Fortnox And Two More Swedish Exchange Growth Companies With Major Insider Ownership

Reviewed by Simply Wall St

As global markets navigate through mixed economic signals and varying regional responses, Sweden's stock market remains a point of interest for investors looking for growth opportunities. In this context, companies with high insider ownership in Sweden can be particularly compelling, as significant insider stakes often align management’s interests with those of shareholders, potentially leading to more prudent and long-term focused business decisions.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 52% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 10.5% | 52.9% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 43.4% |

| SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Let's review some notable picks from our screened stocks.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

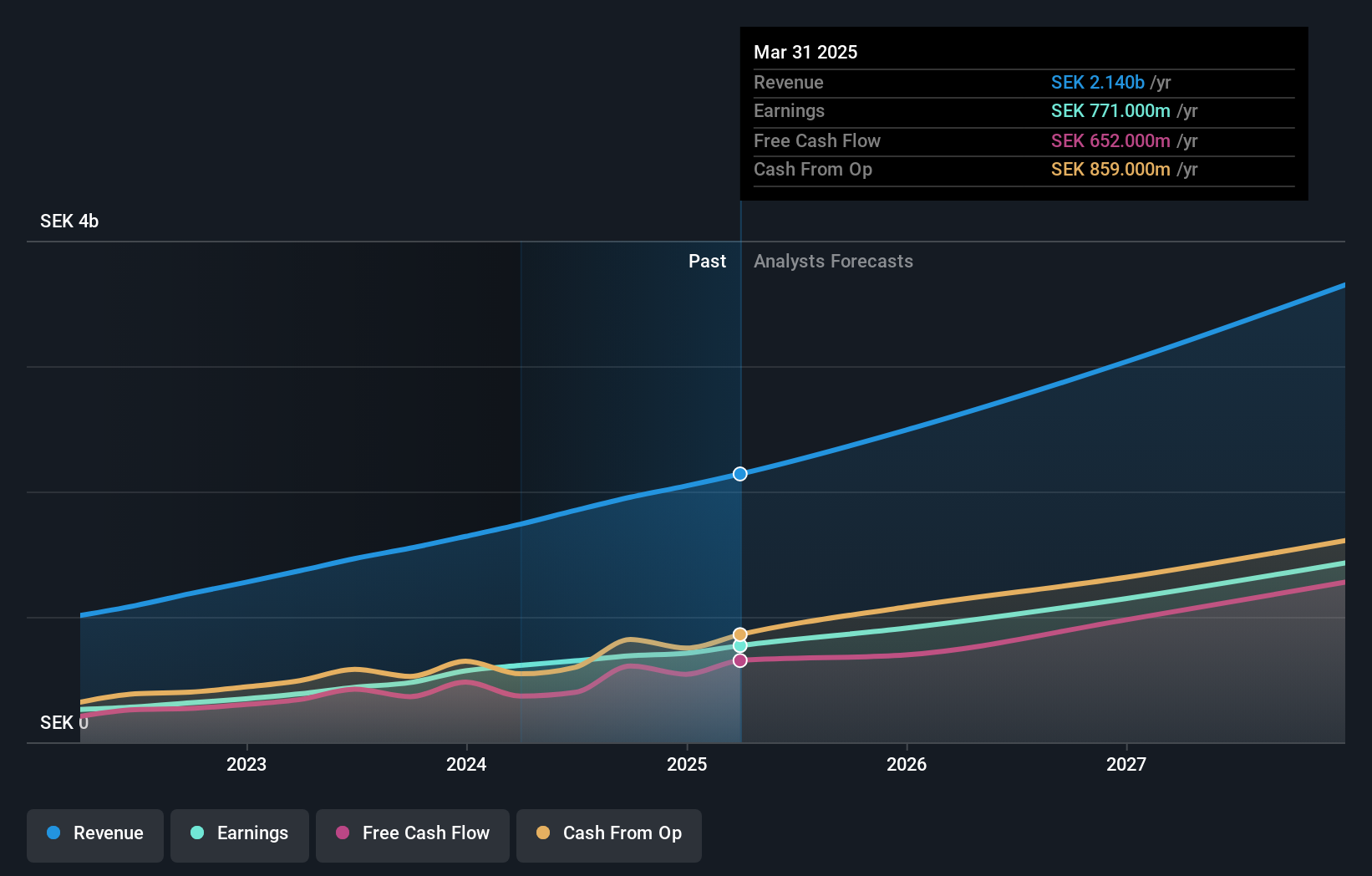

Overview: Fortnox AB operates in providing financial and administrative software solutions to small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of approximately SEK 39.81 billion.

Operations: The company generates revenue through various segments, including Core Products (SEK 698 million), The Agency (SEK 327 million), Entrepreneurship (SEK 356 million), and Marketplaces (SEK 150 million).

Insider Ownership: 21%

Earnings Growth Forecast: 21.1% p.a.

Fortnox, a Swedish software company, has demonstrated robust growth with earnings increasing by 58.8% over the past year and forecasts suggesting a further 21.09% annual growth. Despite slower revenue growth projections at 19.6%, it still outpaces the Swedish market significantly. Insider transactions have not been substantial recently, reflecting a more cautious stance from those within the company. The firm's high return on equity forecast at 33.2% indicates efficient use of shareholder funds, aligning with its strong profit growth outlook.

- Take a closer look at Fortnox's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Fortnox's share price might be too optimistic.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

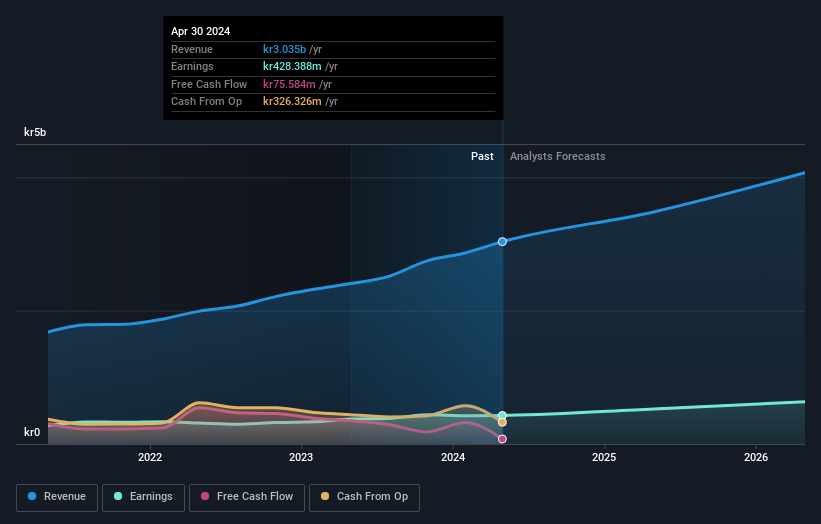

Overview: Sectra AB (publ) specializes in medical IT and cybersecurity solutions across Sweden, the United Kingdom, the Netherlands, and other European countries, with a market capitalization of SEK 48.24 billion.

Operations: The company generates SEK 2.55 billion from Imaging IT Solutions and SEK 367.40 million from Secure Communications, with an additional SEK 89.90 million from Business Innovation.

Insider Ownership: 30.3%

Earnings Growth Forecast: 19.3% p.a.

Sectra, a Swedish company specializing in medical imaging and cybersecurity, has shown significant growth with a recent revenue increase to SEK 3.04 billion, up from SEK 2.41 billion last year. This aligns with its innovative strides in healthcare technology, evidenced by the launch of a new genomic diagnostics module and securing additional contracts like the NATO Communications and Information Agency's extended commitment. Despite these advancements, its projected annual revenue growth of 14.7% slightly trails the more aggressive market benchmarks. Sectra maintains robust insider ownership but lacks substantial insider trading activity over the past three months, suggesting stable internal confidence in its strategic direction.

- Click here to discover the nuances of Sectra with our detailed analytical future growth report.

- Our valuation report here indicates Sectra may be overvalued.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

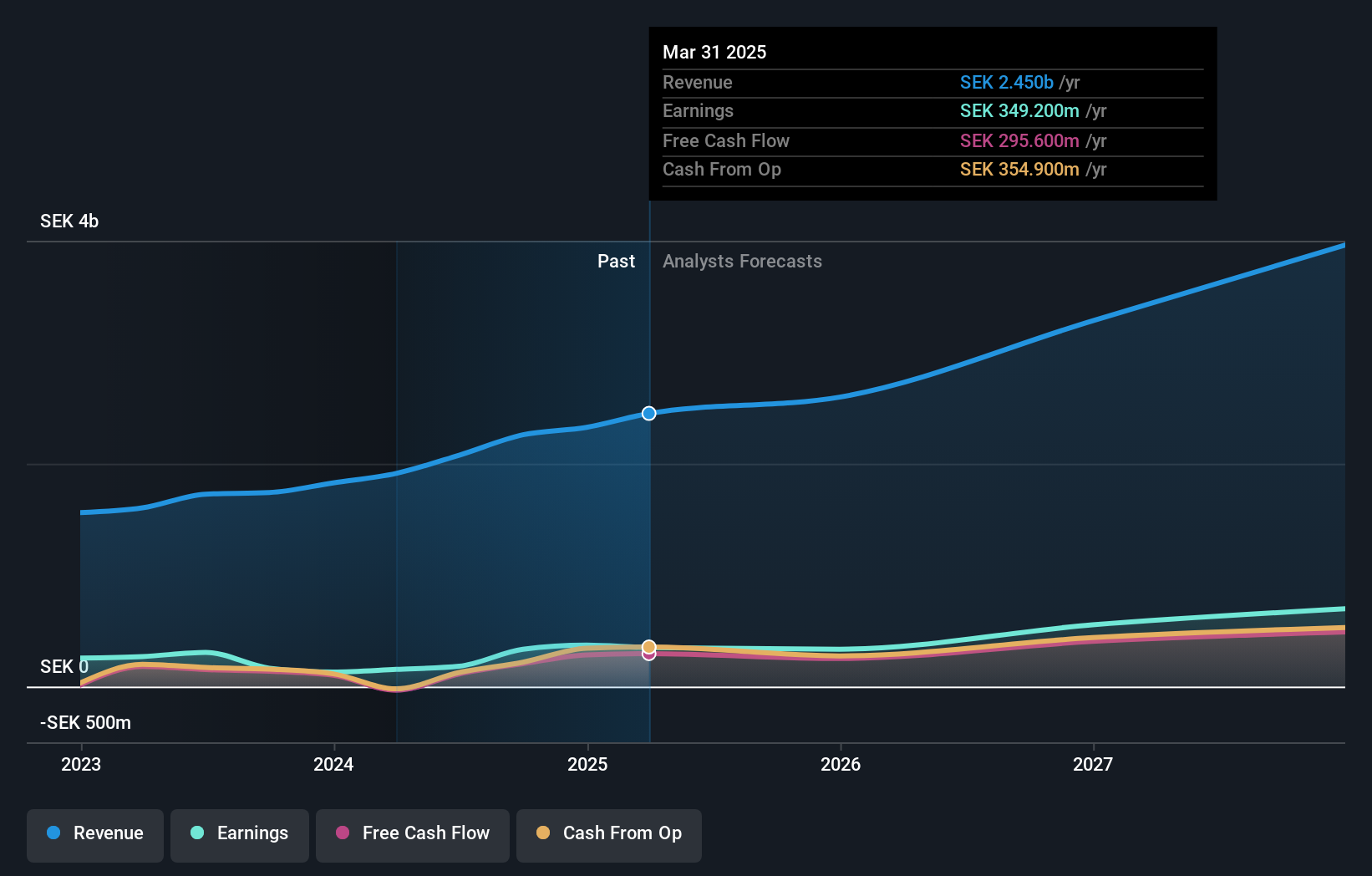

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 21.14 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Earnings Growth Forecast: 43.4% p.a.

Yubico, a Swedish growth company with significant insider ownership, faces challenges with declining profit margins and substantial shareholder dilution over the past year. However, it's poised for robust future growth with earnings expected to increase significantly at 43.42% annually and revenue forecast to grow at 23.2% per year, outpacing the Swedish market considerably. Recent developments include the election of Jaya Baloo as a new director and promising first-quarter financial results showing increased sales and net income.

- Delve into the full analysis future growth report here for a deeper understanding of Yubico.

- Our comprehensive valuation report raises the possibility that Yubico is priced higher than what may be justified by its financials.

Summing It All Up

- Access the full spectrum of 81 Fast Growing Swedish Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FNOX

Fortnox

Provides products, packages, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations.

Outstanding track record with flawless balance sheet.