- Sweden

- /

- Medical Equipment

- /

- OM:XVIVO

Three Swedish Exchange Stocks Estimated To Be Up To 25.5% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As global markets exhibit mixed reactions to recent economic data, with some indices showing resilience amidst unexpected inflation trends, the Swedish stock market presents a unique landscape for investors seeking value. In this context, identifying stocks that appear undervalued relative to their intrinsic estimates becomes particularly compelling, offering potential opportunities in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gränges (OM:GRNG) | SEK136.10 | SEK259.59 | 47.6% |

| Truecaller (OM:TRUE B) | SEK35.40 | SEK70.79 | 50% |

| Nordic Waterproofing Holding (OM:NWG) | SEK160.60 | SEK313.11 | 48.7% |

| C-Rad (OM:CRAD B) | SEK48.85 | SEK95.04 | 48.6% |

| RaySearch Laboratories (OM:RAY B) | SEK139.40 | SEK277.33 | 49.7% |

| Modern Times Group MTG (OM:MTG B) | SEK82.40 | SEK157.38 | 47.6% |

| Sinch (OM:SINCH) | SEK23.60 | SEK43.58 | 45.8% |

| Tourn International (OM:TOURN) | SEK8.00 | SEK14.80 | 45.9% |

| Humble Group (OM:HUMBLE) | SEK9.92 | SEK18.62 | 46.7% |

| Bactiguard Holding (OM:BACTI B) | SEK70.00 | SEK132.65 | 47.2% |

We're going to check out a few of the best picks from our screener tool.

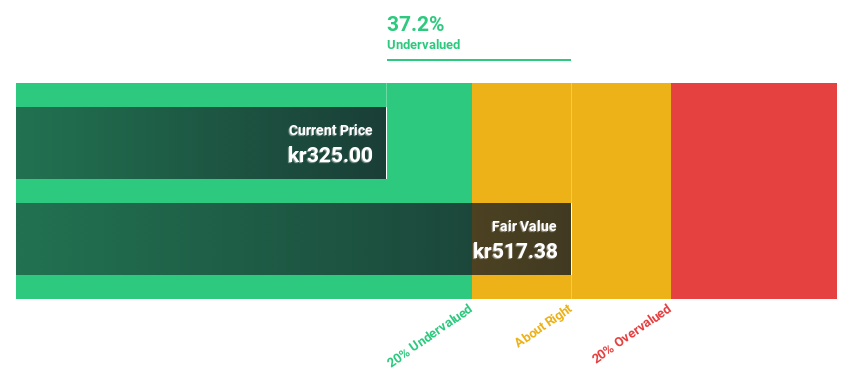

Absolent Air Care Group (OM:ABSO)

Overview: Absolent Air Care Group AB specializes in designing, developing, selling, installing, and maintaining air filtration units with a market capitalization of approximately SEK 4.08 billion.

Operations: The company generates revenue primarily through two segments: Industrial, which brought in SEK 1.12 billion, and Commercial Kitchen, contributing SEK 289.38 million.

Estimated Discount To Fair Value: 14.2%

Absolent Air Care Group, with a current trading price of SEK 360, is positioned below our calculated fair value of SEK 419.78. This indicates a moderate undervaluation based on discounted cash flows. Recent financial results show an increase in net income and earnings per share compared to the previous year, alongside a dividend hike. Despite this positive performance, revenue growth projections (9.6% annually) and forecasted earnings growth (17% annually) suggest potential yet are not exceedingly high compared to broader market expectations.

- Our earnings growth report unveils the potential for significant increases in Absolent Air Care Group's future results.

- Get an in-depth perspective on Absolent Air Care Group's balance sheet by reading our health report here.

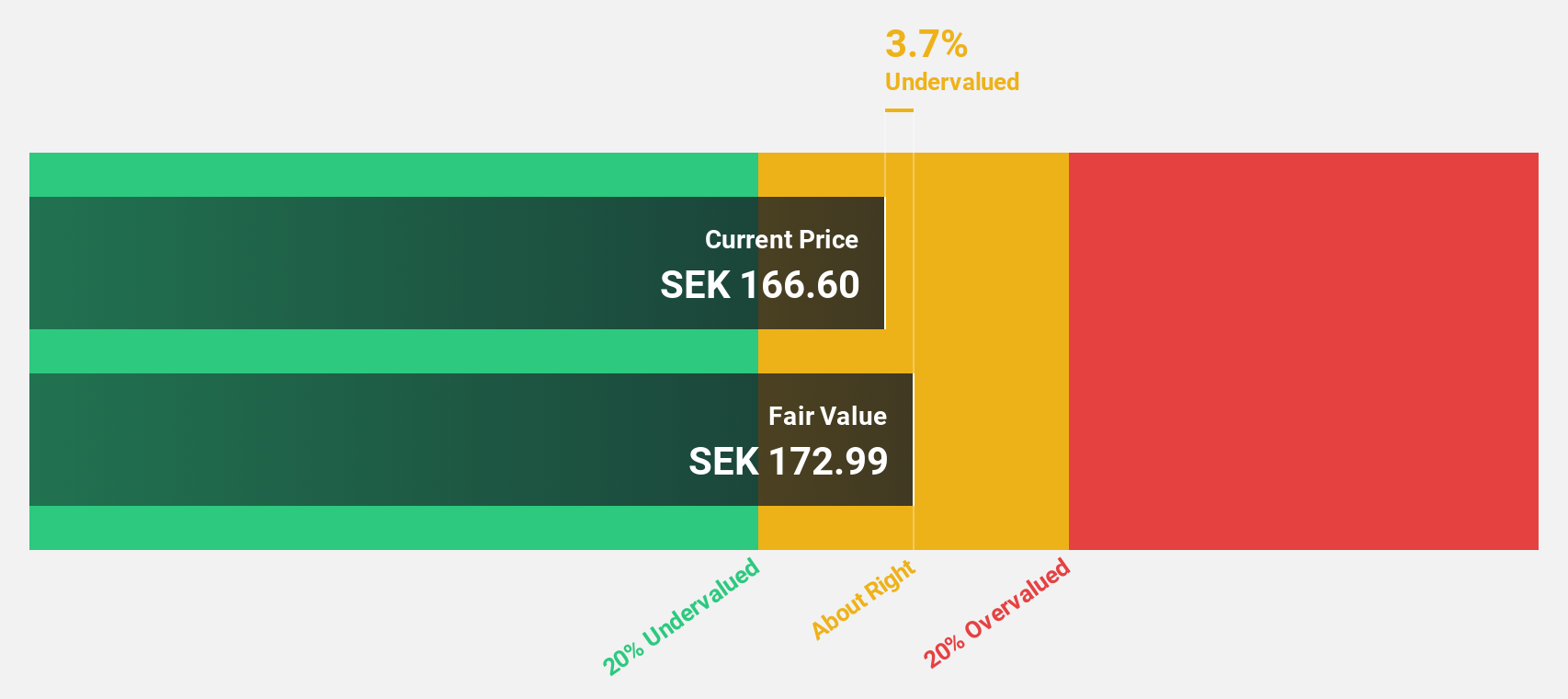

Sweco (OM:SWEC B)

Overview: Sweco AB (publ) is a global provider of architecture and engineering consultancy services, with a market capitalization of approximately SEK 59.71 billion.

Operations: Sweco's revenue is generated from various regional segments, with Sweden contributing SEK 8.74 billion, Norway SEK 3.50 billion, Belgium SEK 3.97 billion, Denmark SEK 3.24 billion, Finland SEK 3.67 billion, the Netherlands SEK 3.00 billion, and Germany & Central Europe SEK 2.71 billion.

Estimated Discount To Fair Value: 19.2%

Sweco, priced at SEK 166, trades below the calculated fair value of SEK 205.43, reflecting a modest undervaluation based on discounted cash flows. The company's return on equity is expected to be strong at 20.4% in three years. While Sweco's revenue growth (6.2% annually) is not rapid, it surpasses the Swedish market average (1.8%). Recent earnings have improved significantly with net income rising to SEK 540 million in Q2 from SEK 357 million year-over-year, alongside securing a substantial contract worth around SEK 400 million with the Swedish Transport Administration for railway expansion projects.

- Insights from our recent growth report point to a promising forecast for Sweco's business outlook.

- Click to explore a detailed breakdown of our findings in Sweco's balance sheet health report.

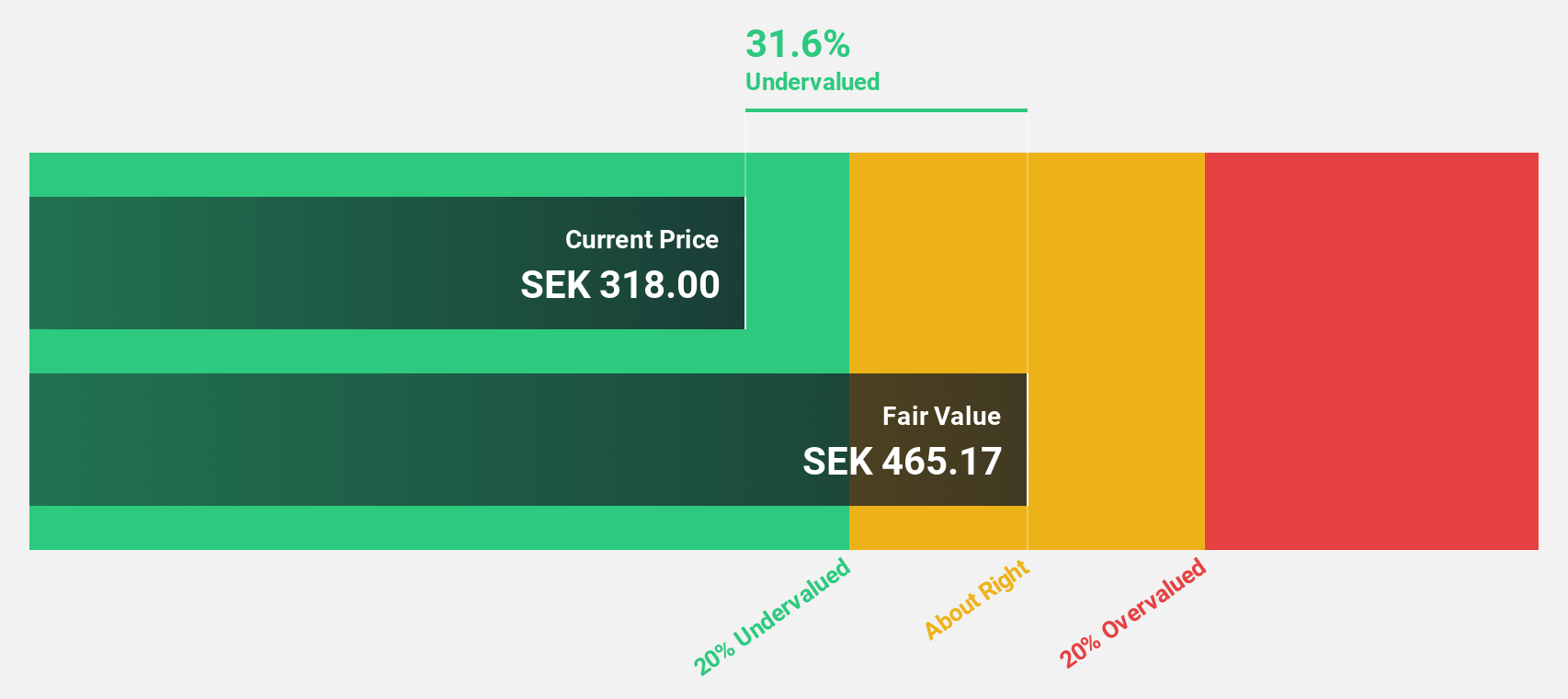

Xvivo Perfusion (OM:XVIVO)

Overview: Xvivo Perfusion AB is a medical technology firm based in Sweden, specializing in the development and marketing of machines and solutions for organ assessment and preservation before transplantation, operating globally with a market cap of SEK 16.95 billion.

Operations: The company generates revenue primarily through three segments: Services (SEK 83.39 million), Thoracic (SEK 451.49 million), and Abdominal (SEK 163.85 million).

Estimated Discount To Fair Value: 25.5%

Xvivo Perfusion, with a current price of SEK 538, is considered undervalued against a fair value of SEK 722.14, showing a significant discount based on discounted cash flows. Despite its low forecasted return on equity at 10.5% in three years, the company's earnings and revenue growth projections are robust. Earnings have surged by 344% over the past year and are expected to grow annually by 36.88%. Recent financials confirm strong performance with Q2 net income reaching SEK 27.19 million from SEK 6.89 million year-over-year, supported by sales growth from SEK 154.57 million to SEK 210.35 million in the same period.

- According our earnings growth report, there's an indication that Xvivo Perfusion might be ready to expand.

- Click here to discover the nuances of Xvivo Perfusion with our detailed financial health report.

Key Takeaways

- Unlock our comprehensive list of 50 Undervalued Swedish Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:XVIVO

Xvivo Perfusion

A medical technology company, develops and markets machines and perfusion solutions for assessing usable organs and maintains in optimal condition pending transplantation in Sweden, the United States, the Netherlands, Italy, North and South America, Europe, the Middle East, Africa, the Asia Pacific, and Oceania.

Flawless balance sheet with high growth potential.