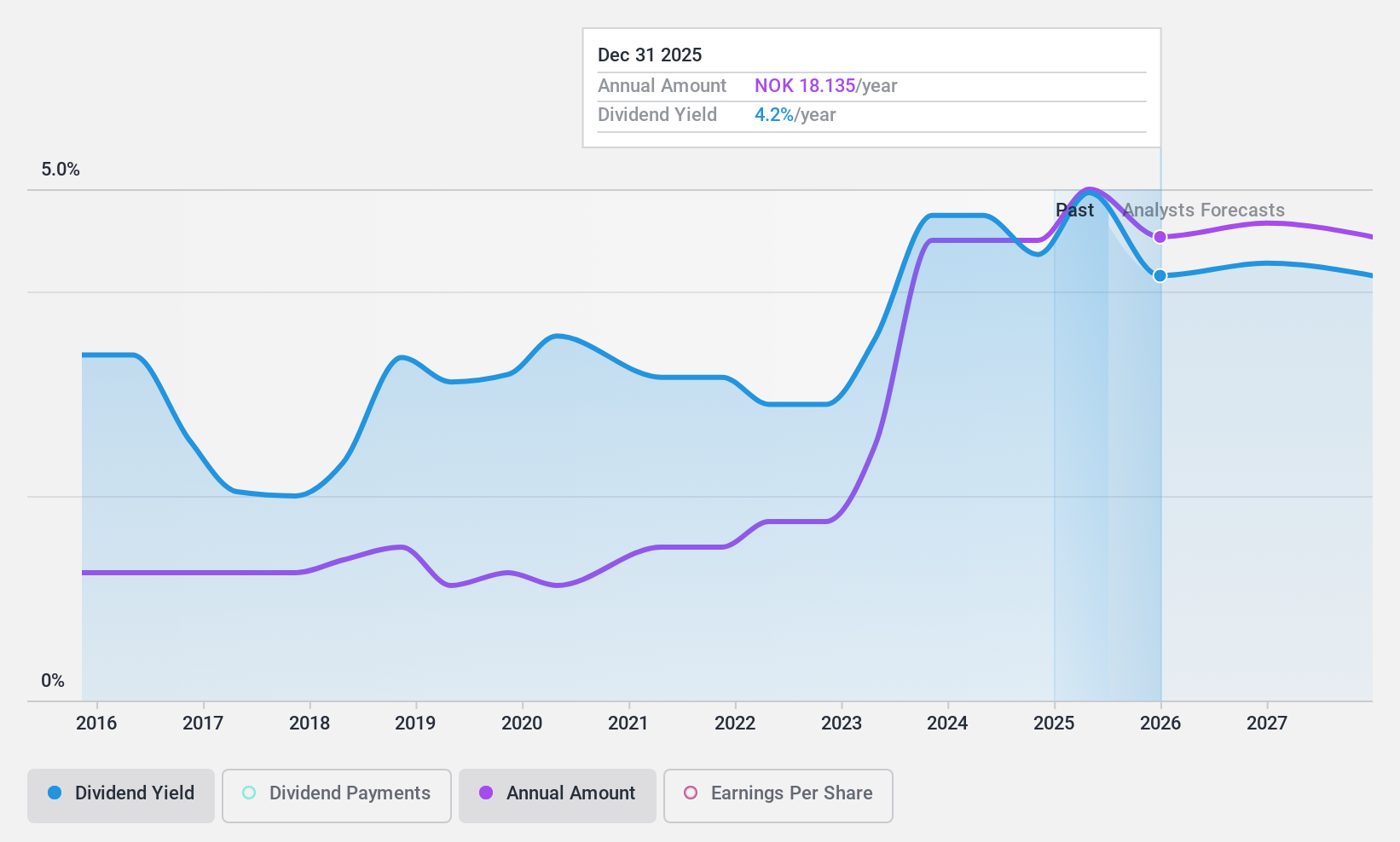

Wilh. Wilhelmsen Holding (OB:WWI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wilh. Wilhelmsen Holding ASA is a global provider of maritime products and services with a market cap of NOK18.06 billion.

Operations: Wilh. Wilhelmsen Holding ASA's revenue is comprised of $293 million from New Energy, $815 million from Maritime Services, and $16 million from Strategic Holdings & Investments.

Dividend Yield: 4.2%

Wilh. Wilhelmsen Holding ASA recently announced a NOK 8.00 per share dividend, reflecting an increase, with payments due on November 20, 2024. The company's dividends are well-covered by earnings with a low payout ratio of 16% and cash flows at 60.7%. Despite past volatility in dividend payments, the company has shown growth over the last decade. Recent buybacks and inclusion in the S&P Global BMI Index may bolster investor confidence despite lower-than-top-tier yield levels in Norway.

- Get an in-depth perspective on Wilh. Wilhelmsen Holding's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Wilh. Wilhelmsen Holding shares in the market.

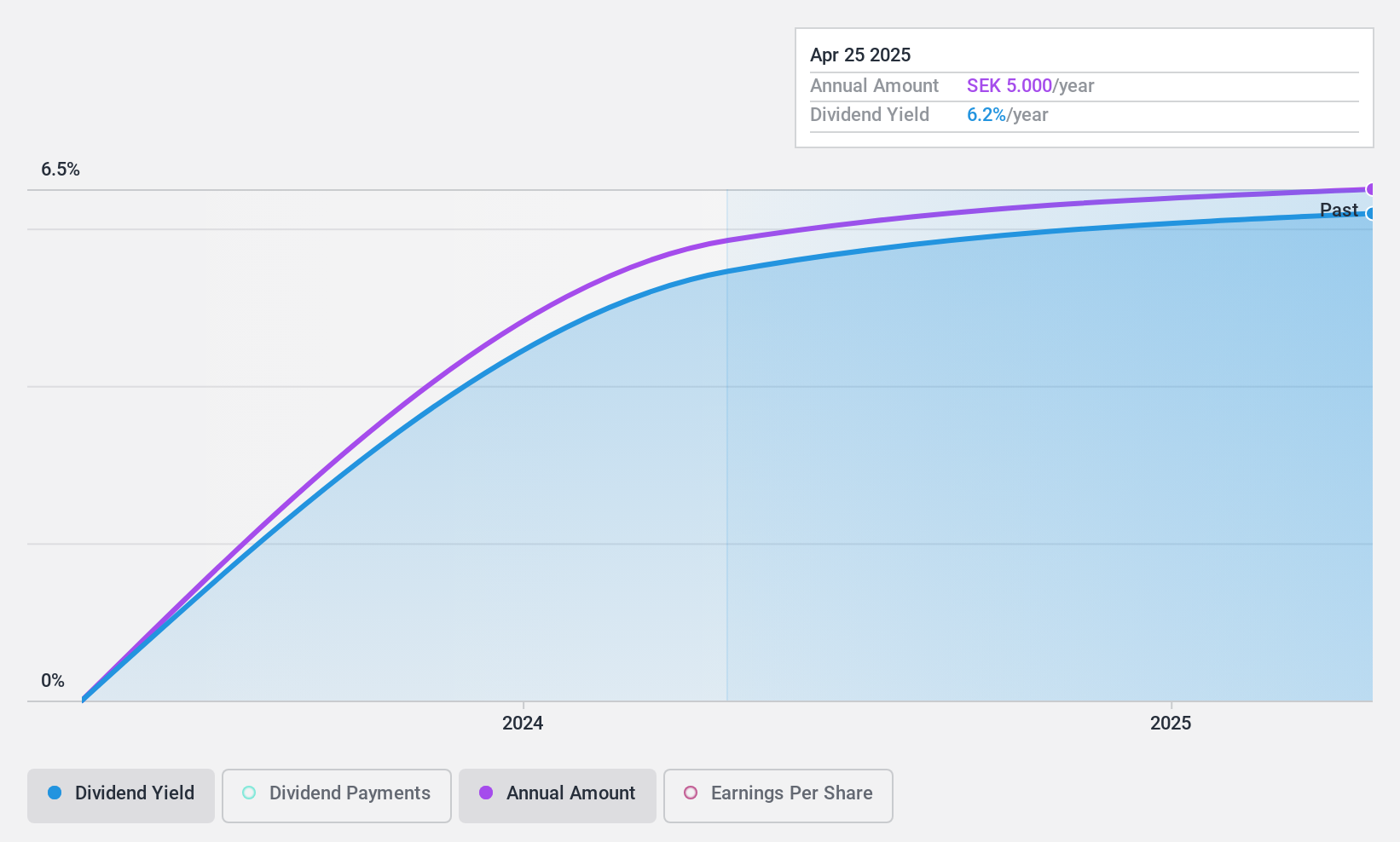

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (OM:SFAB) offers non-life insurance services to private and business customers across Sweden, Denmark, Norway, Finland, Germany, Switzerland, and other international markets with a market cap of SEK1.54 billion.

Operations: Solid Försäkringsaktiebolag's revenue segments include SEK311.85 million from Product, SEK371.42 million from Assistance, and SEK441.04 million from Personal Safety services.

Dividend Yield: 5.3%

Solid Försäkringsaktiebolag's dividend yield of 5.31% places it among the top 25% in Sweden, supported by a payout ratio of 46.4% and cash flow coverage at 60.3%. Despite only two years of dividend history, payments have been stable and increasing. Recent earnings growth—net income rose to SEK 48.8 million in Q3—indicates strong financial health, but limited historical data on dividends may concern some investors seeking long-term reliability.

- Navigate through the intricacies of Solid Försäkringsaktiebolag with our comprehensive dividend report here.

- Our valuation report here indicates Solid Försäkringsaktiebolag may be undervalued.

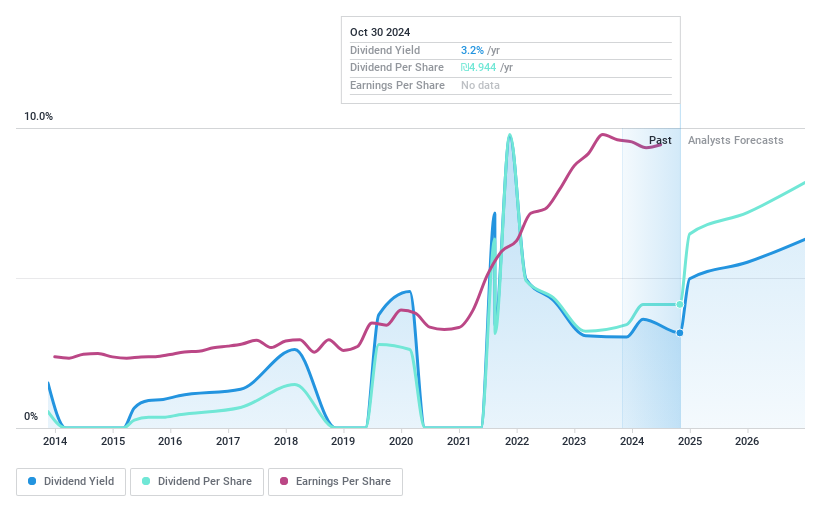

Mizrahi Tefahot Bank (TASE:MZTF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mizrahi Tefahot Bank Ltd., along with its subsidiaries, offers a variety of international, commercial, domestic, and personal banking services to individuals and businesses in Israel, Switzerland, and beyond, with a market cap of ₪41.42 billion.

Operations: Mizrahi Tefahot Bank Ltd. generates revenue through its diverse banking services, catering to both personal and business clients across Israel, Switzerland, and international markets.

Dividend Yield: 3.1%

Mizrahi Tefahot Bank's dividend payments, while covered by a low payout ratio of 30%, have been volatile over the past decade, raising concerns about reliability. Despite this, earnings support current and future dividends with forecasted coverage at 44.9% in three years. Recent Q2 results show net interest income increased to ILS 3.22 billion and net income to ILS 1.45 billion, indicating financial stability despite trading below estimated fair value by nearly 40%.

- Dive into the specifics of Mizrahi Tefahot Bank here with our thorough dividend report.

- Our expertly prepared valuation report Mizrahi Tefahot Bank implies its share price may be lower than expected.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1948 Top Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MZTF

Mizrahi Tefahot Bank

Provides a range of international, commercial, domestic, and personal banking services to individuals and businesses in Israel, Switzerland, and internationally.

Flawless balance sheet average dividend payer.