- Italy

- /

- Aerospace & Defense

- /

- BIT:AVIO

Avio And 2 Other Undiscovered Gems In Europe With Strong Potential

Reviewed by Simply Wall St

As the European market grapples with concerns over valuations in artificial intelligence-related stocks, major indices like the STOXX Europe 600 have seen declines, reflecting a cautious sentiment among investors. In this environment, identifying promising small-cap stocks with strong fundamentals and growth potential becomes crucial for those looking to navigate these uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 6.17% | 5.42% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Avio (BIT:AVIO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Avio S.p.A. is an Italian company that, along with its subsidiaries, specializes in the design, development, production, and integration of space launchers both domestically and internationally, with a market capitalization of €859.80 million.

Operations: Avio's revenue primarily stems from its Space Business segment, generating €549.03 million. The company's financial performance can be evaluated by examining its net profit margin, which provides insight into profitability after accounting for all expenses.

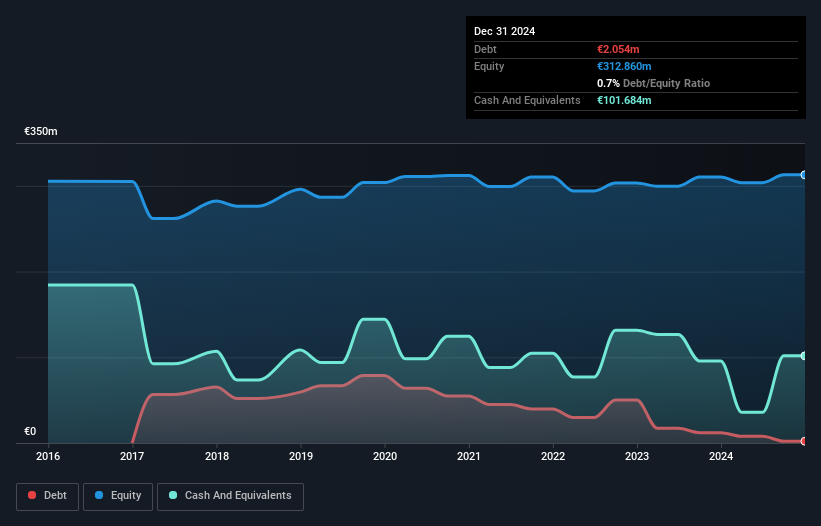

Avio, a nimble player in the aerospace sector, has seen its earnings soar by 132.7% over the past year, outpacing the industry's 21.6%. The company's debt-to-equity ratio impressively shrank from 17.6% to just 0.3% in five years, showcasing prudent financial management. Recent collaborations with Lockheed Martin and Raytheon to establish a solid rocket motor facility in the U.S. underscore Avio's strategic expansion efforts and commitment to enhancing supply chain resilience for defense needs. Trading at €19.14 per share, it sits below its estimated fair value by about 27%, hinting at potential undervaluation despite recent volatility concerns.

Pharmanutra (BIT:PHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on researching, designing, developing, and marketing nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and internationally with a market cap of €428.78 million.

Operations: Pharmanutra generates revenue primarily through the sale of nutritional supplements and medical devices. The company has a market capitalization of €428.78 million.

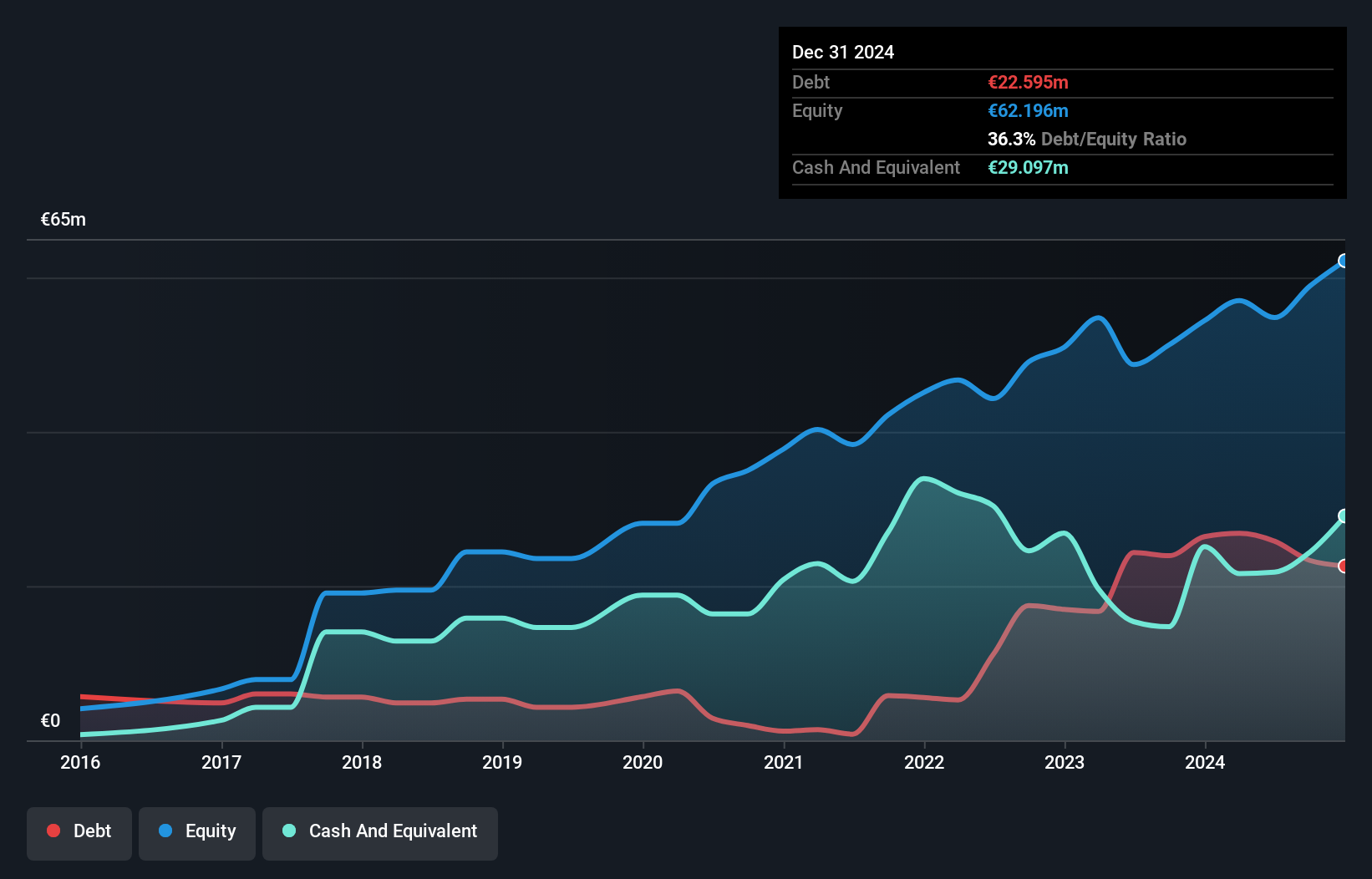

Pharmanutra, a dynamic player in the personal products sector, has shown impressive earnings growth of 16.6% over the past year, outpacing its industry peers who faced a -5.3% downturn. With high-quality earnings and a satisfactory net debt to equity ratio of 10.5%, this company seems well-positioned financially. Its recent half-year results reported sales at €61.88 million and net income at €9.19 million, both showing improvement from previous figures. While shares have been volatile recently, its EBIT covers interest payments 193 times over, indicating robust financial health despite an increased debt to equity ratio now at 36%.

- Take a closer look at Pharmanutra's potential here in our health report.

Examine Pharmanutra's past performance report to understand how it has performed in the past.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

Overview: RaySearch Laboratories AB (publ) is a medical technology company that offers software solutions for cancer treatment globally, with a market cap of SEK7.95 billion.

Operations: RaySearch Laboratories generates revenue primarily from its software solutions for cancer treatment. The company's financial performance includes a net profit margin that reflects its operational efficiency.

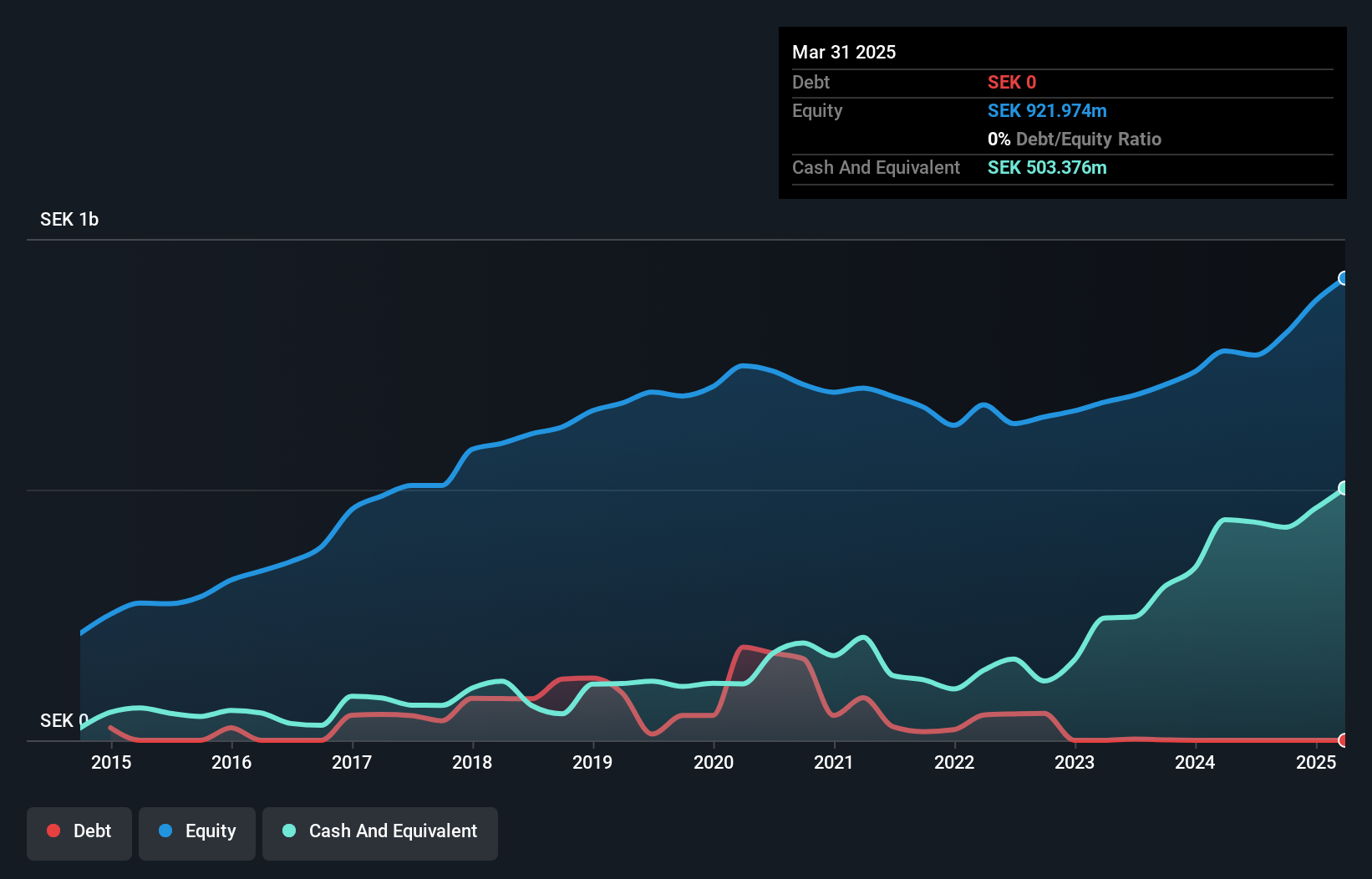

RaySearch Laboratories, a nimble player in the medical tech space, has seen earnings soar 25.2% over the past year, outpacing the Healthcare Services industry at 13.3%. With no debt on its books compared to a 22.9% debt-to-equity ratio five years ago, it stands financially robust and free from interest payment concerns. Recent earnings reports highlight a net income of SEK71.6 million for Q3 2025, up from SEK45.4 million last year, with sales reaching SEK332.3 million from SEK293.3 million previously—indicative of its strong market position and growth trajectory in oncology software solutions.

Seize The Opportunity

- Reveal the 324 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:AVIO

Avio

Through its subsidiaries, designs, develops, produces, and integrates space launchers in Italy and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives