Stock Analysis

Swedish Exchange Highlights Three Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

Amidst the fluctuating dynamics of global markets, Sweden's stock exchange presents a noteworthy stability that attracts investors looking for promising growth opportunities. This resilience is particularly evident in growth companies with high insider ownership, which often signals strong confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.9% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 43.4% |

| SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

We'll examine a selection from our screener results.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medicover AB operates in the healthcare and diagnostic services sector, serving markets in Poland, Sweden, and internationally, with a market capitalization of approximately SEK 29.46 billion.

Operations: The company's revenue is primarily generated from Healthcare Services and Diagnostic Services, which contributed €1.26 billion and €585.20 million respectively.

Insider Ownership: 11.1%

Earnings Growth Forecast: 37.8% p.a.

Medicover exhibits a promising growth trajectory with its revenue and earnings expected to outpace the Swedish market significantly. Recent financial results show robust year-over-year improvements, with notable increases in sales and net income. Despite challenges such as interest coverage, the company's strategic outlook remains positive, underscored by substantial future revenue guidance exceeding €2.2 billion by 2025. However, insider transactions have not been significant in volume recently, suggesting cautious optimism among insiders about the company's near-term prospects.

- Click here to discover the nuances of Medicover with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Medicover shares in the market.

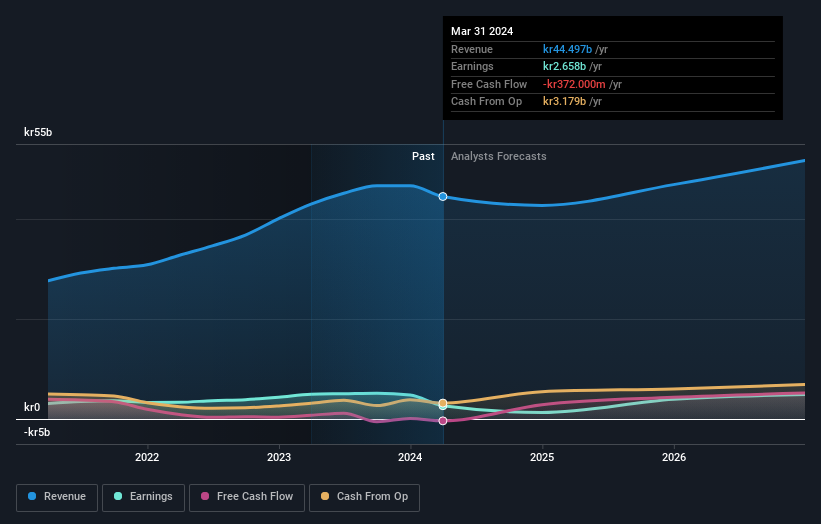

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB operates globally, focusing on the development, manufacturing, and marketing of energy-efficient solutions for indoor climate comfort and intelligent heating and control systems. The company has a market capitalization of approximately SEK 96.77 billion.

Operations: The company's revenue is divided into three main segments: Climate Solutions generating SEK 36.83 billion, Element at SEK 13.62 billion, and Stoves contributing SEK 5.62 billion.

Insider Ownership: 20.2%

Earnings Growth Forecast: 27.6% p.a.

NIBE Industrier AB's projected earnings growth of 27.6% annually outstrips the Swedish market forecast of 14%, signaling strong future performance despite a recent dip in profit margins from 11.5% to 6%. The company's revenue growth is also set to exceed the market average, although at a slower pace than some high-growth benchmarks. Recent leadership changes, including Simon Karlin's appointment, align with strategic expansions aimed at enhancing global competitiveness and operational efficiency.

- Unlock comprehensive insights into our analysis of NIBE Industrier stock in this growth report.

- Our valuation report unveils the possibility NIBE Industrier's shares may be trading at a discount.

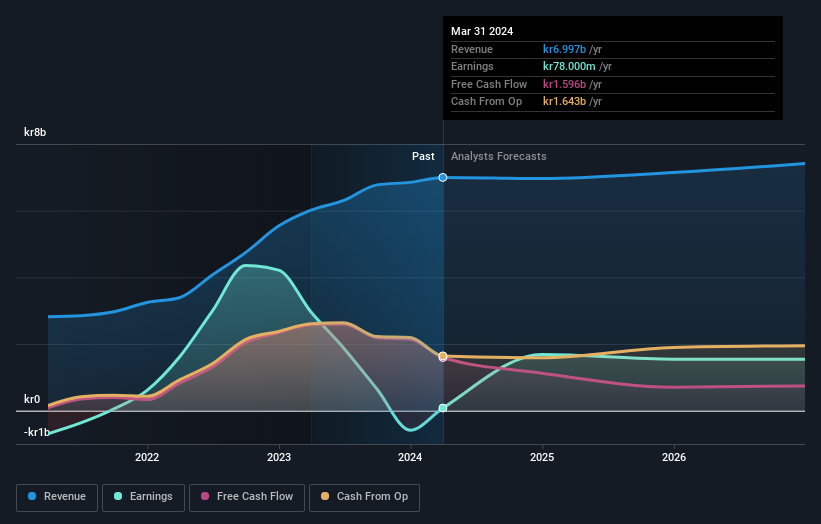

Pandox (OM:PNDX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB, a global hotel property company, engages in owning, developing, and leasing hotel properties with a market capitalization of approximately SEK 34.67 billion.

Operations: The company generates its revenue primarily through two segments: own operation (SEK 3.24 billion) and rental agreements (SEK 3.76 billion).

Insider Ownership: 12.3%

Earnings Growth Forecast: 41.6% p.a.

Pandox AB shows promising signs as a growth-oriented company with its earnings expected to surge by 41.64% annually, outpacing the Swedish market's 14%. Despite this robust profit forecast, challenges include a dividend coverage issue and lower profit margins year-over-year. Recent financials indicate a rebound, with significant increases in sales and net income compared to the previous year. However, financial stability concerns persist due to poor coverage of interest payments by earnings.

- Take a closer look at Pandox's potential here in our earnings growth report.

- Our expertly prepared valuation report Pandox implies its share price may be lower than expected.

Key Takeaways

- Click this link to deep-dive into the 82 companies within our Fast Growing Swedish Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether NIBE Industrier is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NIBE B

NIBE Industrier

Develops, manufactures, markets, and sells various energy-efficient solutions for indoor climate comfort, and components and solutions for intelligent heating and control in Nordic countries, rest of Europe, North America, and internationally.

Reasonable growth potential and fair value.