- Sweden

- /

- Medical Equipment

- /

- OM:SEDANA

Sedana Medical (OM:SEDANA): Persistent Losses Challenge Bullish Revenue Growth Narratives in Latest Earnings

Reviewed by Simply Wall St

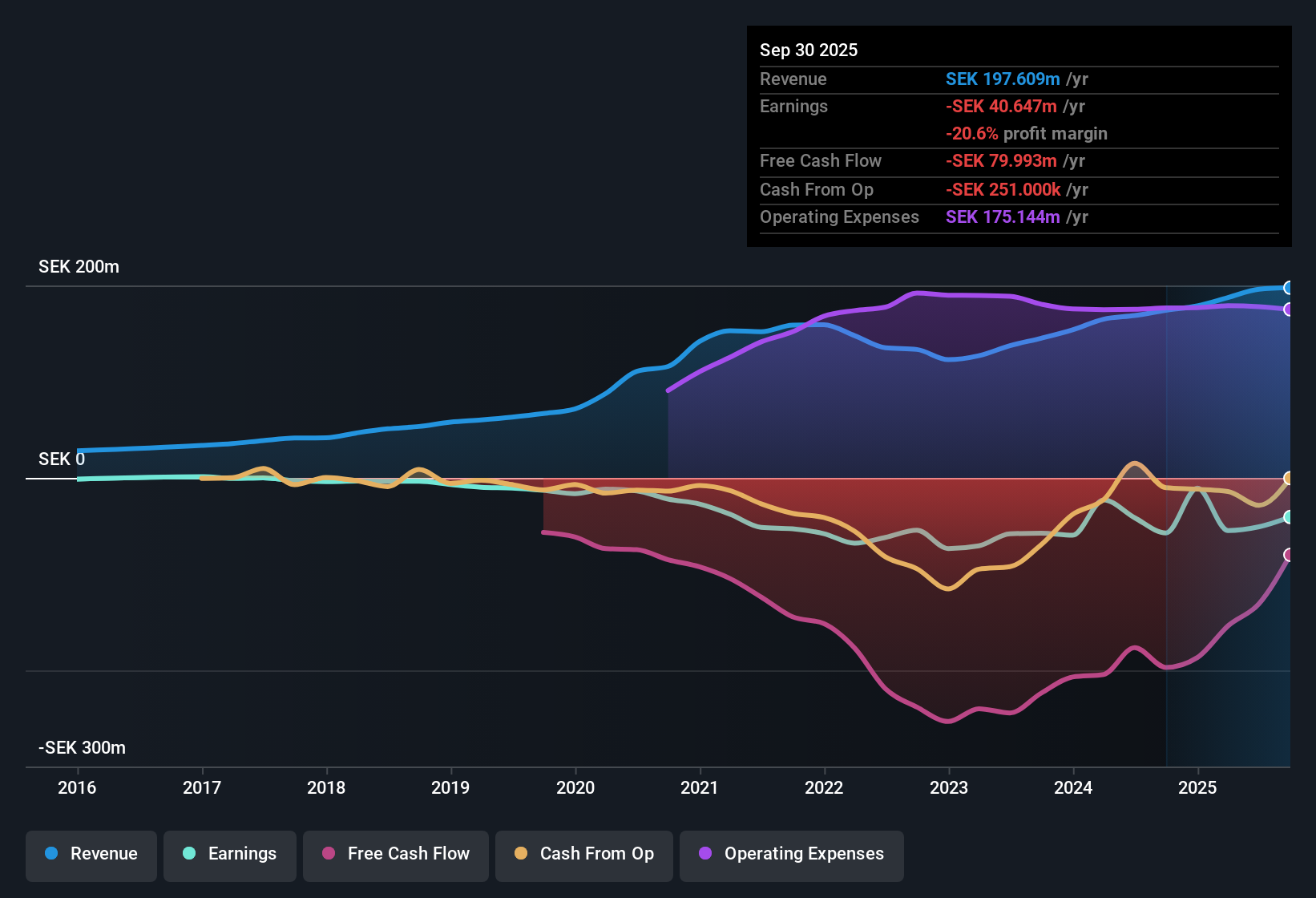

Sedana Medical (OM:SEDANA) continues to operate at a loss, with net losses deepening at a steady rate of 1% per year over the last five years and ongoing forecasts pointing to unprofitability for at least the next three years. Meanwhile, revenue is expected to grow an impressive 26.45% per year, well outpacing the Swedish market average of 3.9% each year. This makes strong sales growth the central reward for investors weighing the company’s persistent challenges in reaching profitability.

See our full analysis for Sedana Medical.Now that the earnings results are in, the next section will put Sedana Medical’s headline numbers to the test against the main narratives followed by investors to see where expectations meet reality.

See what the community is saying about Sedana Medical

Margins Steady Above 70% Despite Costs

- Sedana Medical’s gross margin remains consistently above 70%, signaling pricing power and operational improvements, even as the company scales up in new markets and absorbs supply chain investments.

- According to the analysts' consensus view, stable high gross margins support the case for sustainable top-line growth. However, increasing cost pressures from manufacturing expansion and regulatory hurdles pose challenges to EBITDA and net margin expansion.

- Consensus highlights ongoing cost discipline as a lever for future profit but notes that intensifying competition and post-market regulatory burdens could erode these margin benefits.

- The company’s resilience on gross margin contrasts with the uncertain outlook for net margin if investments in the U.S. and Malaysia escalate faster than revenue gains.

U.S. Entry Could Unlock 3x Market

- Upcoming commercialization in the U.S., a market three times larger than Sedana’s current European footprint, is supported by FDA Fast Track status and the Early Access Program, both considered critical to revenue inflection assumptions.

- The analysts' consensus view emphasizes that sustained sales momentum in Europe and broader pediatric approvals create a launchpad for U.S. growth. However, they warn that delayed or failed FDA approval would significantly reduce expected revenue growth.

- Consensus narrative notes pivotal trial data and regulatory advances as unique growth drivers, yet also flags risk that a narrow clinical niche might limit long-term addressable markets if the U.S. rollout does not proceed as planned.

- Successful entry would bolster long-term growth opportunities, aligning with the company’s strong revenue forecasts, but any setbacks could stall expansion and test patience for profitability.

See how recent developments could reshape the broader narrative in the full consensus take. 📊 Read the full Sedana Medical Consensus Narrative.

Valuation: Premium To Peers, Discount To Growth

- Sedana trades on a Price-To-Sales Ratio of 5.4x, closely matching the Swedish Medical Equipment industry average of 5.5x, but sitting at a premium compared to the direct peer average of 2.9x, even though profitability is still several years away.

- Analysts' consensus narrative argues that the stock’s valuation can be justified if revenue climbs to SEK367.7 million and profit margins improve from -25.9% to the industry average of 10.2% by 2028.

- Current share price is SEK10.60 compared to the analyst price target of SEK21.00, a 98% upside, but this depends on high-growth projections materializing along with margin improvement.

- Consensus also notes that traditional valuation metrics like PE or DCF remain unreliable due to ongoing losses, making top-line delivery the key metric to watch for future rerating.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sedana Medical on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Share your viewpoint in just a few minutes and shape your own narrative: Do it your way

A great starting point for your Sedana Medical research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Sedana Medical continues to face persistent losses and uncertain profitability, with its high sales growth offset by cost pressures and unproven margin improvement.

If you want steadier performance from your investments, use stable growth stocks screener (2099 results) to focus on companies reliably delivering consistent growth and resilience through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SEDANA

Sedana Medical

A medtech and pharmaceutical company, develops, manufactures, and sells medical devices and pharmaceutical products in Sweden, Germany, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives