- Sweden

- /

- Healthtech

- /

- OM:SECT B

The Bull Case For Sectra (OM:SECT B) Could Change Following Launch of AI-Powered Reporting in US Market

Reviewed by Sasha Jovanovic

- Sectra recently introduced its built-in reporting solution for medical imaging, Sectra Reporting, to the US market, offering radiologists an integrated, AI-powered diagnostic workflow designed to streamline image review and report generation.

- This solution stands out by combining direct integration with imaging data, AI-assisted documentation, and seamless interoperability, aiming to reduce turnaround times and support faster care delivery for healthcare providers.

- We'll examine how Sectra's focus on unified, AI-embedded radiology tools could influence its investment narrative and future growth expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Sectra Investment Narrative Recap

Investors in Sectra must be confident in the company’s ability to leverage advanced, integrated imaging IT solutions to increase recurring revenue and maintain customer loyalty. The recent launch of Sectra Reporting in the US fits well with this vision, but it does not materially address the biggest short-term catalyst, the scaling of its as-a-service model, or the main near-term risk around large, lumpy contract dependencies that add revenue volatility.

Of the latest announcements, the SEK45.6 million contract for Sectra One Cloud with a major US healthcare provider stands out as particularly relevant, reflecting sustained demand for cloud-based solutions and recurring revenue streams, both critical to the company’s future catalysts. The new reporting tool complements this push by enhancing the clinical workflow experience that underpins adoption.

By contrast, investors should be aware that reliance on significant individual contracts can still create unpredictable swings in quarterly performance, especially if implementation timelines slip or...

Read the full narrative on Sectra (it's free!)

Sectra's narrative projects SEK5.2 billion revenue and SEK918.0 million earnings by 2028. This requires 16.3% yearly revenue growth and a SEK354.6 million earnings increase from SEK563.4 million today.

Uncover how Sectra's forecasts yield a SEK207.50 fair value, a 28% downside to its current price.

Exploring Other Perspectives

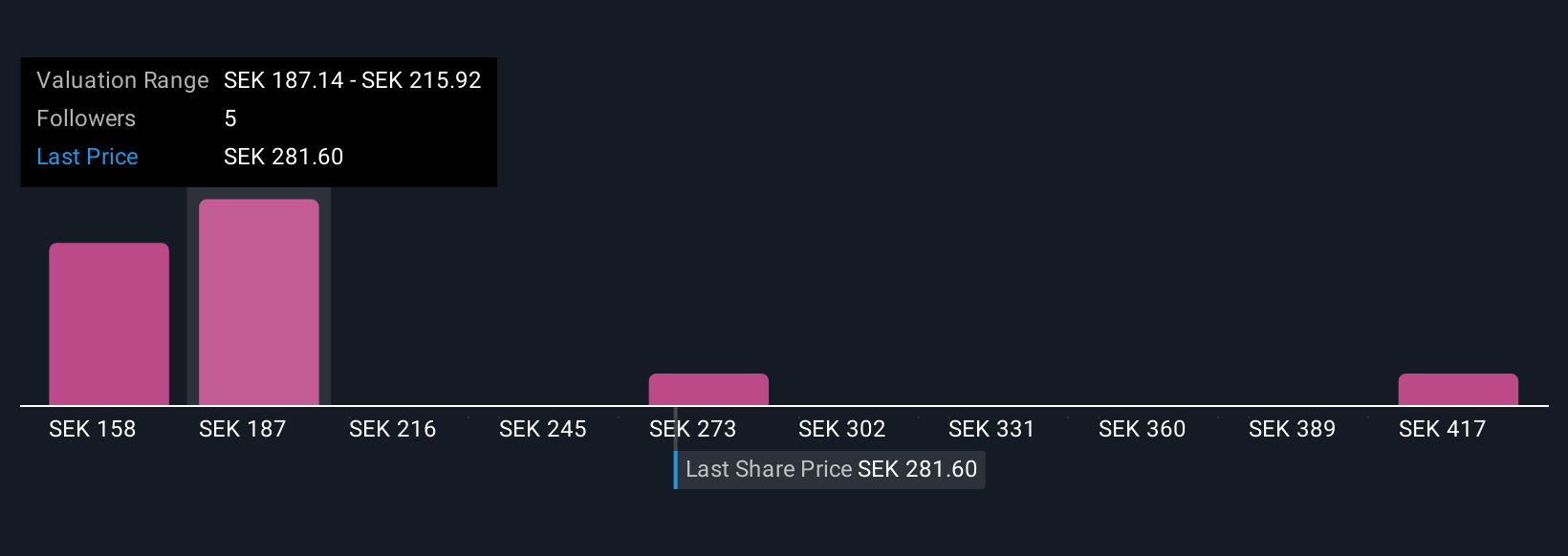

Five fair value estimates from the Simply Wall St Community for Sectra span SEK158 to SEK446 per share. With such wide differences, remember that short-term revenue can shift sharply on individual contract wins or delays, see how others are sizing up this potential.

Explore 5 other fair value estimates on Sectra - why the stock might be worth as much as 55% more than the current price!

Build Your Own Sectra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sectra research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Sectra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sectra's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026