- Sweden

- /

- Medical Equipment

- /

- OM:EKTA B

Elekta (OM:EKTA B) Margins Fall to 1.7%, Underscoring Profitability Concerns vs. Bullish Growth Forecasts

Reviewed by Simply Wall St

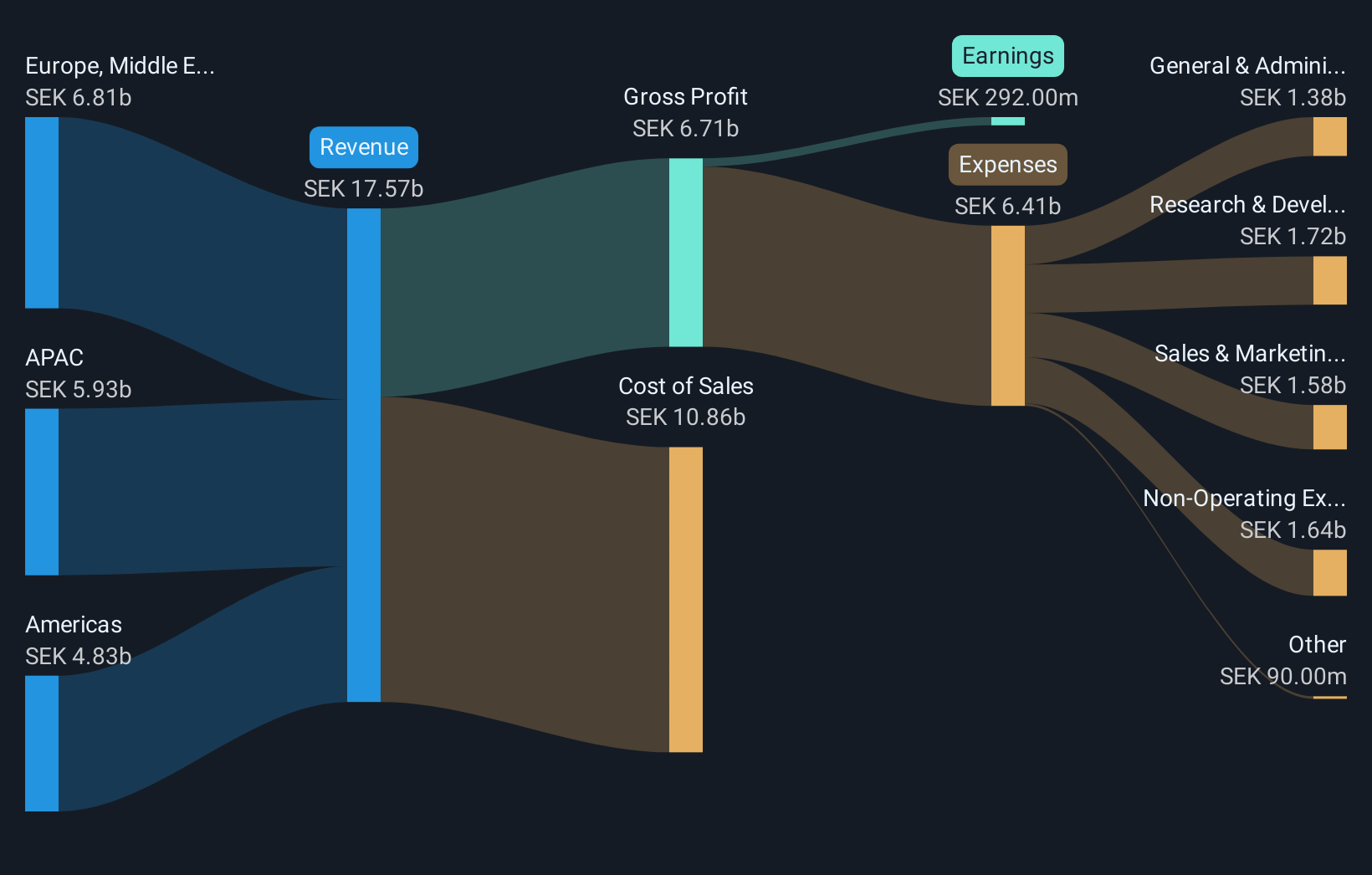

Elekta (OM:EKTA B) just posted its Q2 2026 results, reporting revenue of SEK 4.1 billion and basic EPS of 0.60 SEK for the quarter, with net income reaching SEK 230 million. The company has seen revenue fluctuate over recent quarters, ranging from SEK 3.6 billion to SEK 5.2 billion. EPS has swung from -1.01 SEK to 0.89 SEK since the beginning of 2025. Margins continue to reflect a mixed earnings picture, keeping investor focus firmly on profit trends and sector benchmarks.

See our full analysis for Elekta.Next up, we will put Elekta’s latest results head-to-head with the most widely followed market narratives to see which stories hold up and which might need a rethink.

See what the community is saying about Elekta

Margins Remain Under 2%

- Elekta's net profit margin over the last twelve months landed at only 1.7%, down sharply from the 5.7% margin posted the previous year, even as revenue held close to SEK 17.6 billion.

- Consensus narrative notes that persistent margin pressure is cited as a key investor concern, especially since the past year included a SEK 1.0 billion one-off loss, which limited profit rebound:

- While some point to ongoing cost controls and the profitable rollout of new software and services, the drop in net margins highlights Elekta's continued challenges with tariffs and volatile foreign exchange rates.

- Despite record service revenues, margin recovery is not keeping pace with top-line growth, creating challenges for hopes of a rapid profitability turnaround.

- These margin constraints are central to the consensus view that, even with annual revenue expected to rise 5.8% and earnings forecast to increase by 28.6%, Elekta’s ability to convert growth into sustained profits remains under scrutiny. Analysts continue to watch whether anticipated margin improvement can keep up with sector benchmarks and justify current expectations. See the full market consensus on Elekta's margin story in this narrative. 📊 Read the full Elekta Consensus Narrative.

Share Price Sits Well Below DCF Value

- With the current share price at SEK 58.50, Elekta trades 48.3% below its DCF fair value of SEK 113.07, but the Price-To-Earnings ratio remains a high 76.5x compared to a peer average of 24.6x and a sector average of 27.4x.

- Consensus narrative highlights this tension: the deep discount to DCF value could appeal to value investors, yet the premium PE multiple signals market skepticism about near-term earnings durability:

- Investors considering the DCF discount must also recognize that Elekta’s high valuation by industry standards is difficult to overlook until profit margins recover, despite optimistic sales forecasts.

- The overall risk profile suggests any upside may depend on the company’s ability to translate forecasted growth into stronger earnings, which is not yet evident in the past twelve months.

Dividend Coverage Under Pressure

- Although Elekta offers a 4.1% dividend yield, the most recent earnings show the payout is not well covered by profits, particularly after a SEK 1.0 billion non-recurring loss and net income of only SEK 292 million over the trailing twelve months.

- Consensus narrative cautions that without stronger profitability, high debt levels and weak dividend cover could continue to affect confidence in ongoing distributions:

- While recurring revenue from software and services adds resilience, coverage metrics suggest that Elekta’s dividend outlook may remain a potential risk until margin improvements are realized.

- Investors who rely on dividends will be watching closely to see whether the projected 28.6% annual growth in earnings per share begins to support more sustainable cash returns.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Elekta on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from another angle? Take a couple of minutes to capture your perspective and build out your own narrative. Do it your way.

A great starting point for your Elekta research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Explore Alternatives

Elekta faces ongoing pressure from weak profit margins, questionable dividend coverage, and a balance sheet stretched by one-off charges and recent losses.

If you’re seeking companies with stronger financial foundations and healthier debt profiles, now is the time to look for proven stability using solid balance sheet and fundamentals stocks screener (1931 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elekta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EKTA B

Elekta

A medical technology company, provides clinical solutions for treating cancer and brain disorders in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success