- Sweden

- /

- Healthcare Services

- /

- OM:HUM

Humana (OM:HUM) Net Profit Margin Improves, Challenging Past Bearish Narratives

Reviewed by Simply Wall St

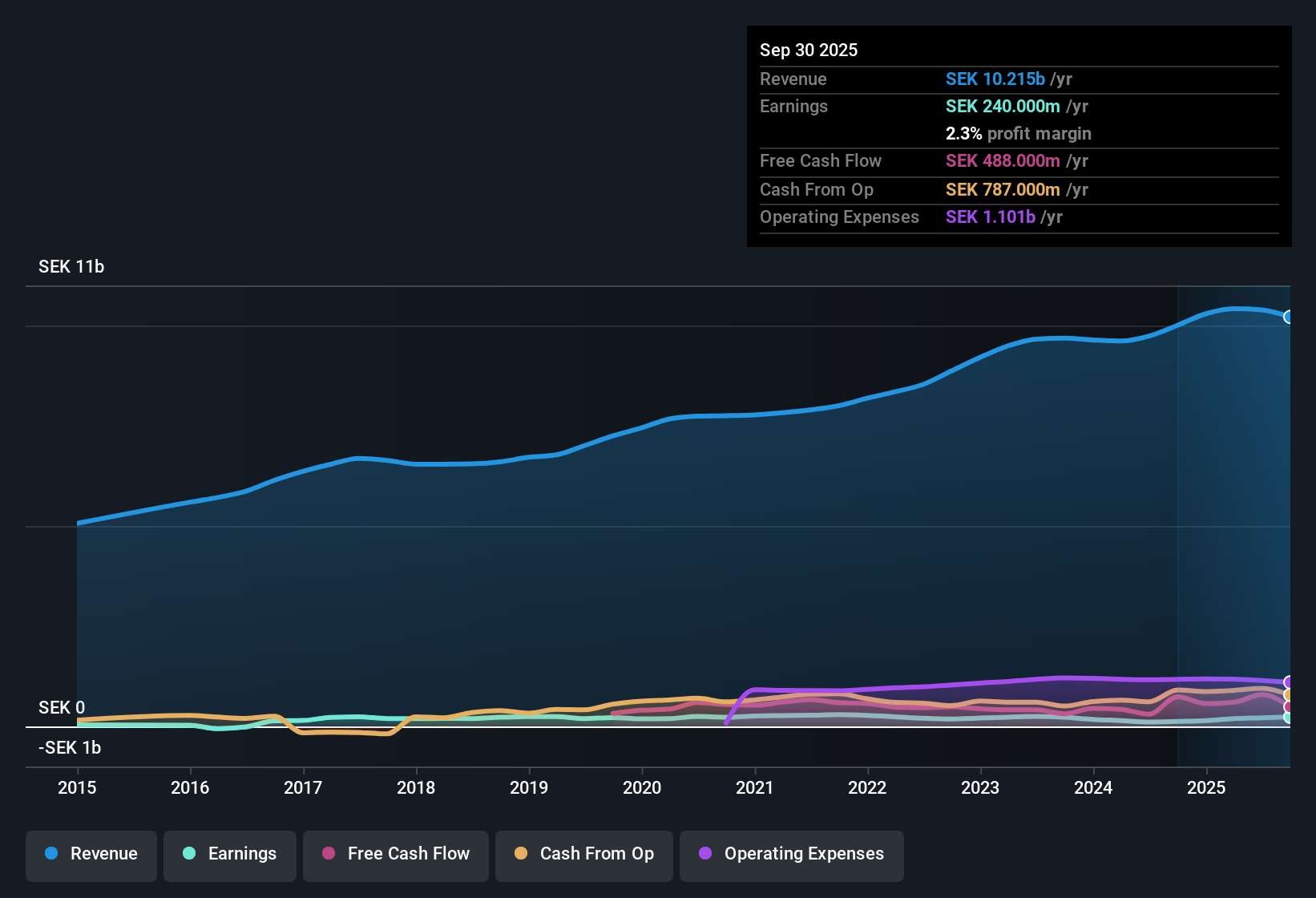

Humana (OM:HUM) turned in a net profit margin of 2%, marking an improvement from last year’s 1.1%. EPS growth soared by 93.6% over the past year, reversing a five-year average decline of 12.2% per year. With forecasted earnings growth of 12.8% annually and shares trading at a price-to-earnings ratio of just 10.8x, which is notably below its peer and industry averages, the company’s recent momentum and attractive valuation are grabbing investor attention.

See our full analysis for Humana.Now, let’s see how these headline numbers line up against the community narratives and market perspectives often debated at Simply Wall St.

See what the community is saying about Humana

Margin Expansion Targets on the Horizon

- Consensus narrative highlights analysts are projecting profit margins to increase from the current 2.0% to 3.0% in three years, with earnings expected to climb from SEK 213.0 million to SEK 329.2 million by 2028.

- According to the analysts' consensus view, these margin improvements are anchored in SEK 100 million of planned cost efficiencies and digital investments intended to enhance operational efficiency and future customer retention.

- Cost-cutting, specialization, and share repurchases are set to materially lower operating costs and support long-term earnings and margin improvement.

- However, ongoing investments in technology may increase near-term financial pressure, creating a trade-off between immediate cost and future operational leverage.

- The number of shares outstanding is expected to shrink by 3.83% annually over the next three years, potentially boosting earnings per share even if overall profit grows at a moderate rate.

Consensus narrative notes margin expansion and cost efficiencies are expected to drive healthy profit growth, but near-term investment costs remain a key watchpoint for investors.

📊 Read the full OM:HUM Consensus Narrative.Organic Growth Faces Regional Headwinds

- Analysts are assuming annual revenue growth of 1.8% for the next three years, which is just over half the Swedish market rate of 3.3%, and hampered partly by sluggish conditions in Finland and some Swedish segments.

- In line with the consensus narrative, topline growth is expected to be driven by expansion in elderly and disability care services as well as portfolio adjustments, but these efforts risk being diluted by persisting demand weakness and regulatory uncertainty in underperforming regions.

- Prolonged market weakness in Finland and lower Swedish occupancy, especially in HVB care, continue to threaten Humana’s ability to achieve the projected revenue gains.

- Regulatory change and tight staffing regulations could create additional barriers to raising utilization and profitability in targeted business areas.

Shares Trade at Deep Discount to DCF Fair Value

- Humana’s current price-to-earnings ratio of 10.8x is far below Swedish peers (27.2x) and the European Healthcare industry average (18.9x), while the SEK 46.00 share price trails well under the DCF fair value of SEK 163.72.

- The analysts' consensus view asserts the discount reflects long-standing market caution around financial position and dividend sustainability. The combination of positive earnings momentum, aggressive cost cuts, and strong relative value offers an attractive entry point for patient investors.

- The projected analyst price target stands at SEK 50.00, a 9% premium to the latest share price, indicating room for upside if execution and growth targets are met.

- Analyst optimism is tempered by active concerns regarding Humana’s balance sheet strength and whether improved profitability will translate to steady dividend payments in an ever-evolving policy environment.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Humana on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Not seeing the story the same way? Share your insights and shape a fresh perspective of Humana’s outlook in just a few minutes, then Do it your way.

A great starting point for your Humana research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite recent earnings momentum, Humana still faces notable concerns around balance sheet strength and the sustainability of future dividend payments.

Want a greater sense of financial security? Find companies built on stronger foundations and robust liquidity in our solid balance sheet and fundamentals stocks screener (1977 results) list. This resource is designed to help you sidestep these financial health risks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUM

Humana

Provides individual and family care services for children and adults in Sweden, Finland, Norway, and Denmark.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives