- Sweden

- /

- Capital Markets

- /

- OM:EQT

European Growth Companies With Strong Insider Ownership In September 2025

Reviewed by Simply Wall St

As of September 2025, the European market has seen mixed performance with the pan-European STOXX Europe 600 Index slightly down amid concerns about global growth and a stronger euro. Despite these challenges, certain growth companies in Europe stand out due to their strong insider ownership, which can be an indicator of confidence in long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 73.9% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.7% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

We'll examine a selection from our screener results.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

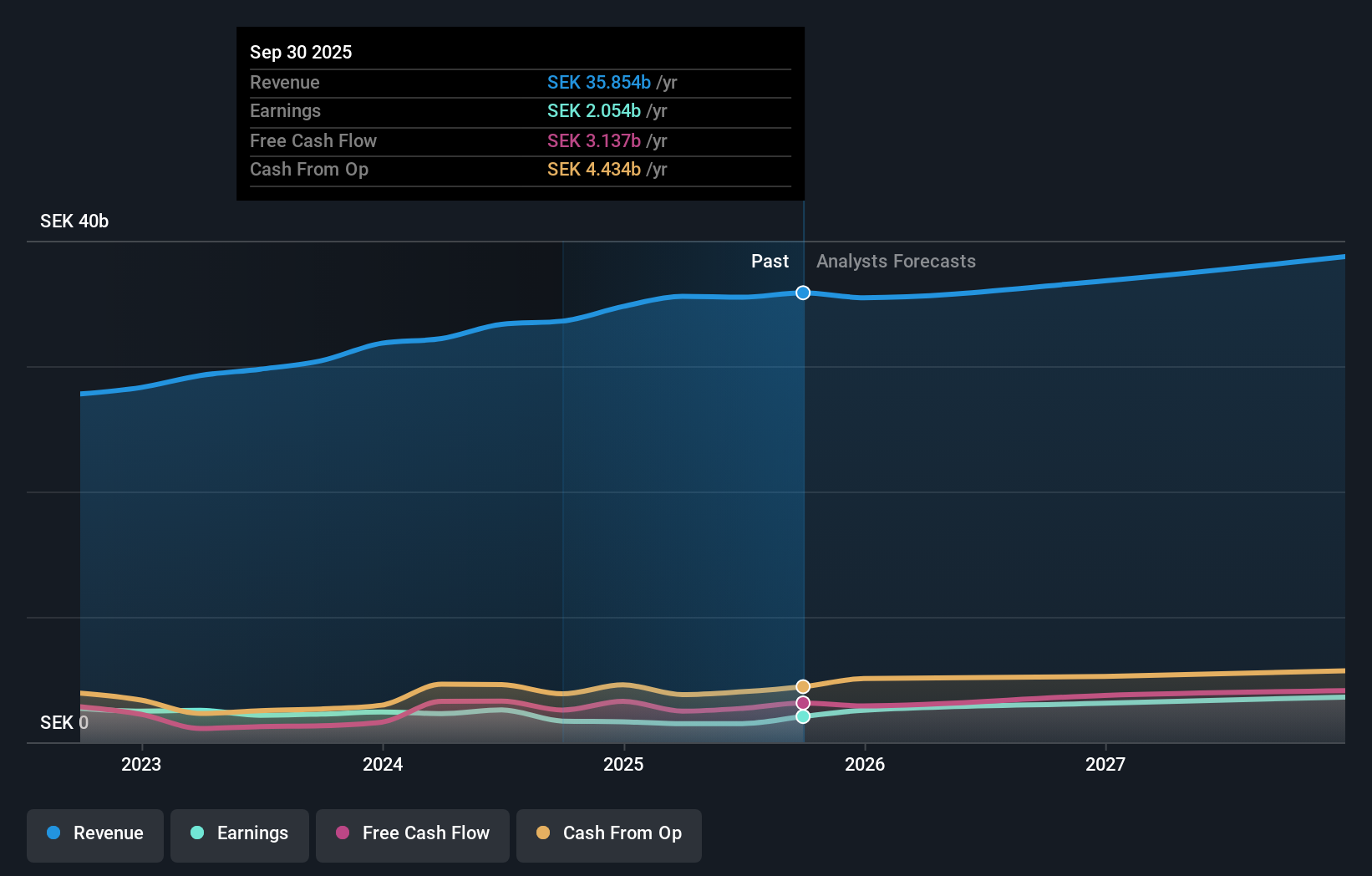

Overview: EQT AB (publ) is a global private equity and venture capital firm focusing on private capital and real asset segments, with a market cap of SEK382.26 billion.

Operations: EQT AB (publ) generates revenue primarily from its Private Capital segment (€1.48 billion) and Real Assets segment (€1.06 billion), with additional contributions from the Central segment (€71.50 million).

Insider Ownership: 12.2%

Earnings Growth Forecast: 25.9% p.a.

EQT AB, a Swedish private equity firm, is actively engaged in strategic acquisitions and investments to bolster its growth trajectory. Recent earnings reports show a robust increase in net income to €346 million for H1 2025, with earnings forecasted to grow significantly at 25.9% annually over the next three years. The company’s insider ownership aligns management interests with shareholders, although there has been no substantial insider buying or selling recently. EQT's involvement in high-profile M&A activities underscores its expansion ambitions.

- Dive into the specifics of EQT here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that EQT is trading beyond its estimated value.

Getinge (OM:GETI B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Getinge AB (publ) is a company that offers products and solutions for operating rooms, intensive-care units, and sterilization departments in Sweden and internationally, with a market cap of SEK57.39 billion.

Operations: Getinge's revenue is primarily derived from its Acute Care Therapies segment at SEK18.80 billion, followed by Surgical Workflows at SEK12.13 billion, and Life Science at SEK4.57 billion.

Insider Ownership: 20.4%

Earnings Growth Forecast: 20% p.a.

Getinge is experiencing moderate insider buying, indicating some confidence from management. Despite a lower profit margin this year, earnings are expected to grow significantly at 20% annually, outpacing the Swedish market. Revenue growth is projected at 5.2%, slightly above the market average. The stock trades at a significant discount to its estimated fair value, suggesting potential upside if performance improves. Recent earnings showed stable sales but a drop in net income for H1 2025 compared to last year.

- Delve into the full analysis future growth report here for a deeper understanding of Getinge.

- According our valuation report, there's an indication that Getinge's share price might be on the cheaper side.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) offers solutions in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of approximately SEK62.31 billion.

Operations: The company's revenue is primarily derived from Imaging IT Solutions, which contributes SEK2.82 billion, followed by Secure Communications at SEK422.26 million and Business Innovation at SEK95.36 million.

Insider Ownership: 16.3%

Earnings Growth Forecast: 17.2% p.a.

Sectra's growth trajectory is supported by high insider ownership, with earnings projected to grow at 17.15% annually, outpacing the Swedish market. Revenue is expected to increase by 14.5% per year, driven by strategic contracts such as a $21 million agreement for a cloud-based imaging solution in the US. Recent earnings show positive momentum with revenue and net income increases from last year, reflecting strong operational performance and expansion into AI-enhanced services.

- Take a closer look at Sectra's potential here in our earnings growth report.

- Our expertly prepared valuation report Sectra implies its share price may be too high.

Seize The Opportunity

- Navigate through the entire inventory of 214 Fast Growing European Companies With High Insider Ownership here.

- Seeking Other Investments? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity & venture capital firm specializing in private capital and real asset segments.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives