- Sweden

- /

- Medical Equipment

- /

- OM:CRAD B

C-Rad (OM:CRAD B) Profit Margin Decline Challenges Bullish Growth Narratives

Reviewed by Simply Wall St

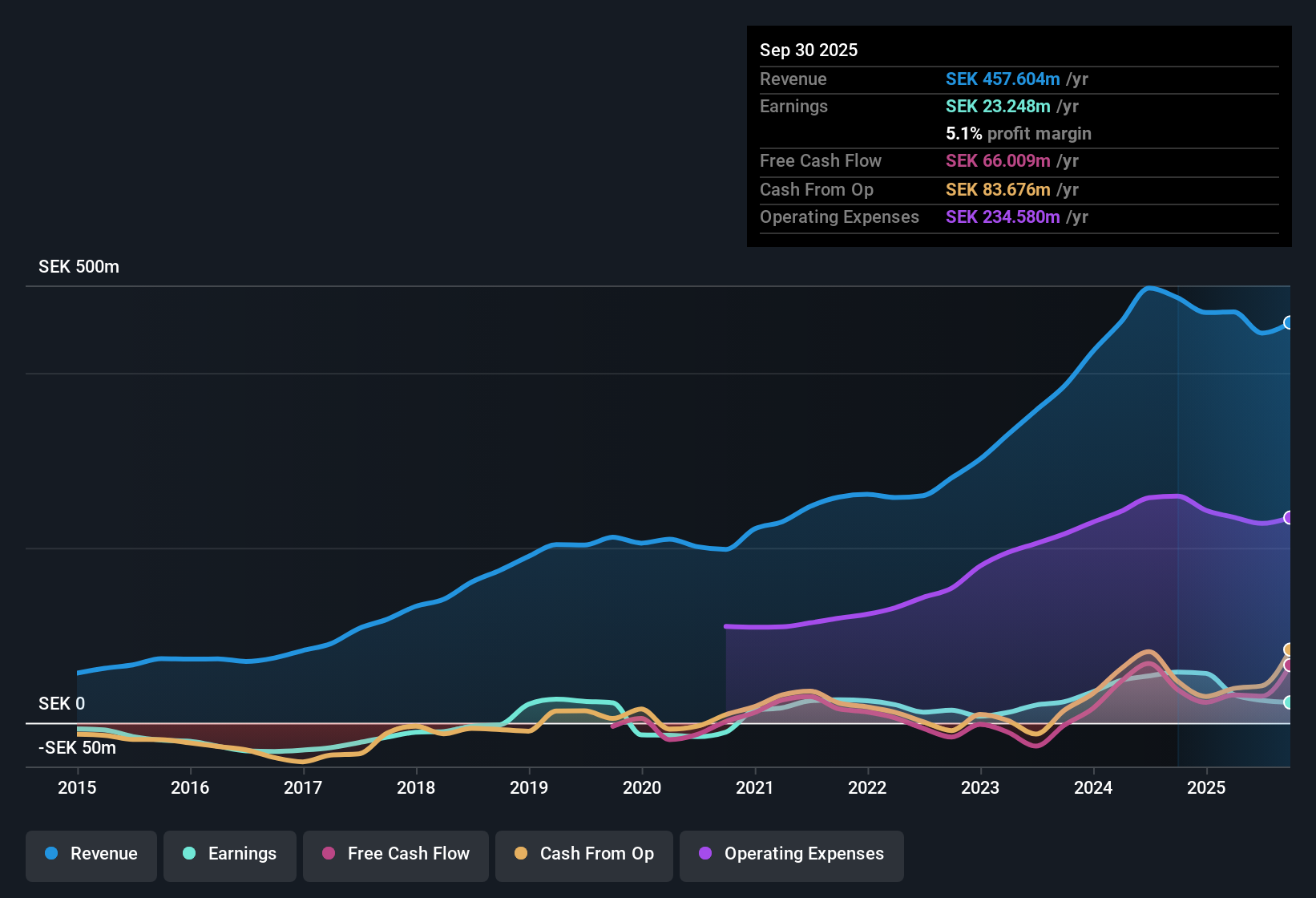

C-Rad (OM:CRAD B) reported a notable set of figures for the latest period, with earnings forecast to surge at an impressive 62.86% annual growth rate over the next three years. This is well ahead of the Swedish market’s 12.5%. Revenue is similarly expected to rise by 11.2% per year, outpacing the broader market’s 3.3%. While profitability has been sustained for five years, current profit margins have narrowed to 5.1% from 11.9% a year prior. This sets the stage for investors to weigh strong growth forecasts against recent margin pressures.

See our full analysis for C-Rad.Next, we'll see how these headline numbers match up with the dominant narratives from the Simply Wall St community. In some cases these narratives reinforce expectations, and in others, they challenge prevailing assumptions.

See what the community is saying about C-Rad

Product Orders Drive Revenue Swings

- Revenue dropped 13% year-on-year in constant currency and EBIT was halved to SEK 8 million, mainly due to weaker order intake in 2024 and no China product deliveries. This highlights how much large regional contracts control the top line.

- According to the analysts' consensus view, C-Rad’s wide exposure to big and sometimes unpredictable regional orders heightens volatility. Recurring service revenue is seen as a steadying influence.

- Consensus narrative notes that recurring contracts jumped 86% year-over-year in Q2 and have become more important for profit stability. However, reliance on one-off shipments can overshadow this effect in weak periods.

- At the same time, consensus maintains long-term optimism as global demand for radiotherapy grows and healthcare digitization accelerates. Both trends could expand the recurring revenue base if the company weathers short-term volatility.

Gross Margin Pressures Offset Efficiency Gains

- Current net margin has narrowed to 5.1%, down sharply from 11.9% a year ago, despite a 10% reduction in operating expenses. This challenges the notion that efficiency measures alone can fully counter margin pressures.

- The consensus narrative highlights that cost reductions and operational streamlining are helping, but not enough to offset the impact of market timing, regional shifts, and competition.

- With EBIT dropping to SEK 8 million and revenue declining, the consensus view stresses that while improved efficiency is valuable, dependence on large deals and fluctuating market activity can make sustaining margins difficult during leaner sales periods.

- Continuous investment in R&D and integration with industry partners remain a buffer. However, these strategies may not prevent profit margin erosion if cost discipline cannot keep pace with regional volatility and pricing competition.

Valuation Below Peers and DCF Fair Value

- C-Rad’s price-to-earnings ratio is 47.8x, well below the peer average of 77.7x, and its share price of SEK 32.95 trades at a large discount to a DCF fair value of SEK 97.42.

- The analysts' consensus view holds that this valuation gap reflects both opportunity and risk, as forecast earnings growth of 62.86% annually could unlock upside if the company delivers on ambitious targets.

- Consensus stresses that analysts are modeling revenue growth of 12.2% annually and see margins rising from 5.8% today to 23.6% over the next three years. Such high expectations make valuation sensitive to missed orders or increased competitive pressure.

- The 19% upside to a price target of SEK 38.00 offers room for optimism, though consensus cautions that achieving it will require sustained progress on both top-line growth and margin recovery to justify a re-rating toward fair value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for C-Rad on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your outlook in just a few minutes to let your perspective shape the conversation. Do it your way

A great starting point for your C-Rad research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

C-Rad’s heavy reliance on large, unpredictable regional orders and recent profit margin declines have made its earnings volatile and less predictable.

If you’d prefer companies with more consistent performance, check out stable growth stocks screener (2089 results) for a shortlist built to deliver reliable growth across changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CRAD B

C-Rad

Develops, manufactures, and sells products and systems with applications in radiotherapy for the treatment of cancer in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives