Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Paxman AB (publ) (STO:PAX) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out the opportunities and risks within the SE Medical Equipment industry.

What Is Paxman's Net Debt?

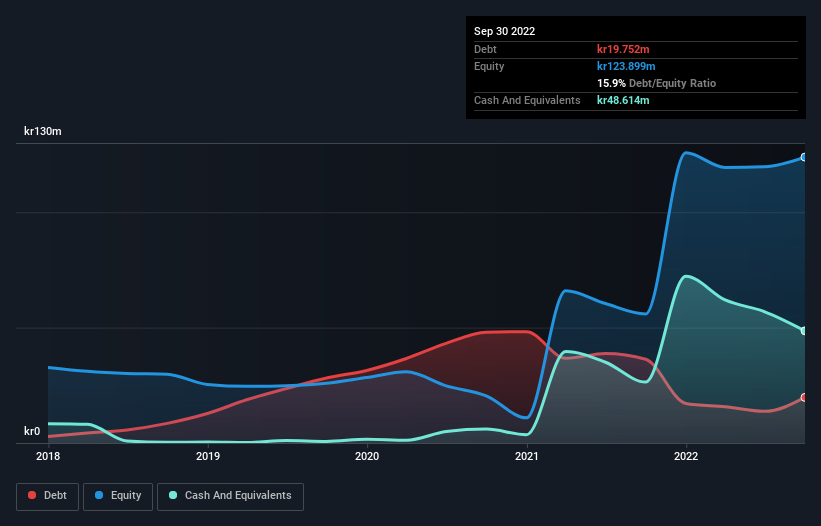

You can click the graphic below for the historical numbers, but it shows that Paxman had kr19.8m of debt in September 2022, down from kr36.3m, one year before. But on the other hand it also has kr48.6m in cash, leading to a kr28.9m net cash position.

A Look At Paxman's Liabilities

The latest balance sheet data shows that Paxman had liabilities of kr48.1m due within a year, and liabilities of kr4.63m falling due after that. Offsetting this, it had kr48.6m in cash and kr28.3m in receivables that were due within 12 months. So it can boast kr24.2m more liquid assets than total liabilities.

This short term liquidity is a sign that Paxman could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Paxman has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Paxman will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Paxman wasn't profitable at an EBIT level, but managed to grow its revenue by 54%, to kr143m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Paxman?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Paxman lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through kr20m of cash and made a loss of kr2.3m. Given it only has net cash of kr28.9m, the company may need to raise more capital if it doesn't reach break-even soon. Paxman's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Paxman (including 1 which is significant) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PAX

Paxman

Develops and sells Paxman scalp cooling system to minimize hair loss in connection with chemotherapy treatment worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success