- Sweden

- /

- Medical Equipment

- /

- OM:INTEG B

Despite shrinking by kr68m in the past week, Integrum (STO:INTEG B) shareholders are still up 610% over 5 years

Integrum AB (publ) (STO:INTEG B) shareholders might be concerned after seeing the share price drop 11% in the last week. But over five years returns have been remarkably great. Indeed, the share price is up a whopping 610% in that time. So we don't think the recent decline in the share price means its story is a sad one. But the real question is whether the business fundamentals can improve over the long term. We love happy stories like this one. The company should be really proud of that performance!

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Integrum

Given that Integrum only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Integrum can boast revenue growth at a rate of 31% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 48%(per year) over the same period. It's never too late to start following a top notch stock like Integrum, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

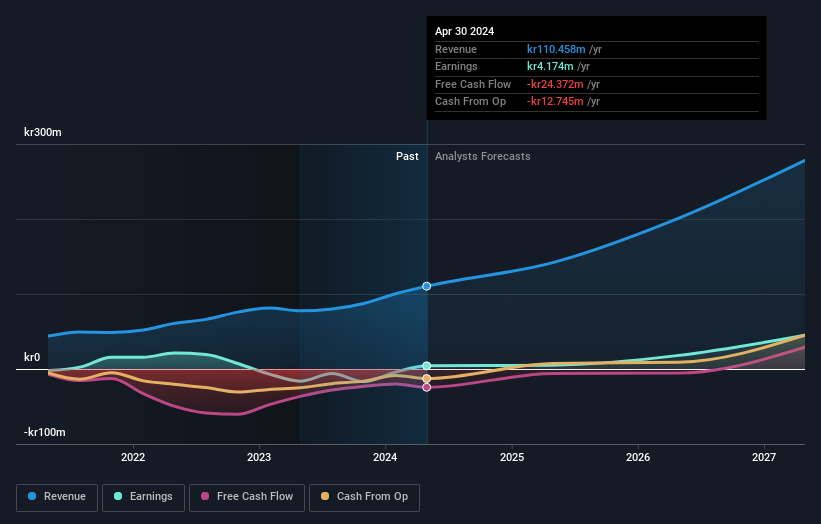

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Integrum has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that Integrum has rewarded shareholders with a total shareholder return of 197% in the last twelve months. That gain is better than the annual TSR over five years, which is 48%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Integrum has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course Integrum may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INTEG B

Integrum

Researches, develops, and sells various systems for bone-anchored prostheses.

Flawless balance sheet with high growth potential.