- Sweden

- /

- Personal Products

- /

- OM:HUMBLE

Humble Group (OM:HUMBLE) Margin Miss Raises Questions on Quality of Earnings Expansion

Reviewed by Simply Wall St

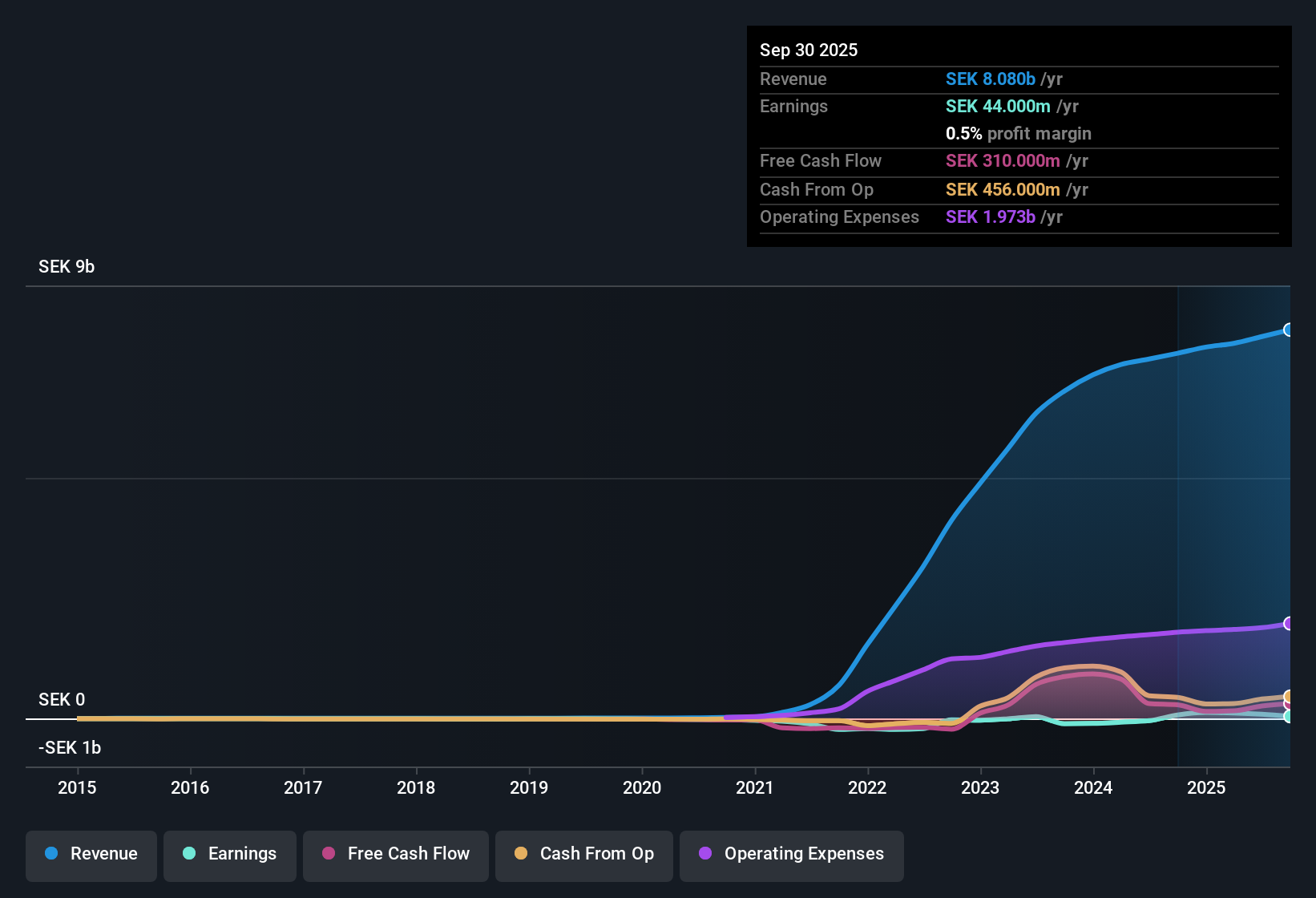

Humble Group (OM:HUMBLE) reported a net profit margin of 0.5%, slipping from 0.9% a year ago, even as its earnings have surged at a brisk 45% annual growth rate over the past five years. The company booked a notable one-off gain of SEK18.0 million in the last twelve months, and now sees forecast annual earnings growth accelerating to 83.1%, with revenue expected to grow 5.8% per year. This is well ahead of the 3.8% pace expected for Sweden’s broader market. Despite these bullish forecasts, Humble currently trades at SEK8.57, well above its estimated fair value of SEK3.88, and sports a premium Price-to-Sales ratio of 4.8x compared to industry peers.

See our full analysis for Humble Group.Next, let’s set these headline results in context by examining how the numbers compare to widely followed community and market narratives around the stock.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off SEK18 Million Gain Skews Net Profit Margin

- Humble Group’s reported net profit margin of 0.5% over the last year includes a notable one-off gain of SEK18.0 million, making the margin less indicative of core business profitability.

- It is noteworthy that while bulls highlight robust five-year annual net profit growth of 45%, the presence of non-recurring items such as this SEK18 million gain raises questions about the sustainability of such high growth.

- Profitability appears elevated for the period, so bullish arguments about ongoing margin strength need to consider this exceptional item.

- If excluded, underlying margins may not be as strong as bullish investors believe, introducing doubt about near-term consistency.

Forecasts Show 83% Annual Earnings Growth, but Margins Lag

- Annual earnings are forecast to expand by an impressive 83.1%, even as net profit margin has slipped from last year’s 0.9% to 0.5%.

- Instead of the margin improvement that often accompanies rapid growth, these trends suggest a need for further examination. Prevailing market analysis indicates investors are optimistic about strong earnings growth, while ongoing profitability challenges maintain debate over underlying operational performance.

- This high forecasted growth surpasses the expected 3.8% rate for the Swedish market, fueling optimism about Humble’s competitive position.

- However, with margin pressure continuing, investors are closely monitoring whether top-line expansion will ultimately result in consistent bottom-line gains.

Valuation Stretched: Price 121% Above DCF Fair Value

- With shares trading at SEK8.57, Humble’s price stands approximately 121% above its DCF fair value of SEK3.88 and is significantly higher than the industry average Price-to-Sales ratios (4.8x for Humble compared to 1.6x for European peers).

- This valuation underscores a situation where market enthusiasm exceeds traditional valuation measures, highlighting a key issue. The data raises questions about whether the rapid earnings growth forecasts will be realized soon enough to justify the current premium.

- If growth proceeds as quickly as forecast, the premium price might be warranted; however, any setback could result in a notable realignment to sector norms.

- Investors focusing on fundamental value may interpret the high Price-to-Sales ratio and the significant fair value gap as an indication to examine growth sustainability more closely.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Humble Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid forecasted growth, Humble’s stretched valuation and thin, non-recurring margin gains highlight concerns about whether strong fundamentals actually support the share price.

If you’re looking for stocks with more compelling value and upside, tap into these 877 undervalued stocks based on cash flows to uncover opportunities that are trading below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humble Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUMBLE

Humble Group

Develops, refines, and distributes fast-moving consumer products in Sweden and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives