Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, NGS Group AB (publ) (STO:NGS) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for NGS Group

What Is NGS Group's Debt?

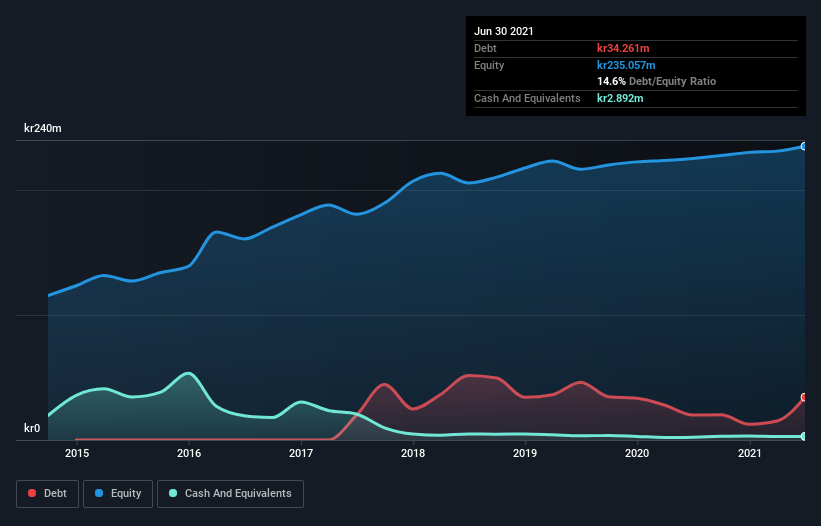

The image below, which you can click on for greater detail, shows that at June 2021 NGS Group had debt of kr34.3m, up from kr19.9m in one year. On the flip side, it has kr2.89m in cash leading to net debt of about kr31.4m.

A Look At NGS Group's Liabilities

The latest balance sheet data shows that NGS Group had liabilities of kr106.4m due within a year, and liabilities of kr9.88m falling due after that. Offsetting these obligations, it had cash of kr2.89m as well as receivables valued at kr80.3m due within 12 months. So its liabilities total kr33.1m more than the combination of its cash and short-term receivables.

Given NGS Group has a market capitalization of kr224.7m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

NGS Group's net debt of 2.3 times EBITDA suggests graceful use of debt. And the alluring interest cover (EBIT of 9.7 times interest expense) certainly does not do anything to dispel this impression. We saw NGS Group grow its EBIT by 9.9% in the last twelve months. Whilst that hardly knocks our socks off it is a positive when it comes to debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since NGS Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, NGS Group generated free cash flow amounting to a very robust 99% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that NGS Group's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its interest cover is also very heartening. We would also note that Healthcare industry companies like NGS Group commonly do use debt without problems. Zooming out, NGS Group seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for NGS Group (of which 1 is a bit unpleasant!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading NGS Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NGS Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:NGS

NGS Group

Provides recruitment and staffing services in Sweden, Norway, and Finland.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives