The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in EQL Pharma (STO:EQL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for EQL Pharma

How Fast Is EQL Pharma Growing Its Earnings Per Share?

Over the last three years, EQL Pharma has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. It's good to see that EQL Pharma's EPS has grown from kr0.95 to kr1.07 over twelve months. That's a 13% gain; respectable growth in the broader scheme of things.

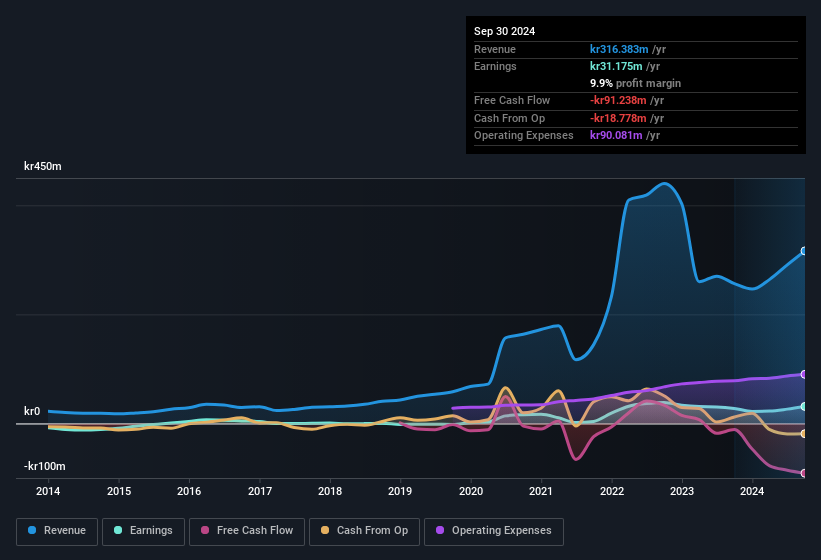

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EQL Pharma maintained stable EBIT margins over the last year, all while growing revenue 23% to kr316m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for EQL Pharma's future profits.

Are EQL Pharma Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Shareholders in EQL Pharma will be more than happy to see insiders committing themselves to the company, spending kr5.4m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. Zooming in, we can see that the biggest insider purchase was by President & CEO Axel Schorling for kr2.5m worth of shares, at about kr47.05 per share.

It's commendable to see that insiders have been buying shares in EQL Pharma, but there is more evidence of shareholder friendly management. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to EQL Pharma, with market caps between kr1.1b and kr4.4b, is around kr5.1m.

EQL Pharma's CEO took home a total compensation package of kr2.3m in the year prior to March 2024. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is EQL Pharma Worth Keeping An Eye On?

One positive for EQL Pharma is that it is growing EPS. That's nice to see. And there's more to love too, with modest CEO remuneration and insider buying interest continuing the positives for the company. If these factors aren't enough to secure EQL Pharma a spot on the watchlist, then it certainly warrants a closer look at the very least. Even so, be aware that EQL Pharma is showing 2 warning signs in our investment analysis , you should know about...

Keen growth investors love to see insider activity. Thankfully, EQL Pharma isn't the only one. You can see a a curated list of Swedish companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if EQL Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EQL

EQL Pharma

Engages in the development, marketing, and sale of generic medicines to pharmacies and hospitals in Sweden, Denmark, Norway, Finland, and the rest of Europe.

Exceptional growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives