- Thailand

- /

- Retail Distributors

- /

- SET:SPC

Dividend Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a varied impact on different sectors, with financials and energy benefiting from deregulation hopes while healthcare faces challenges. Amidst this backdrop, dividend stocks present an intriguing option for those seeking steady income streams, as they tend to offer resilience during times of market volatility and policy shifts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.66% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.47% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.88% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.55% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

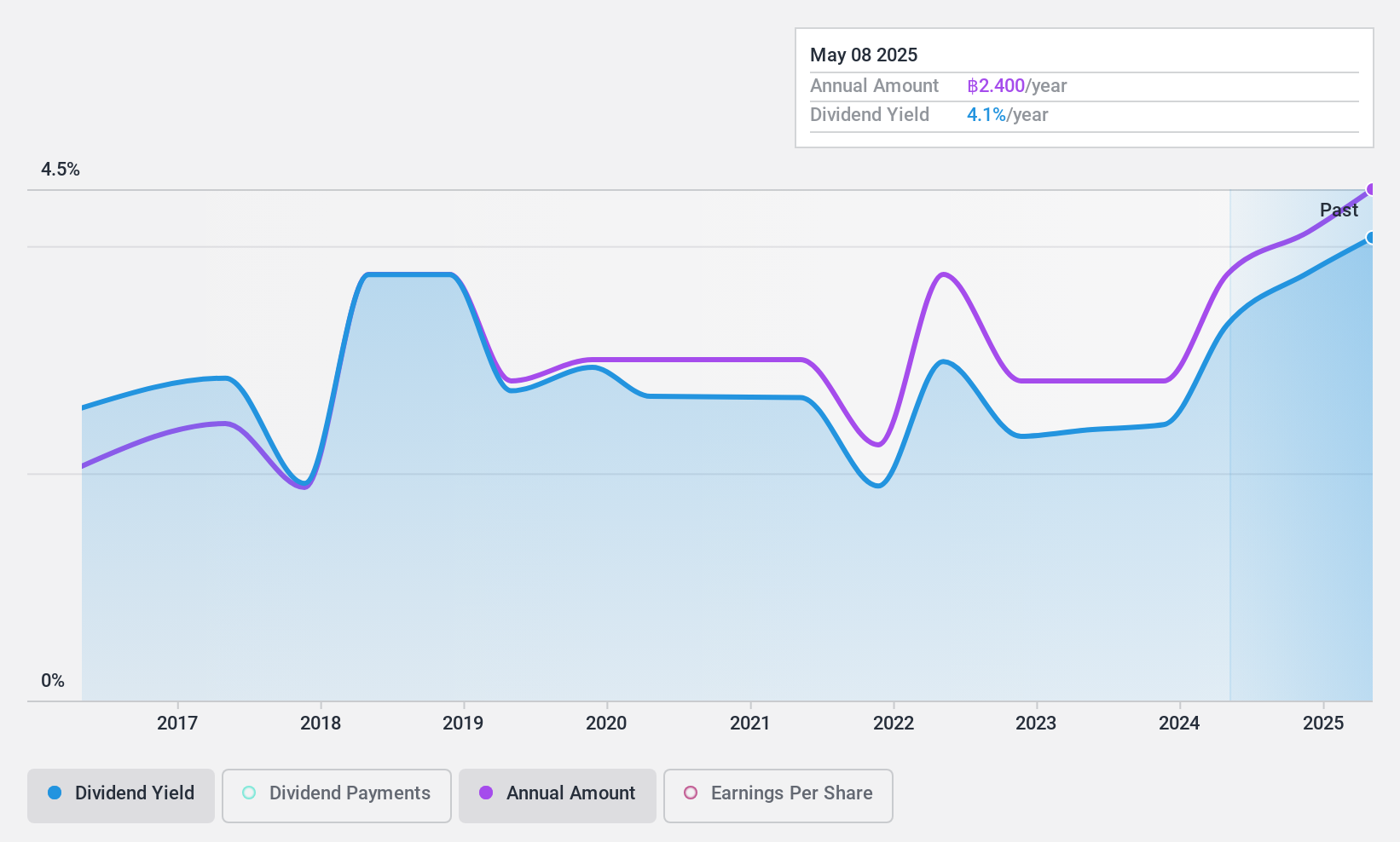

Saha Pathanapibul (SET:SPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saha Pathanapibul Public Company Limited, with a market cap of THB19.37 billion, operates in the consumer goods distribution sector both in Thailand and internationally through its subsidiaries.

Operations: Saha Pathanapibul Public Company Limited generates revenue primarily from the sales of consumer products, amounting to THB40.27 billion, and also earns from office building rentals totaling THB144 million.

Dividend Yield: 3.3%

Saha Pathanapibul offers a low price-to-earnings ratio of 7.1x, suggesting good value compared to the Thai market average. Its dividend payments are well covered by earnings with a payout ratio of 16.5% and cash flows at 55.7%, indicating sustainability despite a volatile history over the past decade. Recent board decisions, such as waiving rights in President Foods (Cambodia), reflect strategic financial management but do not directly impact dividends.

- Take a closer look at Saha Pathanapibul's potential here in our dividend report.

- Upon reviewing our latest valuation report, Saha Pathanapibul's share price might be too optimistic.

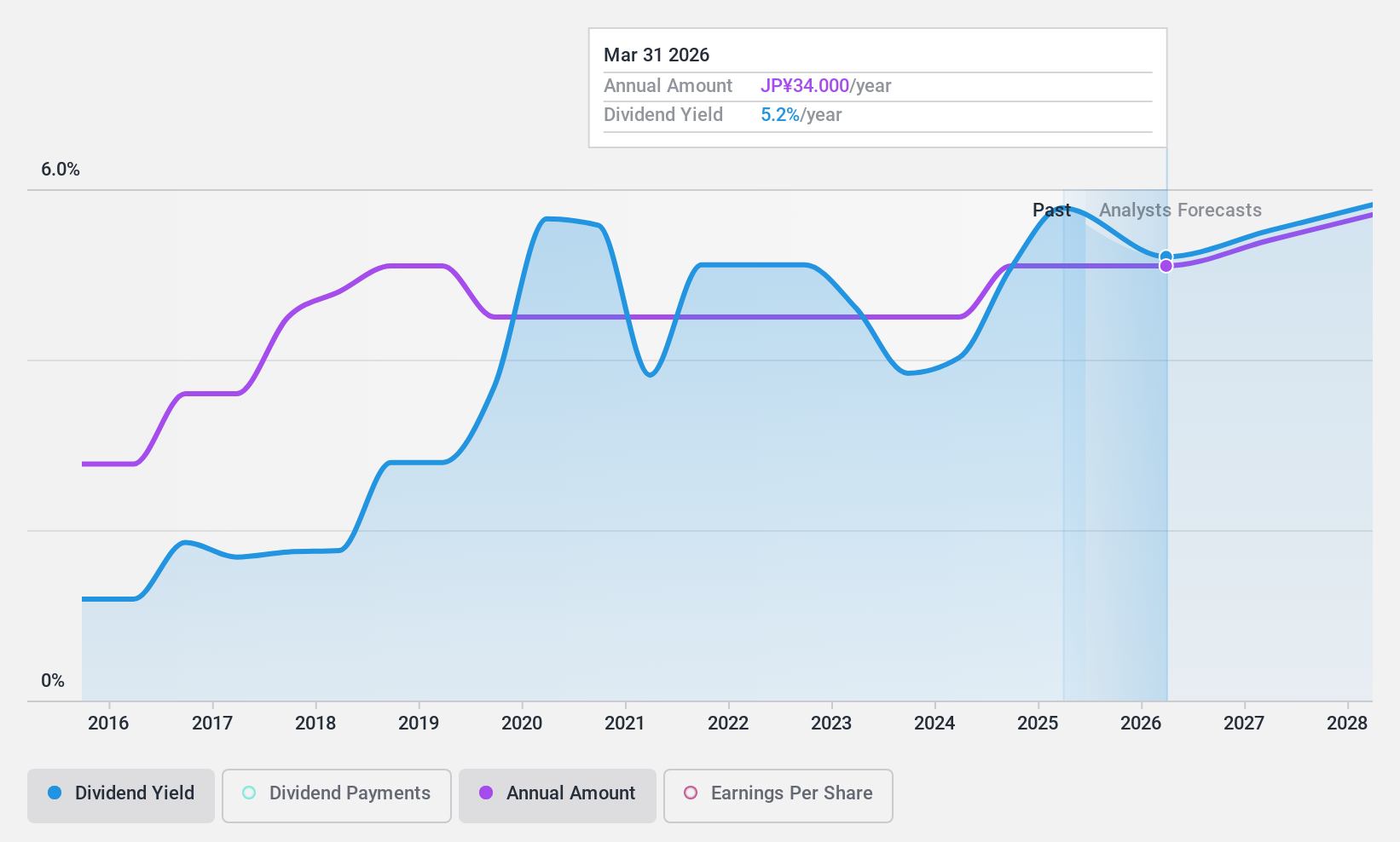

DaikyoNishikawa (TSE:4246)

Simply Wall St Dividend Rating: ★★★★★★

Overview: DaikyoNishikawa Corporation develops, manufactures, and sells automotive and housing synthetic plastic parts in Japan, with a market cap of ¥43.89 billion.

Operations: DaikyoNishikawa Corporation's revenue stems from its operations in the automotive and housing synthetic plastic parts sectors in Japan.

Dividend Yield: 5.4%

DaikyoNishikawa's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 37.4% and 18.8%, respectively, ensuring sustainability. The company has maintained stable and reliable dividends over the past decade, with a notable increase in earnings by ¥20.9% last year contributing to this stability. Trading significantly below its estimated fair value suggests potential for capital appreciation alongside its attractive dividend yield of 5.43%, which ranks in the top quarter among Japanese stocks.

- Delve into the full analysis dividend report here for a deeper understanding of DaikyoNishikawa.

- Upon reviewing our latest valuation report, DaikyoNishikawa's share price might be too pessimistic.

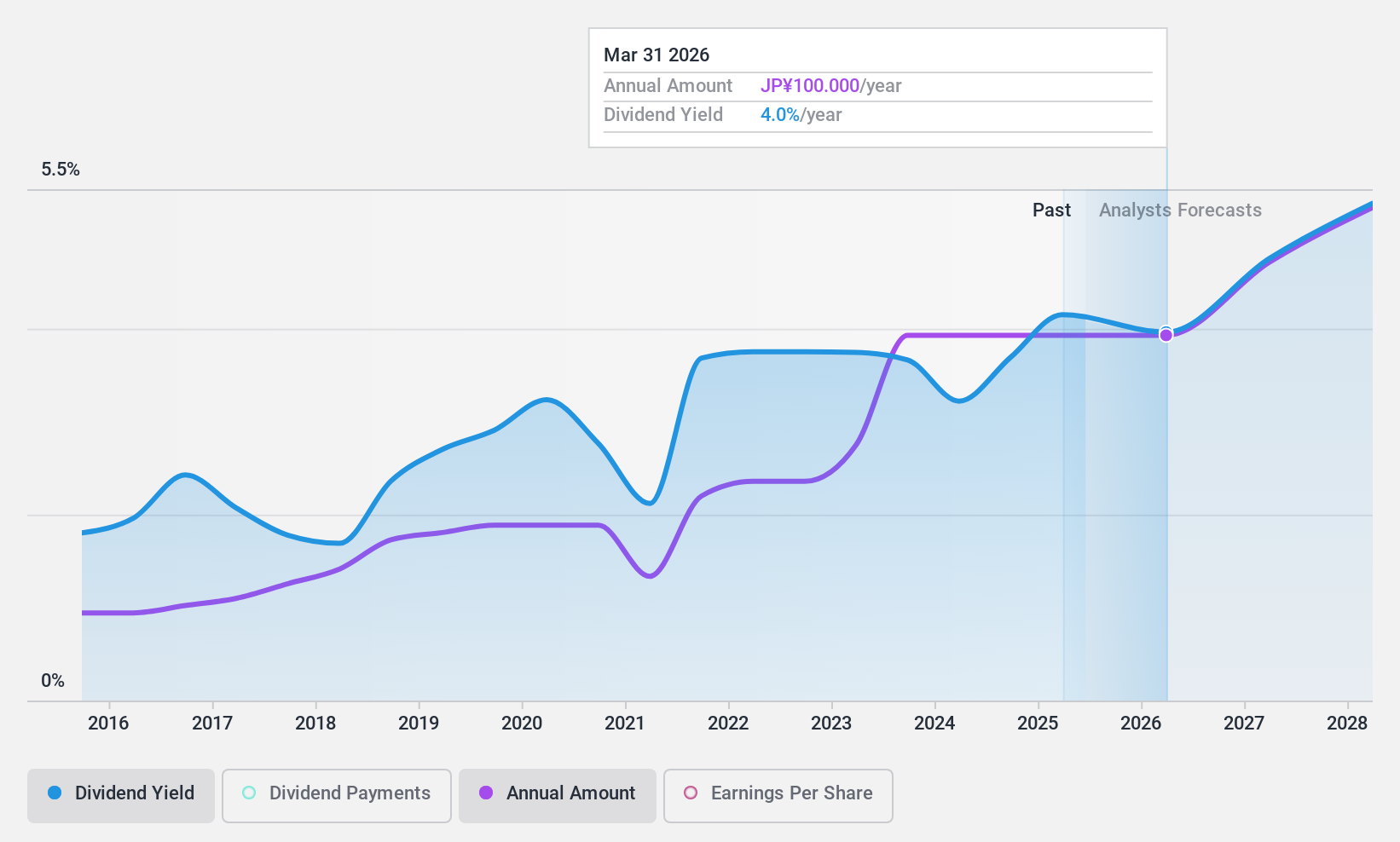

Tachibana Eletech (TSE:8159)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tachibana Eletech Co., Ltd. is a technology-driven trading company operating both in Japan and internationally, with a market cap of ¥60.91 billion.

Operations: Tachibana Eletech Co., Ltd. generates its revenue through various segments, including technology trading operations both domestically and internationally.

Dividend Yield: 3.8%

Tachibana Eletech's dividend of ¥50.00 per share remains consistent with the previous period, supported by a low payout ratio of 17.7% and cash payout ratio of 23.1%, indicating strong coverage by earnings and cash flows. Despite past volatility in dividends, recent buybacks suggest shareholder value focus. Trading at a significant discount to estimated fair value enhances its appeal alongside a competitive dividend yield within Japan's top quartile at 3.85%.

- Unlock comprehensive insights into our analysis of Tachibana Eletech stock in this dividend report.

- Our valuation report unveils the possibility Tachibana Eletech's shares may be trading at a discount.

Seize The Opportunity

- Navigate through the entire inventory of 1954 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SPC

Saha Pathanapibul

Engages in the consumer goods distribution business in Thailand and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives