- Sweden

- /

- Household Products

- /

- OM:ESSITY B

Essity (OM:ESSITY B) Valuation Spotlight as Supply Chain Leader Donato Giorgio Announces Departure

Reviewed by Kshitija Bhandaru

Essity (OM:ESSITY B) just shared that Donato Giorgio, their President of Global Supply Chain and a member of the Executive Management Team, is stepping down at the end of October. Giorgio has played a significant role in the company’s sustainable manufacturing efforts and resource circularity, so this change could prompt investors to consider what is next for the business. Changes in top leadership, especially in areas closely tied to a company’s operational backbone, often raise questions about whether strategy and performance will remain on track.

Looking at the bigger picture, Essity shares have experienced a steady downward movement this year, with the stock down about 18% since January and over 20% lower over the past twelve months. While longer-term investors who have stayed with Essity over the past three years are still in positive territory, recent momentum has been negative. The leadership news adds another layer of uncertainty to a situation that has already seen some pressure on valuation and sentiment.

This brings up a key question: is the recent drop in Essity’s share price creating a potential buying window, or is the market simply preparing for more change ahead?

Most Popular Narrative: 15.8% Undervalued

The most widely followed narrative suggests Essity shares are trading at a notable discount to what they are worth, indicating undervaluation based on anticipated financial drivers.

Innovations in premium, eco-friendly, and coreless products, along with industry recognition for sustainability, position Essity to capitalize on shifting consumer preference for sustainable and higher-value tissue and hygiene products. This supports both topline growth and margin expansion. Investment in brand building and marketing, as demonstrated by recent awards and increased A&P spend, is expected to drive greater brand loyalty and premiumization. This may bolster future sales and improve net margins.

What if the secret to Essity’s future upside is hidden in ambitious growth forecasts and bold profit targets? The narrative relies on a mix of operational transformation and high-margin opportunities that could reshape the company’s valuation story. Want to know the critical projections and core assumptions fueling this double-digit discount? Dive in to uncover which financial levers matter most to the bulls.

Result: Fair Value of $288.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak volume growth or margin pressures from rising costs could quickly undermine confidence in Essity’s expected recovery and potential valuation upside.

Find out about the key risks to this Essity narrative.Another View: The SWS DCF Model

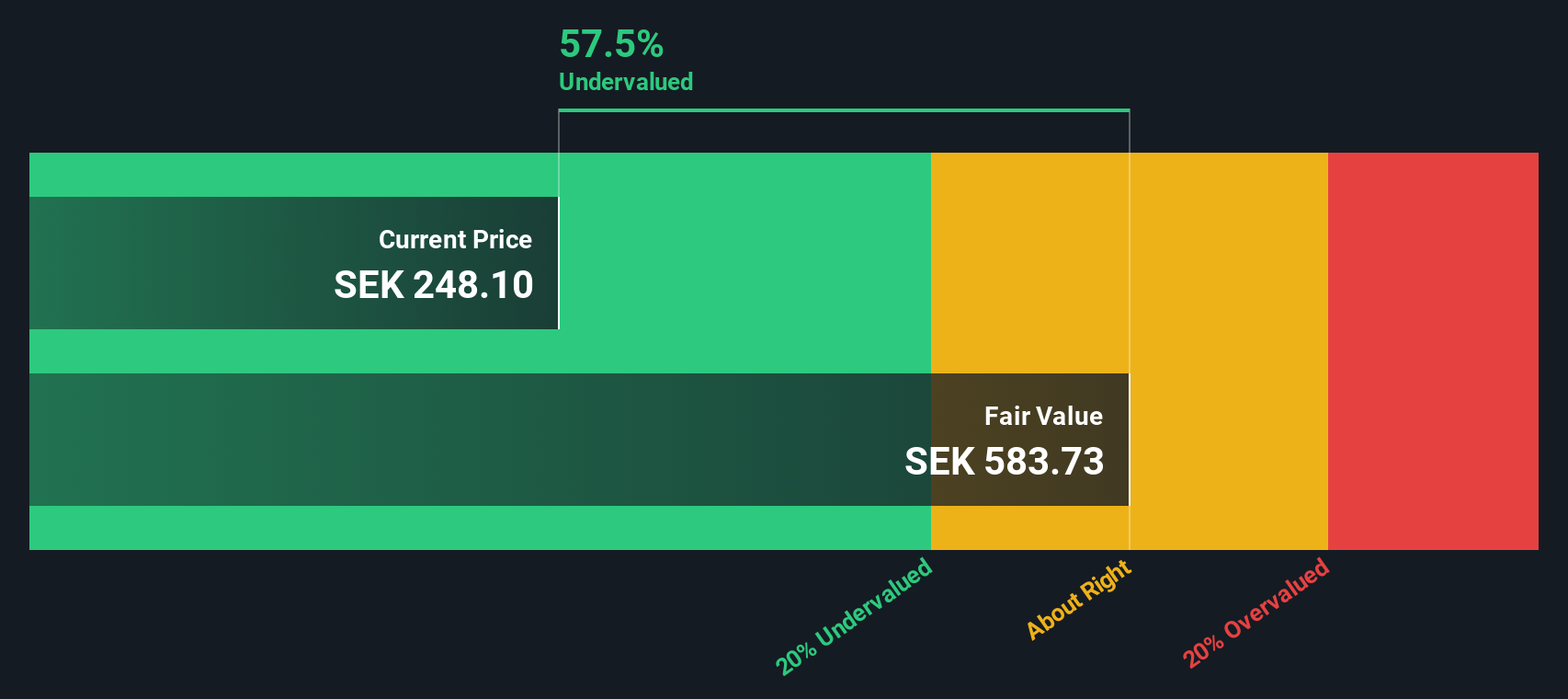

While analyst price targets suggest Essity is undervalued, our DCF model offers a similar perspective. This reinforces the idea that the shares may be trading below their intrinsic worth. However, it is possible that both methods could be missing key risks or potential upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Essity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Essity Narrative

If these conclusions do not match your perspective, you can always check the figures on your own and craft your own outlook within minutes. Do it your way.

A great starting point for your Essity research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for the usual. Take the next step and uncover opportunities where innovation and growth meet value. If you want an edge, these powerful screens can shape your portfolio in exciting ways:

- Spot rising stars with huge upside potential when you browse penny stocks with strong financials. These stocks are making waves beyond the headlines and redefining what’s possible for early-stage investors.

- Target consistent income and financial stability by checking out dividend stocks with yields > 3%. This screen features yields that could boost your returns when others are chasing riskier trends.

- Catch tomorrow’s tech leaders before they become household names by starting with AI penny stocks, packed with companies driving artificial intelligence breakthroughs and shaping the next decade.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ESSITY B

Essity

Develops, produces, and sells hygiene and health products and services in Europe, North and Latin America, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives