Stock Analysis

- Sweden

- /

- Healthtech

- /

- OM:SECT B

Swedish Growth Leaders With High Insider Ownership In June 2024

Reviewed by Simply Wall St

As of June 2024, Sweden’s market landscape reflects a cautious optimism, mirroring the broader European trend of navigating political uncertainties and fluctuating economic indicators. In such an environment, growth companies with high insider ownership can be particularly compelling as these insiders often have a deep commitment to the company's long-term success. In assessing what makes a good stock within this context, it's important to consider firms where high insider ownership aligns with robust growth prospects. This alignment can signal strong confidence from those who know the company best, potentially making these stocks more resilient in unpredictable markets.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.9% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 43.4% |

| SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Here we highlight a subset of our preferred stocks from the screener.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB operates in providing financial and administrative software solutions tailored for small and medium-sized enterprises, accounting firms, and organizations, with a market capitalization of approximately SEK 39.23 billion.

Operations: The company generates revenue primarily through Core Products (SEK 698 million), followed by Entrepreneurship (SEK 356 million), The Agency (SEK 327 million), Money (SEK 232 million), and Marketplaces (SEK 150 million).

Insider Ownership: 21%

Fortnox, a Swedish software company, has demonstrated robust financial performance with a significant increase in sales and net income as reported in its Q1 2024 earnings. The company's revenue and earnings have grown substantially over the past year, with forecasts indicating continued strong growth above market averages in both metrics for the next three years. However, despite high insider ownership, recent months have seen only modest insider trading activity, lacking substantial buying. This scenario suggests cautious optimism among insiders about the company's future trajectory.

- Dive into the specifics of Fortnox here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Fortnox is trading beyond its estimated value.

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Humble Group AB operates in the refining, development, and distribution of fast-moving consumer goods both in Sweden and internationally, with a market capitalization of approximately SEK 4.34 billion.

Operations: The company generates revenue through four primary segments: Future Snacking (SEK 935 million), Sustainable Care (SEK 2.24 billion), Quality Nutrition (SEK 1.51 billion), and Nordic Distribution (SEK 2.62 billion).

Insider Ownership: 22.2%

Humble Group, a Swedish company, reported a positive shift from a net loss to a net income of SEK 23 million in Q1 2024, with sales rising to SEK 1.84 billion. Despite this growth, the company's forecasted annual revenue increase of 12% outpaces the market but remains below high-growth benchmarks. Insider transactions show more buying than selling, albeit not in large volumes. The stock is currently valued at 49.8% below its estimated fair value, indicating potential undervaluation despite concerns over recent shareholder dilution and modest return on equity projections of 9.1% in three years.

- Navigate through the intricacies of Humble Group with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Humble Group implies its share price may be lower than expected.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK 48.13 billion.

Operations: The company generates revenue primarily through its Imaging IT Solutions and Secure Communications segments, which respectively contributed SEK 2.55 billion and SEK 367.40 million.

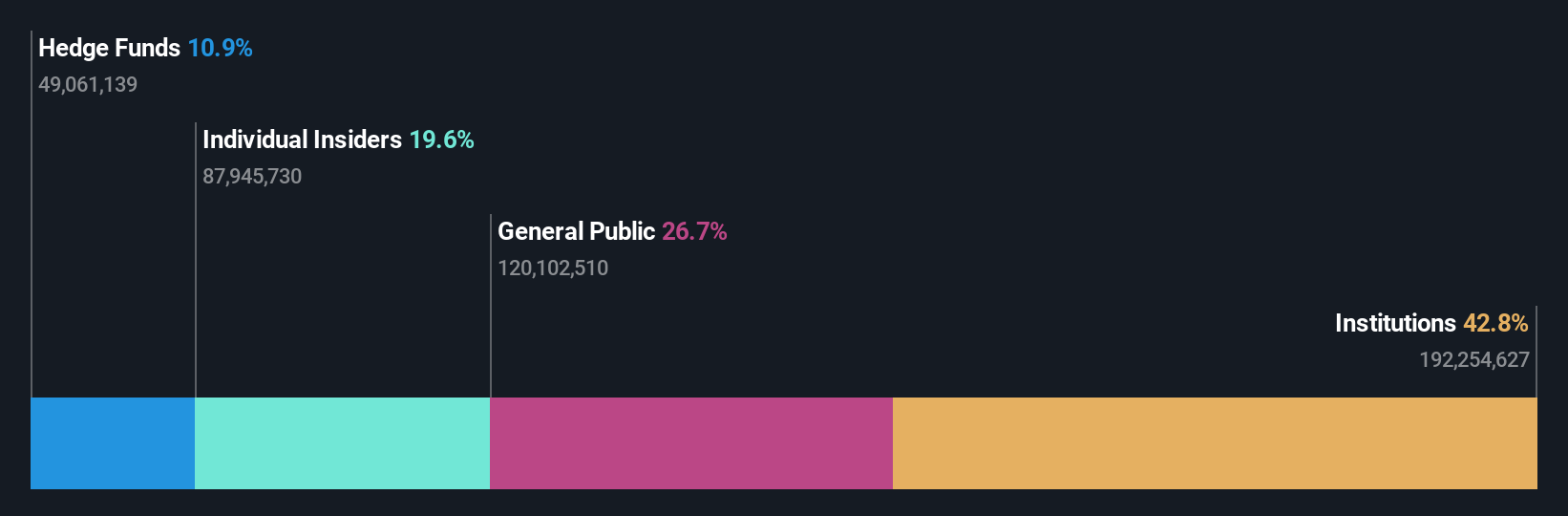

Insider Ownership: 30.3%

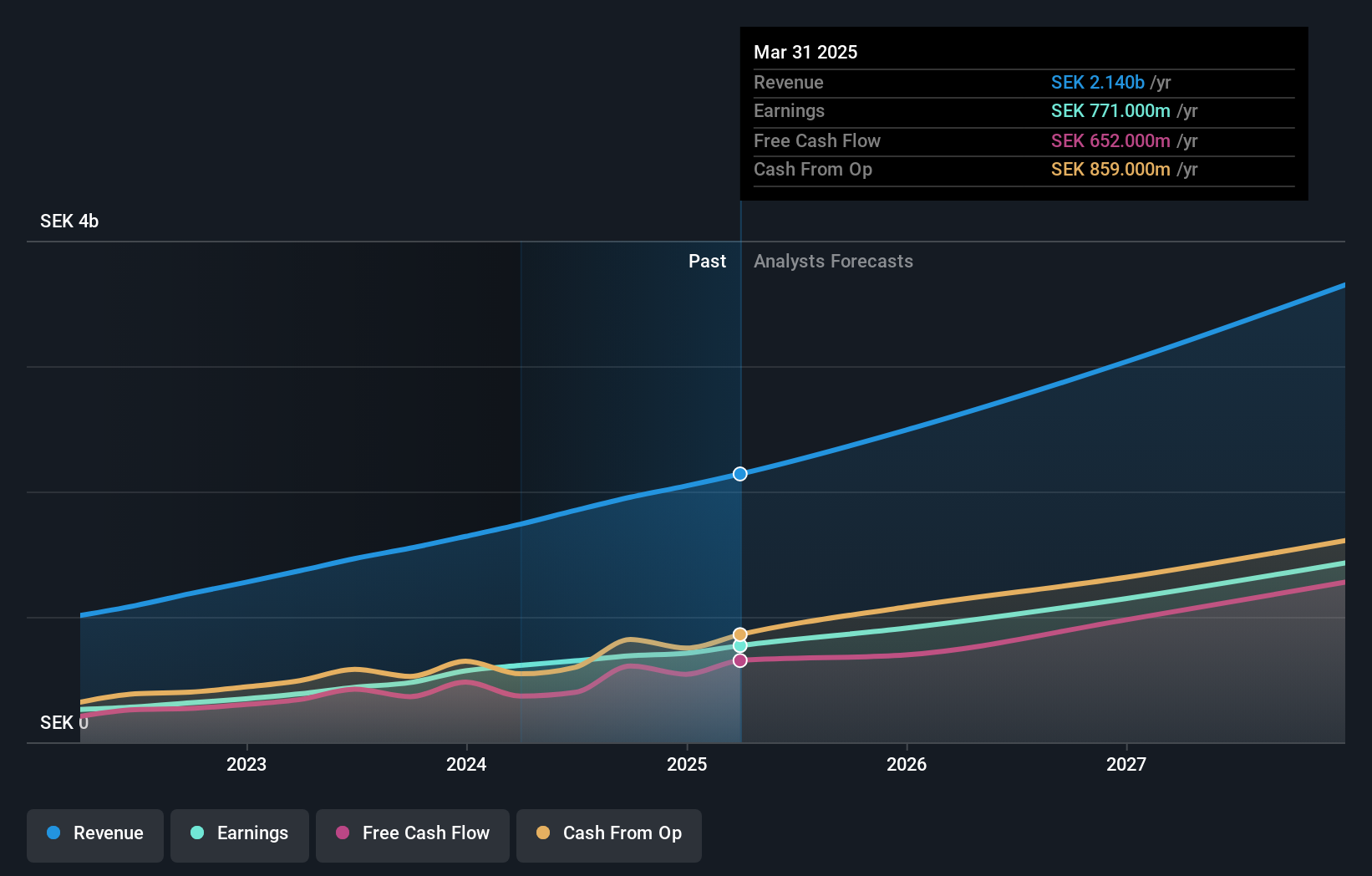

Sectra, a Swedish firm specializing in medical imaging and cybersecurity, reported robust earnings with a year-over-year increase in net income to SEK 428.39 million and sales reaching SEK 3,035.18 million for the fiscal year ending April 2024. Recent innovations include a genomic diagnostics IT module enhancing cancer treatment precision, now integrated at the University of Pennsylvania Health System. Despite these advancements and high insider ownership, Sectra's projected revenue growth of 14.7% per year trails behind more aggressive growth benchmarks but surpasses the average Swedish market growth rate.

- Take a closer look at Sectra's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Sectra's share price might be too optimistic.

Summing It All Up

- Click this link to deep-dive into the 82 companies within our Fast Growing Swedish Companies With High Insider Ownership screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Sectra is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Flawless balance sheet with reasonable growth potential.