- Israel

- /

- Specialty Stores

- /

- TASE:DLTI

Uncovering Undiscovered Gems With Strong Fundamentals This November 2024

Reviewed by Simply Wall St

As global markets respond to the recent U.S. election and Federal Reserve's rate cut, small-cap stocks have shown notable resilience, with the Russell 2000 Index leading gains despite remaining below its record high. In this dynamic environment, identifying stocks with strong fundamentals becomes crucial, as these companies are often well-positioned to capitalize on potential economic shifts and regulatory changes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Rasan Information Technology (SASE:8313)

Simply Wall St Value Rating: ★★★★★★

Overview: Rasan Information Technology Company is a financial technology firm offering insurance and financial services in Saudi Arabia, with a market capitalization of SAR6.03 billion.

Operations: The company's revenue streams primarily include leasing and its Tameeni platforms, with Tameeni - Motors generating SAR187.93 million and Tameeni - Health contributing SAR40.40 million. Leasing adds another SAR77.92 million to the revenue mix.

Rasan Information Technology has demonstrated impressive earnings growth of 84% over the past year, outpacing the Insurance industry's 9%. The company is debt-free, which adds a layer of financial stability and reduces risk. Over recent years, Rasan's levered free cash flow has seen substantial improvement, rising from US$10.82 million in 2021 to US$86.18 million by late 2024. Despite its volatile share price in recent months, Rasan's high-quality earnings and forecasted revenue growth of approximately 30% annually suggest potential for future expansion within its sector.

- Dive into the specifics of Rasan Information Technology here with our thorough health report.

Learn about Rasan Information Technology's historical performance.

Delta Israel Brands (TASE:DLTI)

Simply Wall St Value Rating: ★★★★★★

Overview: Delta Israel Brands Ltd. designs, develops, markets, and sells various clothing products in Israel with a market cap of ₪1.76 billion.

Operations: Delta Israel Brands generates revenue primarily through the sale of clothing products in Israel. The company's financial performance includes a notable trend in its gross profit margin, which has shown significant variation across different periods.

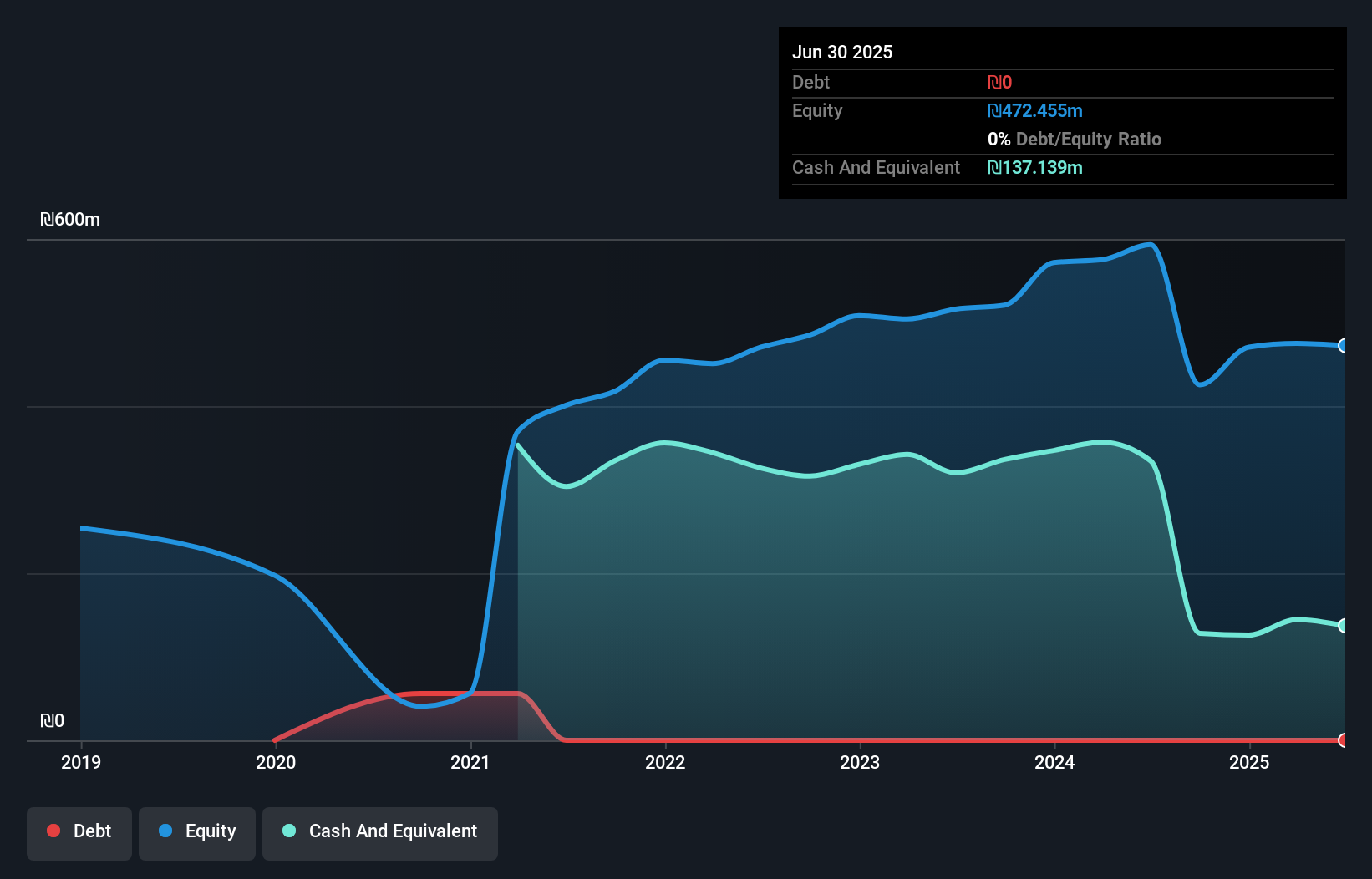

Delta Israel Brands seems to be carving a niche with its impressive earnings growth of 61.9% over the past year, outpacing the Specialty Retail industry's -31.2%. The company appears to offer good value, trading at 65.5% below its estimated fair value, which might catch the eye of discerning investors. With no debt on its books now compared to a debt-to-equity ratio of 49.1% five years ago, it is in a strong financial position. Furthermore, Delta Israel Brands boasts high-quality earnings and positive free cash flow, reinforcing confidence in its operational efficiency and fiscal health.

- Navigate through the intricacies of Delta Israel Brands with our comprehensive health report here.

Examine Delta Israel Brands' past performance report to understand how it has performed in the past.

Hilan (TASE:HLAN)

Simply Wall St Value Rating: ★★★★★★

Overview: Hilan Ltd. is a software as a service (SaaS) provider that develops solutions for enterprise human capital management in Israel, with a market cap of ₪6.15 billion.

Operations: Hilan generates revenue primarily from Business Information Services (₪1.59 billion) and Payroll Services, Human Resources, and Organizational Systems (₪495.46 million). Additional income comes from Computer Infrastructure (₪331.54 million) and Marketing of Software Products (₪308.42 million).

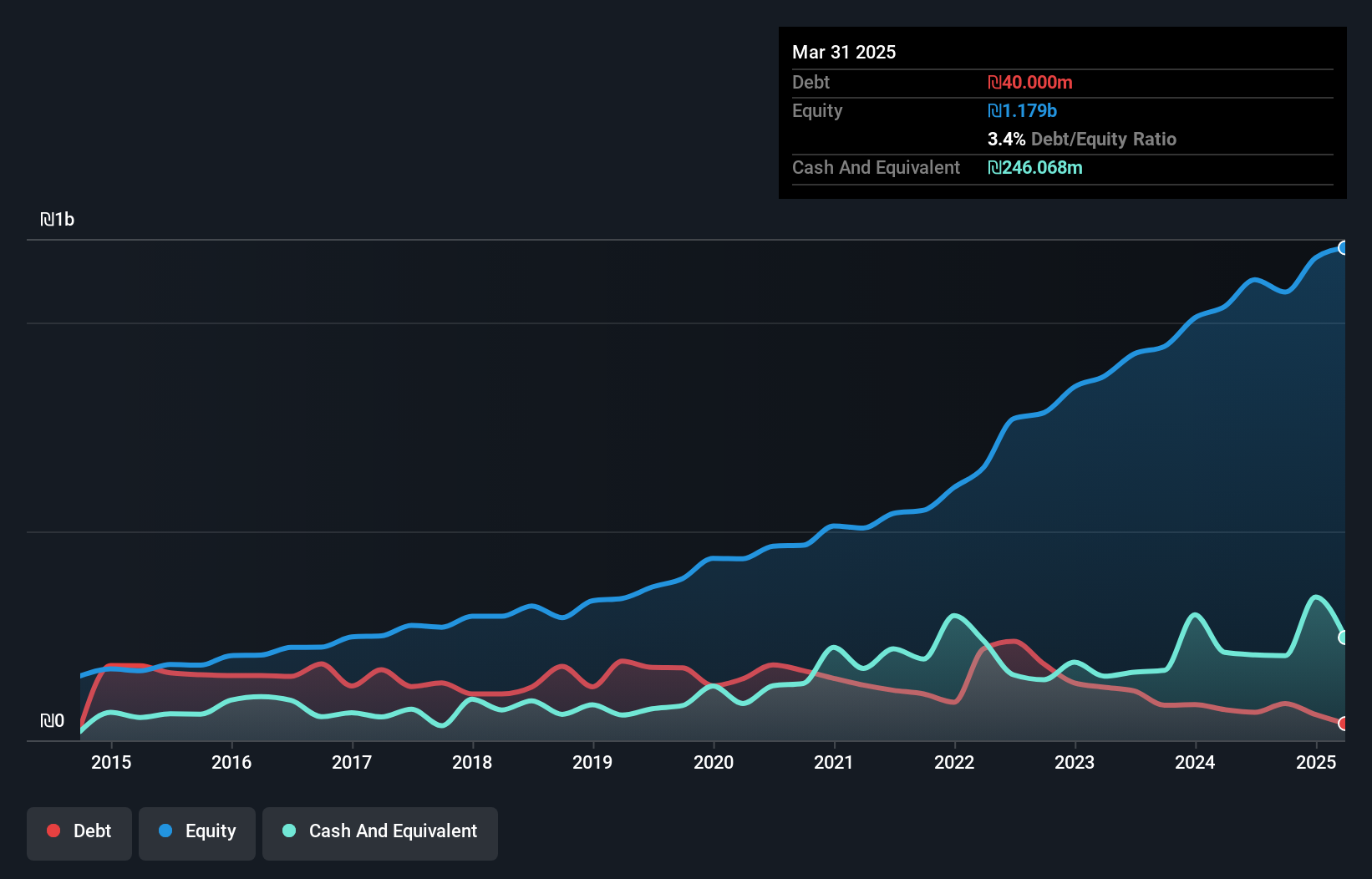

Hilan, a relatively small player in the professional services industry, has shown promising financial strides. Over the past year, earnings surged by 19.4%, outpacing the industry's 7.1% growth rate. The company's debt to equity ratio impressively dropped from 47.5% to just 6.1% over five years, highlighting strong financial management with more cash than total debt on hand. Despite shareholder dilution recently, Hilan trades at a hefty discount of 53% below its estimated fair value, suggesting potential undervaluation in the market. Recent earnings reports show net income rose to ILS 58 million for Q2 and basic EPS increased to ILS 2.56 from ILS 2.21 last year.

- Click here and access our complete health analysis report to understand the dynamics of Hilan.

Evaluate Hilan's historical performance by accessing our past performance report.

Seize The Opportunity

- Reveal the 4666 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DLTI

Delta Israel Brands

Designs, develops, markets, and sells various clothing products in Israel.

Outstanding track record with flawless balance sheet.