- Sweden

- /

- Medical Equipment

- /

- OM:OSSD

OssDsign (OM:OSSD): Strong 25% Revenue Growth Forecast Supports Bull Case Despite Persistent Losses

Reviewed by Simply Wall St

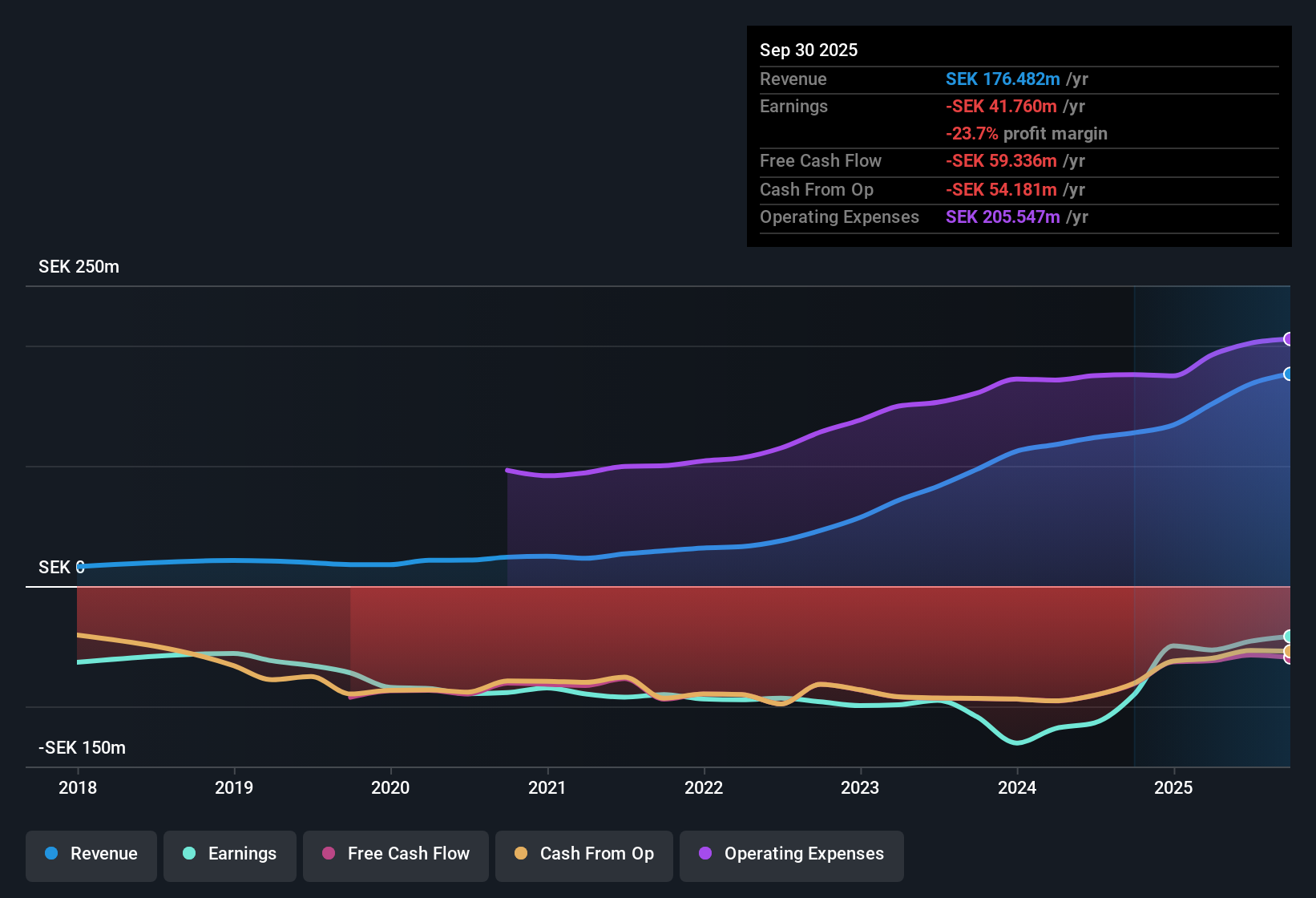

OssDsign (OM:OSSD) remains unprofitable, with forecasts projecting continued losses over the next three years. Losses have narrowed by 6.3% per year over the past five years, and revenue is expected to grow at a rapid 25.1% per year, well ahead of the Swedish market’s 3.7% average. Investors are monitoring this strong top-line growth and ongoing loss reduction, but the company’s premium Price-To-Sales ratio of 7.1x signals that future performance needs to deliver to justify current market expectations.

See our full analysis for OssDsign.The next step is to see how these earnings trends compare to the major narratives shaping investor sentiment. Some storylines will find support, while others could be called into question.

See what the community is saying about OssDsign

Margins Climb to New Highs

- OssDsign’s gross margin jumped to 95.4% for the year, a substantial increase from 74.6% in 2023, indicating significantly improved production efficiencies.

- Analysts' consensus view highlights how this margin improvement heavily supports the company’s long-term path to profitability, yet cautions that achieving cash flow positivity remains a challenge.

- The strategic move to focus on orthobiologics has led to year-over-year growth exceeding 100%, boosting both revenue and operational efficiency.

- Despite these gains, ongoing negative earnings and a heavy reliance on key customers mean that higher margins have not yet translated into sustainable profits.

- Consensus narrative suggests OssDsign is better positioned. However, volatility from customer concentration and competition could mute these margin gains.

- Growth in clinical evidence and expanded U.S. access are positives. Although, regulatory hurdles and dependence on key markets remain pronounced risks.

- Sustaining these high margins will be important if revenue volatility increases due to changes in large customer orders.

To see how analysts are weighing these margin improvements against ongoing risks, check out the latest consensus view on OssDsign. 📊 Read the full OssDsign Consensus Narrative.

Share Price Sits Below Analyst Target

- OssDsign’s share price of SEK 11.26 trades at a discount compared to the analyst price target of SEK 16.25, showing room for upside if growth targets are met.

- Analysts' consensus view notes that this current discount reinforces the belief that OssDsign is fairly valued, with targets reflecting optimism about revenue growth and margin expansion.

- Bulls might point to the ongoing improvements in gross margin and rapid U.S. market gains as justification for closing the price gap.

- Bears will focus on OssDsign’s ongoing unprofitability and the risk of future volatility as reasons the price may remain subdued.

Sales Multiple Highlights High Expectations

- OssDsign’s Price-To-Sales ratio of 7.1x stands well above the Medical Equipment industry average (5.5x) and the peer average (5x). This spotlights the market’s elevated future growth expectations.

- Analysts' consensus view underscores that while investors are paying a premium for OssDsign’s rapid growth, persistent negative earnings present a substantial test for sustaining this valuation.

- If growth projections are met and margins remain high, the premium could be justified over time.

- However, the lack of profitability and exposure to customer and regulatory risks could cause this premium valuation to unwind quickly with any misstep.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OssDsign on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Share your take and shape your own company story in just a few clicks. Do it your way

A great starting point for your OssDsign research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

OssDsign’s ongoing unprofitability and volatile earnings, despite impressive growth, make it vulnerable if revenue targets slip or margin gains stall.

If you want steadier performance, use our stable growth stocks screener (2083 results) to discover companies consistently delivering reliable growth and more predictable results through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:OSSD

OssDsign

Designs, manufactures, and sells implants and material technology for bone regeneration in Sweden, Germany, the United States, the United Kingdom, rest of Europe, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives