- Sweden

- /

- Healthtech

- /

- OM:SECT B

A Valuation Check on Sectra (OM:SECT B) After New Secure Platform Launch and Major Imaging Deal

Reviewed by Simply Wall St

Sectra (OM:SECT B) has just launched its new Tiger/E Managed Service, expanding into secure, managed collaboration platforms for sensitive communication outside of strictly classified settings. The company also landed an enterprise imaging contract with Germany’s Xcare Group and is broadening its healthcare IT footprint.

See our latest analysis for Sectra.

Sectra’s latest product launches and new enterprise deals arrive as the company’s share price shows some near-term weakness, with a 16% decline over the past three months. However, its one-year total shareholder return is still positive at 2.8%. Looking at a longer-term perspective, holders have seen impressive gains, with a 77% total return over three years and 152% over five years. This suggests that recent momentum may be pausing after a period of strong performance.

Curious about where the next wave of medical technology winners could emerge? Let your search begin with our See the full list for free.

With growth in both secure communications and healthcare imaging, and shares taking a breather after years of outperformance, investors may wonder whether Sectra represents a compelling entry point or if the market is already pricing in the next chapter of expansion.

Most Popular Narrative: 2.9% Undervalued

Sectra's last close was SEK291.4, while the consensus narrative sees fair value just above at SEK300.0. The difference is slim, but it suggests a slight disconnect between market expectations and fundamental drivers. This hints that upside potential exists if projections play out.

Transition to an as-a-service model is expected to enhance future revenue stability and growth, with a significant increase in recurring cloud revenue anticipated as products move from hardware-based to cloud solutions. This transition is likely to impact revenue positively in the long term.

Want to know what powers this bold new price target? The growth calculus here banks on Sectra's recurring revenue surge and the confidence that current profit margins are only the beginning. Interested in which bullish financial projections support that premium valuation? Find out the full set of fiercely debated assumptions driving the narrative's optimism.

Result: Fair Value of $300.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slower-than-expected transition to subscription revenue or delays in major IT deployments could challenge the upbeat outlook that analysts project for Sectra.

Find out about the key risks to this Sectra narrative.

Another View: Market Pricing Ratio Raises Eyebrows

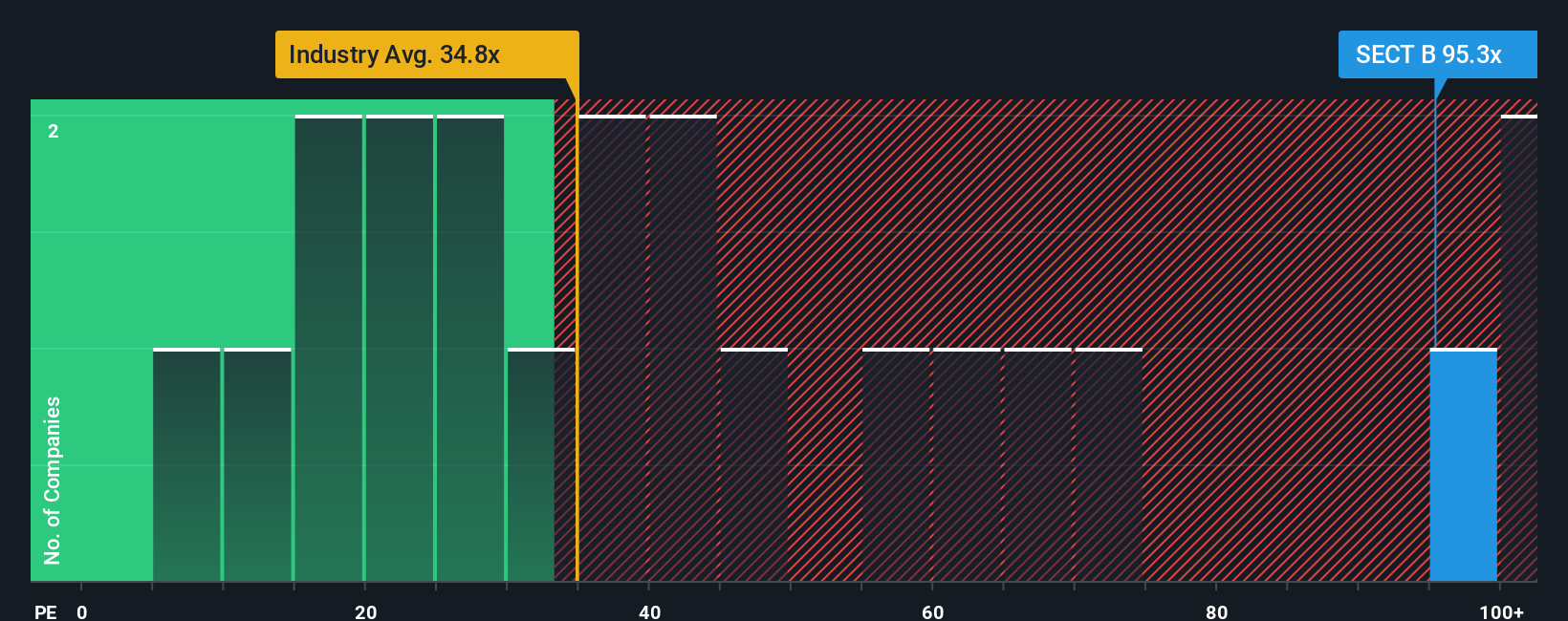

Taking a step back from future growth forecasts, Sectra’s valuation based on price-to-earnings looks stretched. Its current ratio sits at 95.8x, noticeably higher than both the global healthcare services average of 35x and its peer group’s 57.3x. The fair ratio for Sectra is assessed at just 38.5x, suggesting the stock is trading at a significant premium. Does this imply heightened risk if growth falls short, or is the market looking further ahead than most?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sectra Narrative

If you see things differently or value doing your own due diligence, you can shape your own perspective using the available data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sectra.

Looking for More Investment Ideas?

Jump on the latest trends and broaden your portfolio with unique opportunities only a click away. Don’t miss your shot at game-changing stocks and fresh sectors shaking up the market this year.

- Uncover hidden potential by tracking these 885 undervalued stocks based on cash flows that analysts believe have significant upside based on fundamental cash flow strength and attractive entry prices.

- Tap into the surge of advanced medicine by following these 31 healthcare AI stocks leading innovation in diagnostics, personalized treatment, and healthcare automation.

- Capitalize on industry-shifting breakthroughs as you target these 27 AI penny stocks poised for rapid growth in artificial intelligence solutions impacting every corner of the economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives