- Sweden

- /

- Healthtech

- /

- OM:SECT B

Exploring High Growth Tech Stocks In November 2025

Reviewed by Simply Wall St

As global markets navigate the aftermath of the longest U.S. government shutdown in history and mixed performances across major indices, small-cap stocks have faced particular challenges, with the Russell 2000 Index dropping amid interest rate sensitivities. In this environment, identifying high-growth tech stocks requires a focus on companies that can adapt to economic uncertainties and leverage innovation to maintain momentum despite broader market volatility.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Fositek | 37.73% | 51.16% | ★★★★★★ |

| Pharma Mar | 26.56% | 44.88% | ★★★★★★ |

| Hacksaw | 32.71% | 37.88% | ★★★★★★ |

| Gold Circuit Electronics | 25.30% | 31.13% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CD Projekt | 35.69% | 51.01% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Webzen (KOSDAQ:A069080)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Webzen Inc. is a global gaming company involved in PC, online, and mobile gaming, with a market capitalization of ₩374.09 billion.

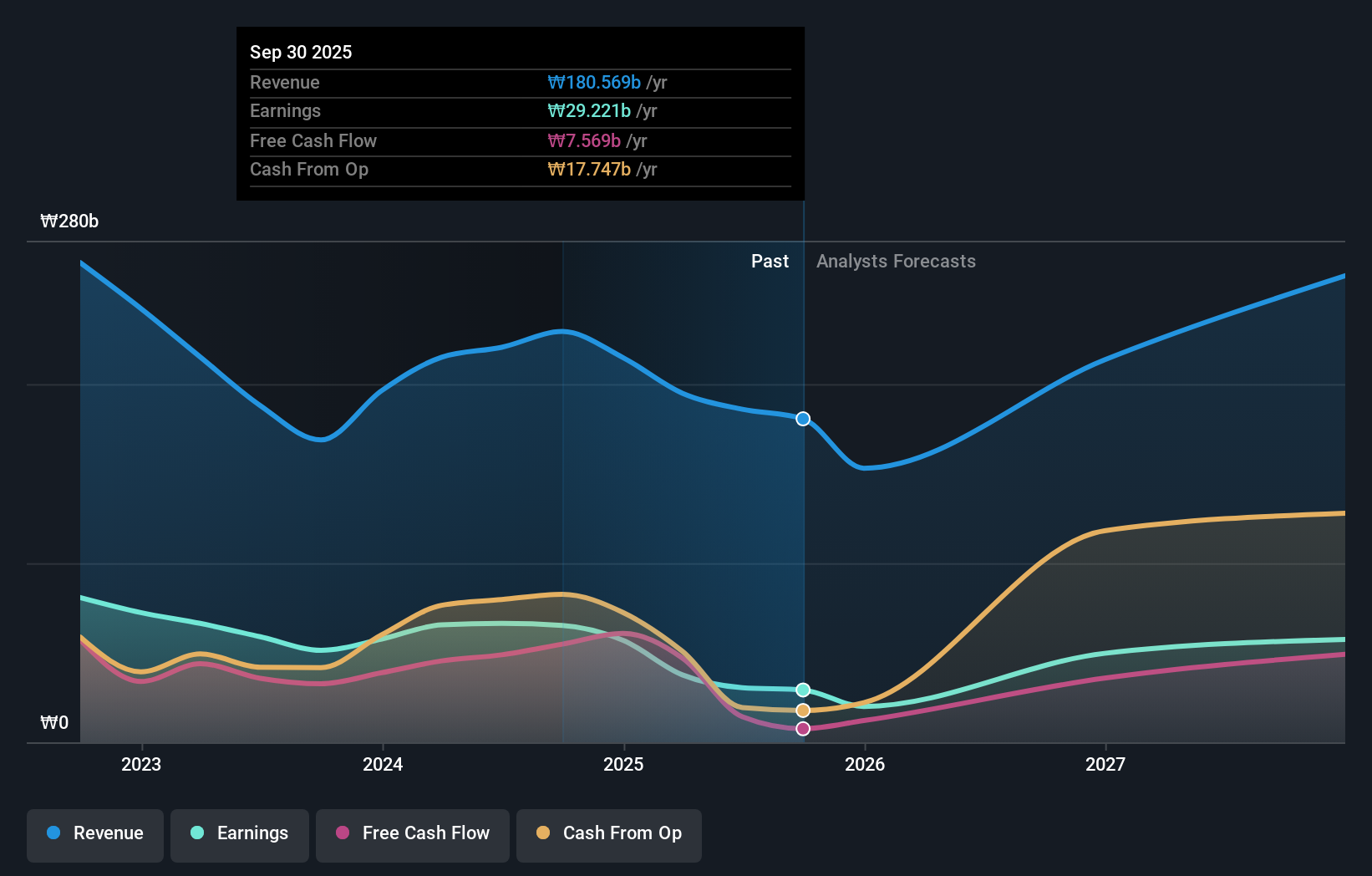

Operations: Webzen Inc. generates revenue primarily through its entertainment software segment, which contributes ₩180.57 billion. The company focuses on PC, online, and mobile gaming across global markets.

Webzen, navigating through a challenging tech landscape, has shown resilience with a projected annual earnings growth of 37.3%, significantly outpacing the KR market's 28.5%. Despite a recent dip in profit margins to 16.2% from last year's 28.5%, the company maintains robust revenue growth at an annual rate of 19.6%, which exceeds the broader market's growth of 11.5%. This performance is underpinned by high-quality earnings and positive free cash flow, positioning Webzen favorably against many industry peers who struggle with negative earnings trends. Recent affirmations of dividends and forthcoming Q3 results could provide further insights into its operational trajectory amidst evolving industry dynamics.

- Click to explore a detailed breakdown of our findings in Webzen's health report.

Understand Webzen's track record by examining our Past report.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK55.84 billion.

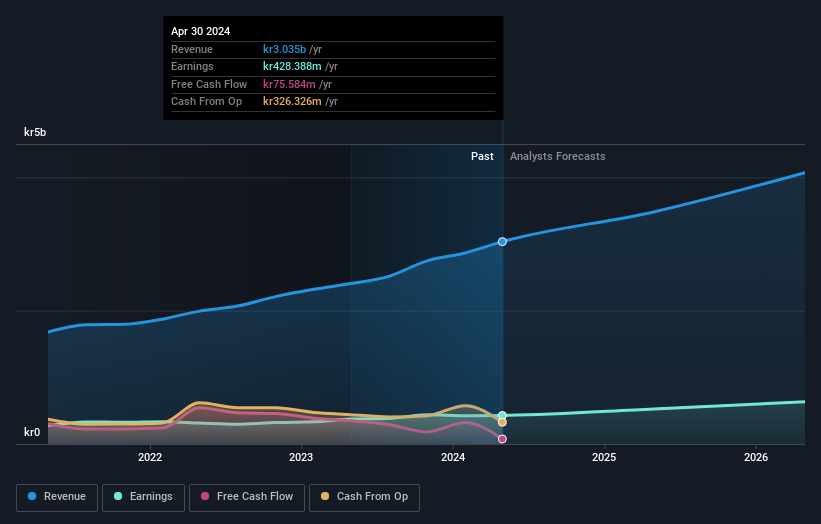

Operations: Sectra AB (publ) generates revenue primarily from its Imaging IT Solutions segment, contributing SEK2.82 billion, and Secure Communications segment, which adds SEK422.26 million. The company's focus is on providing specialized solutions in medical IT and cybersecurity across several European markets.

Sectra, exhibiting robust growth in a competitive tech landscape, reported a notable 31% increase in earnings over the past year, outperforming the Healthcare Services industry average of 13.3%. This growth is underpinned by an aggressive R&D strategy, with expenses aligning closely with its revenue uptick—indicative of its commitment to innovation and market expansion. The recent launch of Sectra Tiger/E Managed Service underscores this approach, enhancing secure communication technologies for sensitive but unclassified information. With revenues and earnings forecasted to grow annually at 14.5% and 17.2%, respectively—both metrics surpassing Swedish market averages—Sectra is well-positioned to capitalize on emerging opportunities within digital healthcare solutions while maintaining high-quality earnings as evidenced by their strategic expansions and product launches.

- Delve into the full analysis health report here for a deeper understanding of Sectra.

Gain insights into Sectra's historical performance by reviewing our past performance report.

Zhejiang Meorient Commerce Exhibition (SZSE:300795)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Meorient Commerce Exhibition Inc. operates as a company specializing in organizing trade exhibitions and events, with a market capitalization of CN¥4.17 billion.

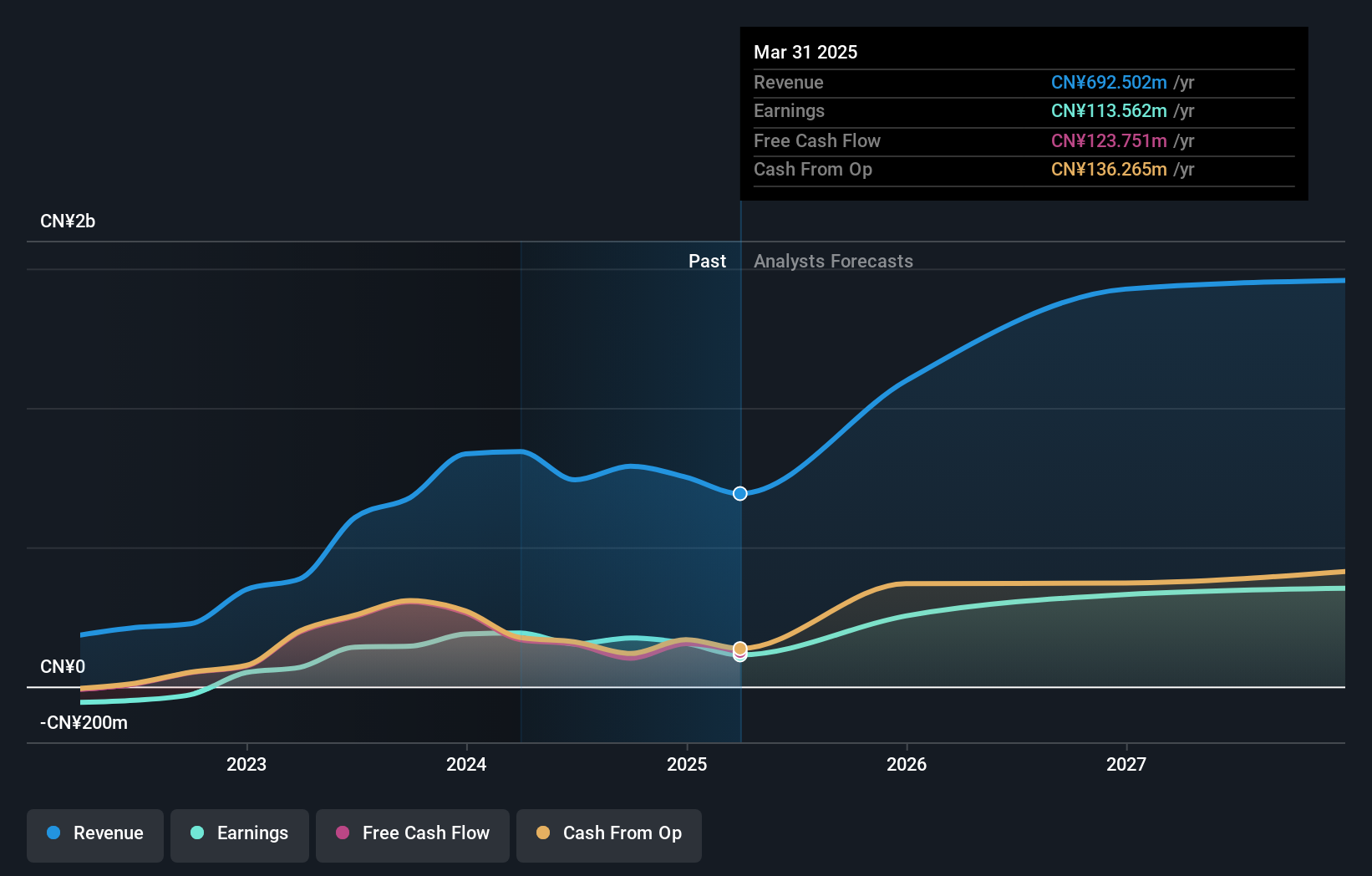

Operations: The company generates revenue primarily from organizing trade exhibitions and events. It operates within the exhibition industry, focusing on facilitating business connections through these events.

Zhejiang Meorient Commerce Exhibition, amidst a challenging year, saw its earnings dip by 30.3%, contrasting sharply with its industry's slight decline of 0.3%. Despite this setback, the company is poised for recovery with anticipated revenue and earnings growth of 27% and 36.7% per annum respectively, outpacing the Chinese market forecasts of 14.3% and 27.4%. This optimism is underpinned by robust R&D investment strategies that align closely with revenue trends, ensuring sustained innovation and competitive edge in high-growth tech sectors.

Summing It All Up

- Explore the 245 names from our Global High Growth Tech and AI Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives