- Sweden

- /

- Medical Equipment

- /

- OM:STIL

Stille (OM:STIL) Margin Hit by SEK44.5m One-Off Loss, Testing Profit Quality Narratives

Reviewed by Simply Wall St

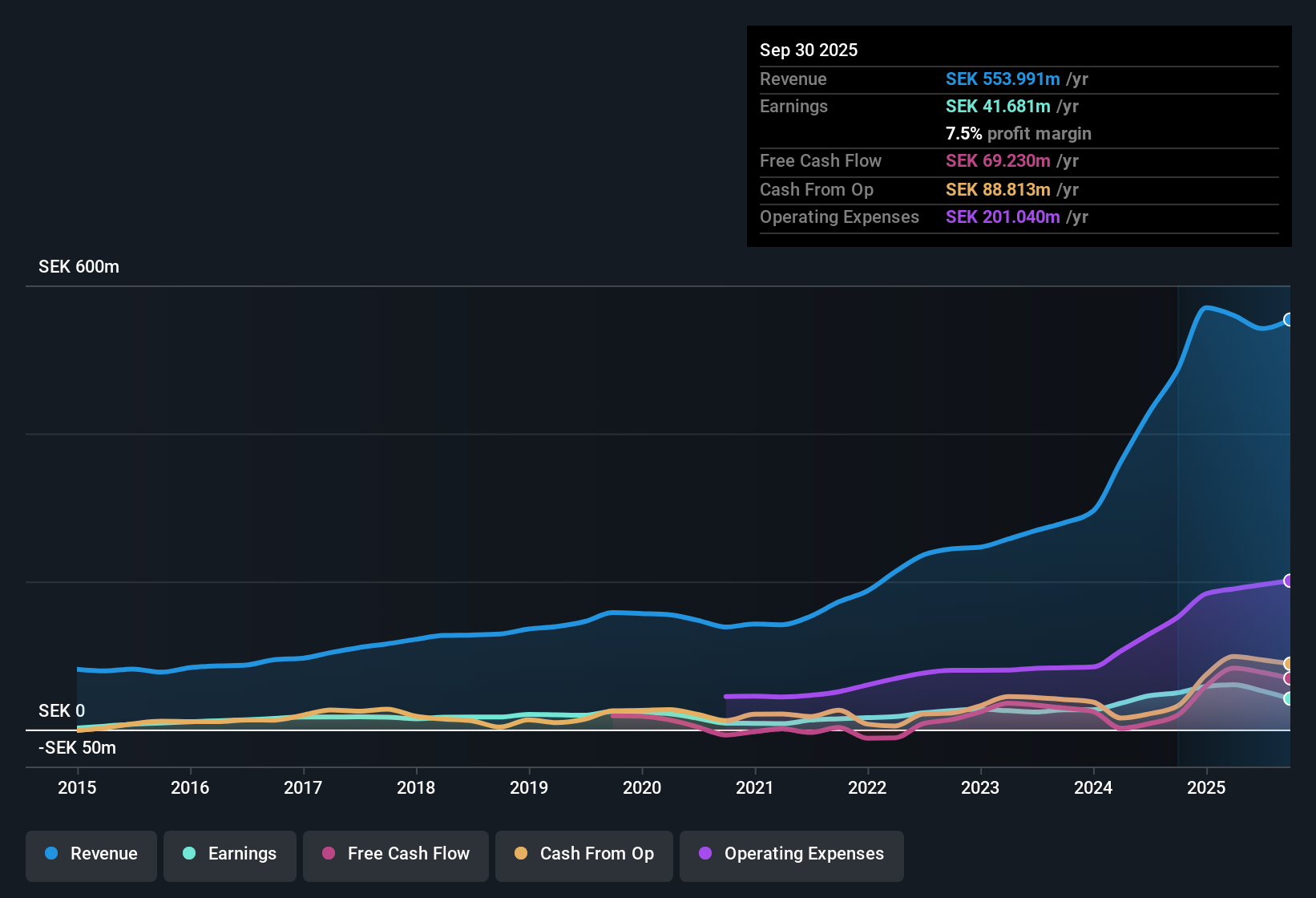

Stille (OM:STIL) posted annual earnings forecast to grow 19.86% per year and revenue expected to expand 8.6% annually, outpacing Swedish market averages of 12.3% for earnings and 3.6% for revenue. However, the company’s net profit margin slipped to 9.6% from last year’s 11.1% as a non-recurring loss of SEK44.5 million weighed on results for the twelve months ending 30th September 2025. On the valuation front, Stille is trading at 32.3 times earnings, which is above the sector average. Its SEK187.5 share price is well below the estimated fair value of SEK361.19.

See our full analysis for Stille.Next, we’ll see how the latest results compare with the narratives often shared by the Simply Wall St community, highlighting where the data supports the consensus and where new questions may arise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Pressure From One-Off Costs

- The current net profit margin declined to 9.6%, down from last year’s 11.1%. A non-recurring loss of SEK44.5 million affected the latest results.

- Bears highlight that margin contraction can be a red flag for future profitability, especially when it stems from a sizeable one-time charge.

- Compared to the previous year, the drop in net profit margin aligns with concerns that underlying cost dynamics or operational surprises could limit near-term recovery.

- The presence of a SEK44.5 million non-recurring loss creates uncertainty about whether future margins will rebound or remain pressured if similar events occur again.

Growth Track Record Slows, But Outpaces Market

- While Stille averaged hefty 38% annual earnings growth over the past five years, most recent-year growth slipped to 9%. Despite the slowdown, this remains comfortably ahead of the Swedish market average.

- What is surprising is that even with this pullback, the pace of expansion is still robust versus peers, supporting the narrative that Stille’s underlying business retains significant momentum.

- The five-year average demonstrates unusual strength in the company’s core operations, mitigating some concern about the latest slowdown.

- Bears expecting a more dramatic deceleration may find little support in the current trend, as ongoing double-digit growth keeps Stille positioned well relative to broader market conditions.

DCF Valuation Gap Signals Potential Upside

- Stille’s current share price of SEK187.5 sits well below its DCF fair value estimate of SEK361.19, representing a material discount.

- This discrepancy between price and fair value heavily supports investors looking for upside, as it suggests the stock could offer significant value if growth and margin trends stabilize.

- Trading at 32.3 times earnings, the company is at a premium to the European Medical Equipment industry average of 29.5, but far below the peer group average of 91.3. This provides context for the DCF gap.

- Bulls argue that the valuation disconnect is a case for long-term conviction, especially if profitability rebounds after the one-off loss.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Stille's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Stille’s declining profit margin and recent one-off loss introduce uncertainty about future profitability and the potential for sustainable value recovery.

If steady, predictable growth is what you want, focus instead on stable growth stocks screener (2090 results) and discover companies that deliver reliable results through various market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STIL

Stille

Develops, manufactures, and distributes medtech products in Sweden and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives