- Thailand

- /

- Healthcare Services

- /

- SET:SMD

Discover November 2024's Top Penny Stocks

Reviewed by Simply Wall St

As global markets react to recent political shifts and economic policies, major indices have reached new heights, with U.S. stocks rallying on expectations of growth and tax reforms. In this context, the often-overlooked realm of penny stocks presents intriguing opportunities for investors seeking potential value in smaller or newer companies. Despite their name suggesting a bygone era, penny stocks can offer significant returns when backed by strong financials and growth prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.78 | MYR135.97M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.92 | THB1.67B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.615 | A$71.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR761.86M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$140.36M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.8789 | £385.78M | ★★★★☆☆ |

Click here to see the full list of 5,781 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Impact Coatings (OM:IMPC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Impact Coatings AB (publ) offers physical vapor deposition (PVD) surface treatment solutions for hydrogen and metallization applications globally, with a market cap of SEK418.19 million.

Operations: The company generates revenue from its Specialty Chemicals segment, totaling SEK128.7 million.

Market Cap: SEK418.19M

Impact Coatings AB, with a market cap of SEK418.19 million, has shown recent improvements in its financial performance despite being unprofitable. The company reported increased sales and reduced net losses for the third quarter of 2024 compared to the previous year. Its short-term assets exceed liabilities, providing some financial stability, although it faces challenges with long-term liabilities coverage and a limited cash runway under current free cash flow conditions. The management team's relative inexperience could impact strategic execution; however, no significant shareholder dilution occurred recently. Earnings are forecasted to grow significantly, offering potential upside for investors interested in speculative opportunities within the specialty chemicals sector.

- Take a closer look at Impact Coatings' potential here in our financial health report.

- Explore Impact Coatings' analyst forecasts in our growth report.

SpectraCure (OM:SPEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SpectraCure AB (publ) develops cancer treatment systems and has a market cap of SEK165.12 million.

Operations: SpectraCure AB (publ) has not reported any revenue segments.

Market Cap: SEK165.12M

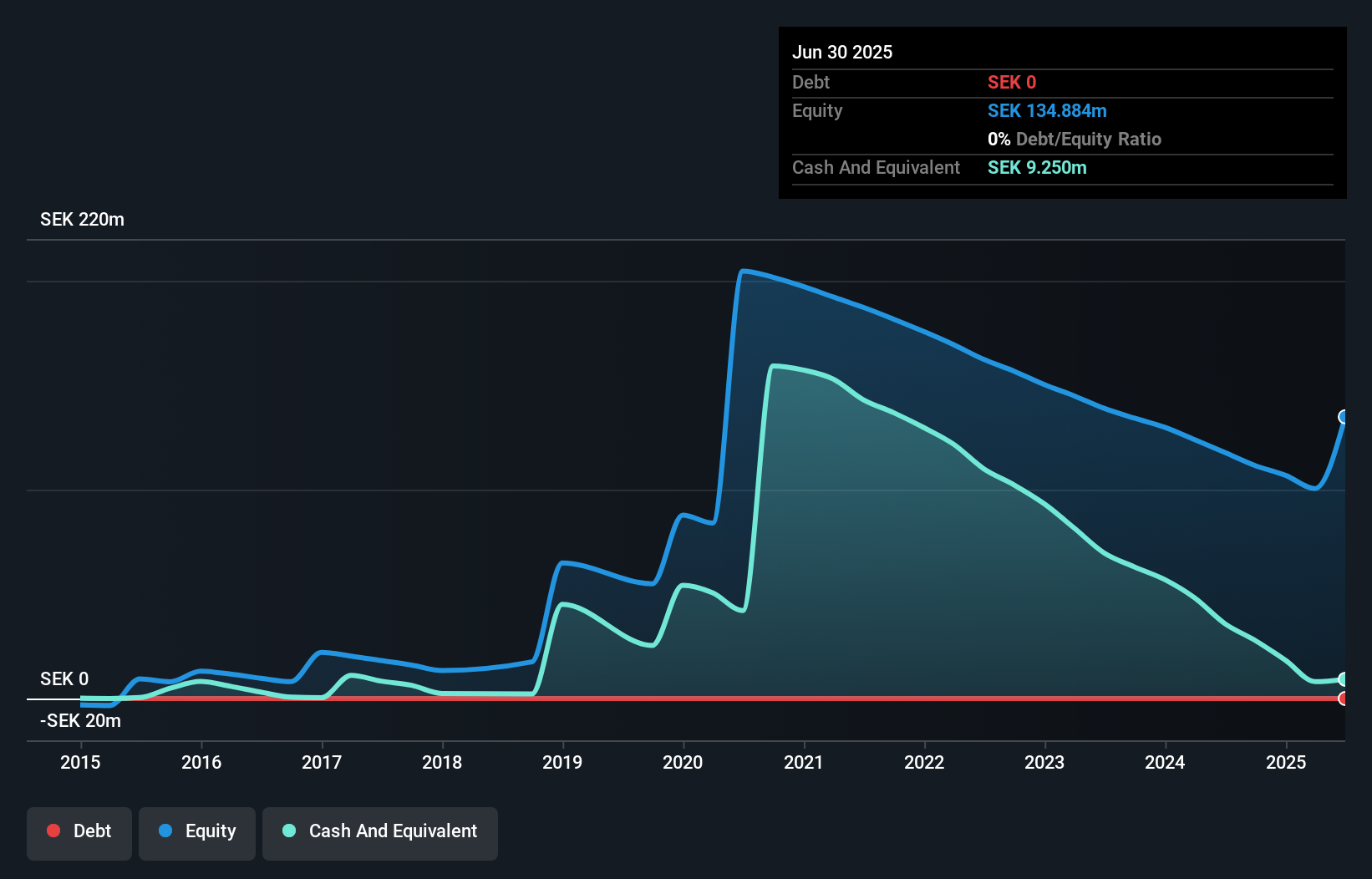

SpectraCure AB, with a market cap of SEK165.12 million, operates as a pre-revenue entity with minimal revenue reported at SEK0.412 million for Q2 2024. The company remains unprofitable, experiencing increased losses over the past five years and a negative return on equity of -17.98%. However, SpectraCure maintains financial stability with short-term assets of SEK38.9 million surpassing both its short and long-term liabilities and is debt-free after reducing its previous debt levels. Despite having less than one year of cash runway if current cash flow trends persist, shareholders have not faced significant dilution recently amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of SpectraCure.

- Assess SpectraCure's previous results with our detailed historical performance reports.

SaintMed (SET:SMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SaintMed Public Company Limited imports and distributes medical equipment to private hospitals, clinics, and the general public in Thailand, with a market cap of THB851.58 million.

Operations: The company's revenue is derived entirely from selling medical equipment and devices, totaling THB748.04 million.

Market Cap: THB851.58M

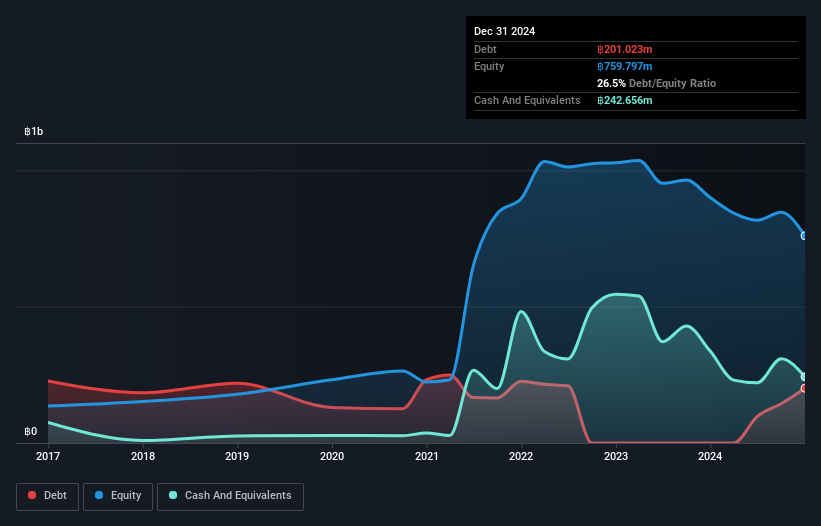

SaintMed Public Company Limited, with a market cap of THB851.58 million, generates revenue entirely from medical equipment sales totaling THB748.04 million. Despite negative earnings growth of -65.9% over the past year and declining profit margins from 10.9% to 5%, the company has not diluted shareholders significantly in the past year and trades at 20.2% below estimated fair value. The company's debt-to-equity ratio has improved significantly over five years, reducing from 85.5% to 12%. However, negative operating cash flow indicates challenges in covering debt obligations despite strong short-term asset coverage for liabilities and well-covered interest payments by EBIT (10.7x).

- Navigate through the intricacies of SaintMed with our comprehensive balance sheet health report here.

- Examine SaintMed's past performance report to understand how it has performed in prior years.

Make It Happen

- Reveal the 5,781 hidden gems among our Penny Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SMD

SaintMed

Engages in the importing and distribution of medical equipment to private hospitals, clinics, and the general public in Thailand.

Excellent balance sheet slight.