Stock Analysis

- Sweden

- /

- Communications

- /

- OM:HMS

Swedish Exchange Growth Companies With High Insider Ownership And Up To 19% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate through fluctuating economic indicators and inflation trends, Sweden's market remains a focal point for investors looking for growth opportunities. In this context, exploring Swedish companies with high insider ownership and significant revenue growth offers a promising avenue, particularly when these firms demonstrate resilience and strategic adaptiveness in the current economic climate.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Sileon (OM:SILEON) | 20.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Here we highlight a subset of our preferred stocks from the screener.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB operates in providing financial and administrative software solutions to small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of approximately SEK 40.87 billion.

Operations: The company generates revenue through several key segments: Core Products (SEK 734 million), Businesses (SEK 378 million), Accounting Firms (SEK 352 million), Financial Services (SEK 249 million), and Marketplaces (SEK 160 million).

Insider Ownership: 21%

Revenue Growth Forecast: 19.7% p.a.

Fortnox, a Swedish software company, is demonstrating robust growth with earnings expanding by 48.1% over the past year and revenue increasing from SEK 404 million to SEK 521 million in Q2 2024 alone. Despite limited insider transactions recently, Fortnox trades at a notable discount to its estimated fair value and forecasts suggest significant earnings growth ahead. However, while its revenue growth outpaces the Swedish market average, it remains below the high-growth benchmark of 20% per year.

- Dive into the specifics of Fortnox here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Fortnox's current price could be inflated.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

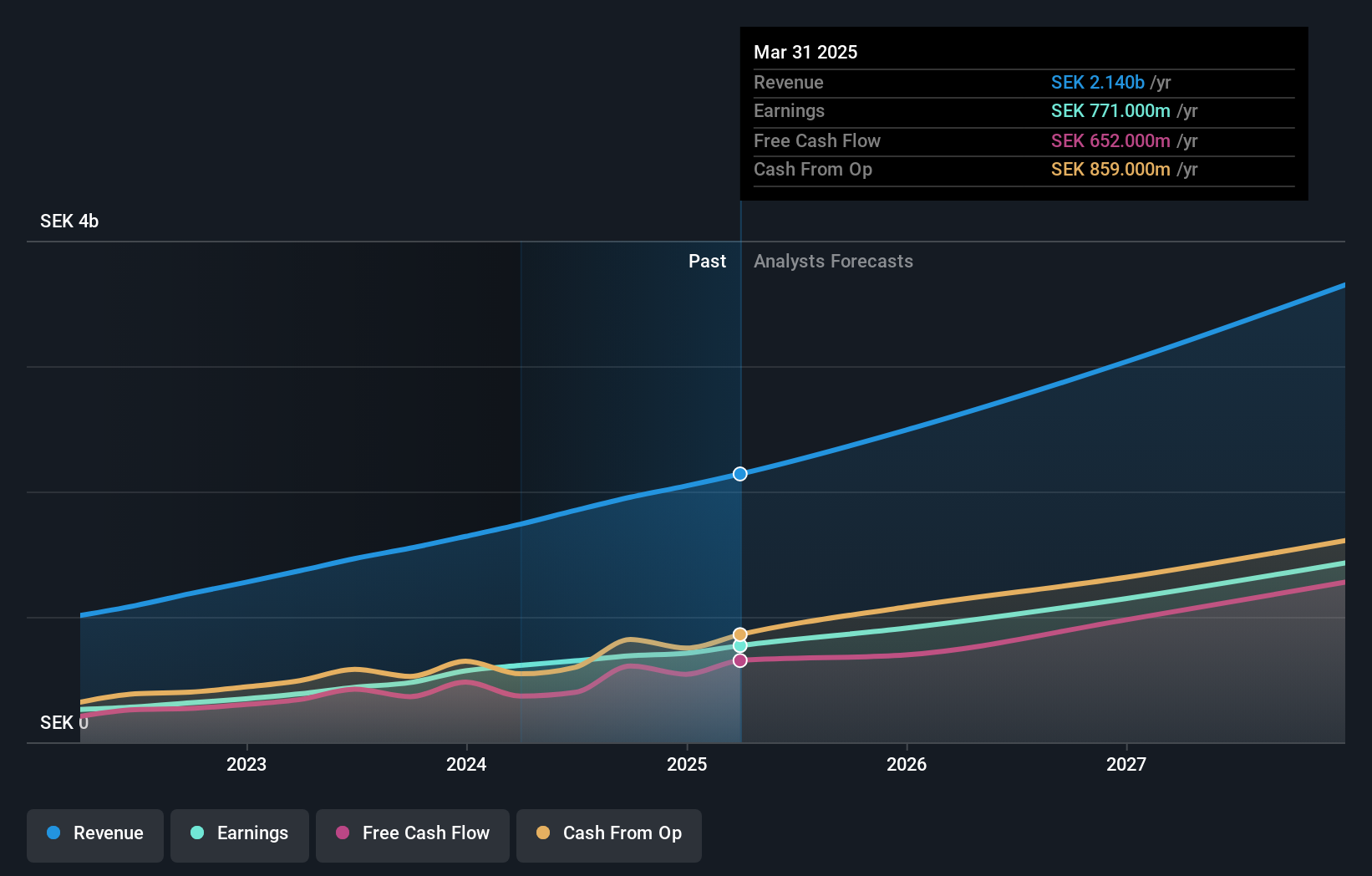

Overview: HMS Networks AB operates globally, providing products that facilitate communication and information sharing between industrial equipment, with a market cap of approximately SEK 19.78 billion.

Operations: The company generates SEK 3.01 billion from its wireless communications equipment segment.

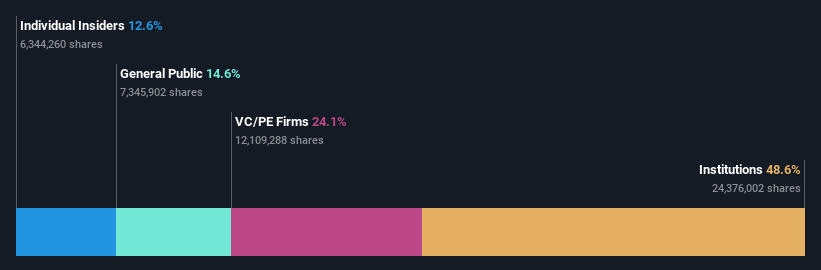

Insider Ownership: 12.6%

Revenue Growth Forecast: 12.2% p.a.

HMS Networks, a Swedish tech firm, reported a decline in net income from SEK 288 million to SEK 140 million over six months, with earnings per share also falling. Despite this downturn, HMS is projected to outpace the Swedish market with an expected annual profit growth of 26.3% and revenue growth of 12.2%. Insider activity has been muted with more shares purchased than sold recently but not in significant volumes. Additionally, the company's high level of debt may pose challenges despite its promising growth forecasts.

- Click here and access our complete growth analysis report to understand the dynamics of HMS Networks.

- The analysis detailed in our HMS Networks valuation report hints at an inflated share price compared to its estimated value.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

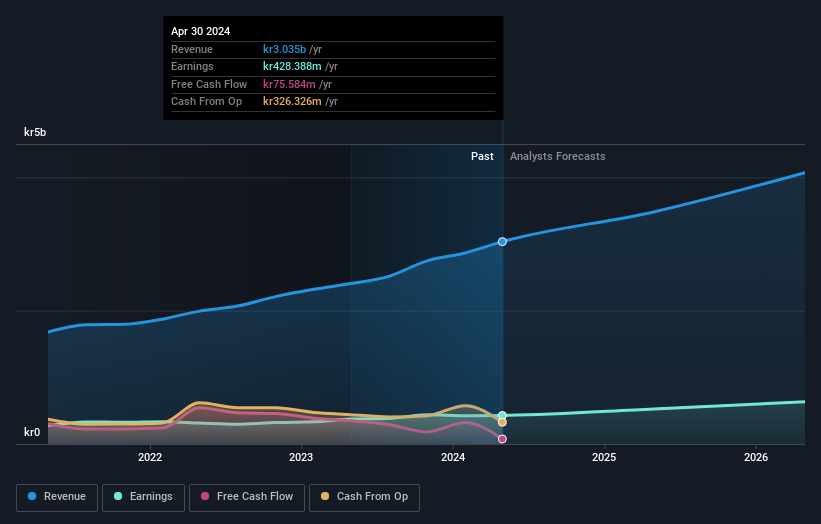

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK 45.97 billion.

Operations: The company generates revenue primarily through its Imaging IT Solutions and Secure Communications segments, which reported SEK 2.55 billion and SEK 367.35 million respectively, along with a smaller contribution from Business Innovation at SEK 89.87 million.

Insider Ownership: 30.3%

Revenue Growth Forecast: 14.7% p.a.

Sectra, a Swedish health tech company, demonstrates robust insider ownership and promising growth metrics. While its revenue growth at 14.7% annually is below the high-growth threshold of 20%, it outpaces the Swedish market's average of 1.7%. Earnings are expected to rise by 19.33% per year, surpassing the market's 15.2%. Recent initiatives include launching a cloud-based service in Belgium and introducing a genomic diagnostics module in collaboration with the University of Pennsylvania Health System, enhancing its product suite and potentially boosting future performance.

- Take a closer look at Sectra's potential here in our earnings growth report.

- Our valuation report unveils the possibility Sectra's shares may be trading at a premium.

Next Steps

- Gain an insight into the universe of 88 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether HMS Networks is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HMS

HMS Networks

Engages in the provision of products that enable industrial equipment to communicate and share information worldwide.

Reasonable growth potential with mediocre balance sheet.