- Sweden

- /

- Household Products

- /

- OM:ESSITY B

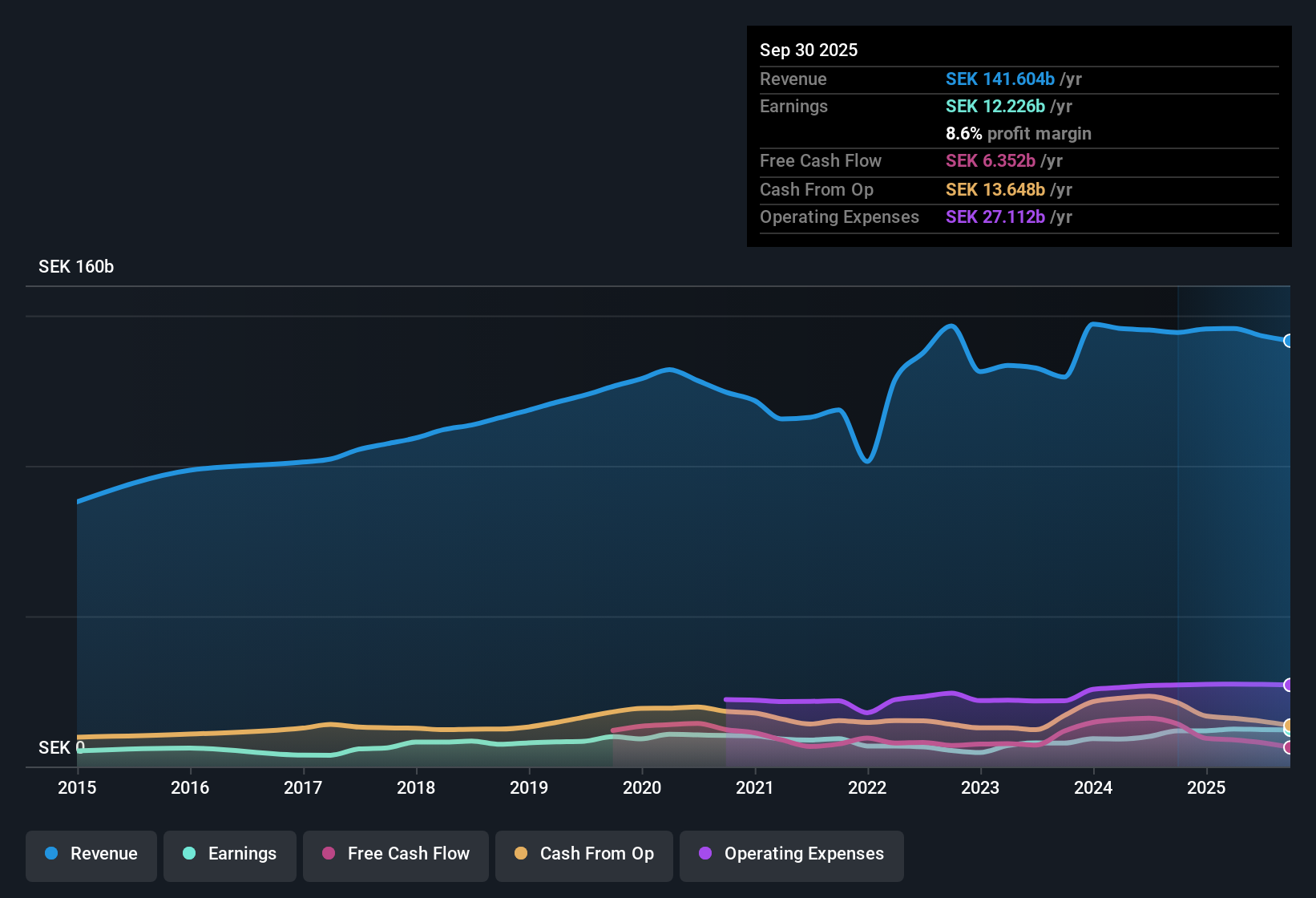

Essity (OM:ESSITY B) Profit Margin Jumps to 8.6%, Reinforcing Bullish Value Narratives

Reviewed by Simply Wall St

Essity (OM:ESSITY B) posted an impressive year, with earnings rising 23.2% in the most recent period and a five-year annual earnings growth rate of 7.4%. Net profit margins climbed to 8.6% from last year's 6.9%, reflecting a clear improvement in profitability. With earnings set to grow 4.7% annually, but revenue growth forecast at just 2.8% per year, which is behind the Swedish market’s 3.6% average, investors can see improved profits, moderate expansion ahead, and relative value, as shares trade at SEK267.9, well below the estimated SEK588.4 fair value.

See our full analysis for Essity.Up next, we’ll see how these latest results stack up against the most widely held market narratives for Essity and whether the numbers support or challenge prevailing sentiment.

See what the community is saying about Essity

Profit Margins Rise to 8.6%

- Net profit margins climbed to 8.6%, up from 6.9% the prior year, showing a notable lift in profitability even as revenue growth is set to be a modest 2.8% annually versus the Swedish market's 3.6%.

- Analysts' consensus view highlights that Essity benefits from robust demand for incontinence and medical products along with innovation and brand investments, which together support the expectation of sustained global revenue and margin growth.

- Ongoing cost-efficiency initiatives, including supply chain savings and digitalization, are expected to further shore up margins, especially if operating leverage improves as input costs stabilize.

- Improved profitability gives credence to the consensus view that the company is positioned for steady growth, even if top-line expansion is relatively muted.

Consensus narrative balances optimism on steady margin expansion with a watchful eye on modest headline revenue growth.

📊 Read the full Essity Consensus Narrative.

PE Ratio Sits Below Industry

- The current Price-To-Earnings Ratio is 14.9x, well under the global household products industry average of 19.7x and the peer average of 23.2x. This suggests Essity trades at a significant valuation discount despite the company’s recent profit gains.

- According to analysts' consensus view, this relative undervaluation is seen as an attractive entry point:

- The DCF fair value stands at SEK588.40, much higher than the current share price of SEK267.90. This points to meaningful upside should long-term profitability momentum persist.

- Consensus also notes that analysts’ price target of SEK288.75 is 12% above the current price, reinforcing the idea that the market could be underestimating Essity’s potential as margin trends solidify.

Volume Growth Lags as Operating Leverage Tested

- Future revenue is expected to grow by just 2.8% annually, with analysts forecasting only 1.6% growth per year over the next three years. This pace may underwhelm next to sector peers and inflationary cost pressures.

- Analysts' consensus view spotlights the importance of international expansion and cost savings but flags challenges:

- Structural pressure in key segments and risk from rising SG&A costs could weigh on net margins if volume growth fails to pick up, especially in Health & Medical and Baby Care.

- Exposure to volatile input costs and increased competition from private labels and new entrants may continue to cap Essity's pricing power and margin gains, offsetting the benefits of premiumization and innovation if not managed carefully.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Essity on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the figures the consensus overlooked? Share your unique take in just minutes and start building your personal outlook: Do it your way

A great starting point for your Essity research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Essity faces sluggish volume growth and may struggle to outpace sector peers because of modest revenue forecasts and challenges in driving operating leverage.

If you want to focus on companies that consistently grow their revenues and profits without these slowdowns, check out stable growth stocks screener (2088 results) and find steadier opportunities for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ESSITY B

Essity

Develops, produces, and sells hygiene and health products and services in Europe, North and Latin America, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives