European Stocks Estimated To Be Up To 37.6% Undervalued With Discounts Starting At 11.1%

Reviewed by Simply Wall St

As European markets experience a modest upswing, buoyed by hopes of lower U.S. borrowing costs and an increase in business activity, investors are keenly observing potential opportunities in undervalued stocks. In this environment, identifying stocks trading below their intrinsic value can offer attractive prospects for those looking to capitalize on market inefficiencies and the current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK44.16 | SEK85.89 | 48.6% |

| Norconsult (OB:NORCO) | NOK45.55 | NOK90.57 | 49.7% |

| Midsummer (OM:MIDS) | SEK2.765 | SEK5.36 | 48.4% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.94 | 49.6% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.98 | €23.22 | 48.4% |

| Honkarakenne Oyj (HLSE:HONBS) | €2.80 | €5.59 | 49.9% |

| Canatu Oyj (HLSE:CANATU) | €8.98 | €17.84 | 49.7% |

| Camurus (OM:CAMX) | SEK713.00 | SEK1416.78 | 49.7% |

| Aquila Part Prod Com (BVB:AQ) | RON1.464 | RON2.86 | 48.8% |

| Apotea (OM:APOTEA) | SEK105.26 | SEK209.15 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

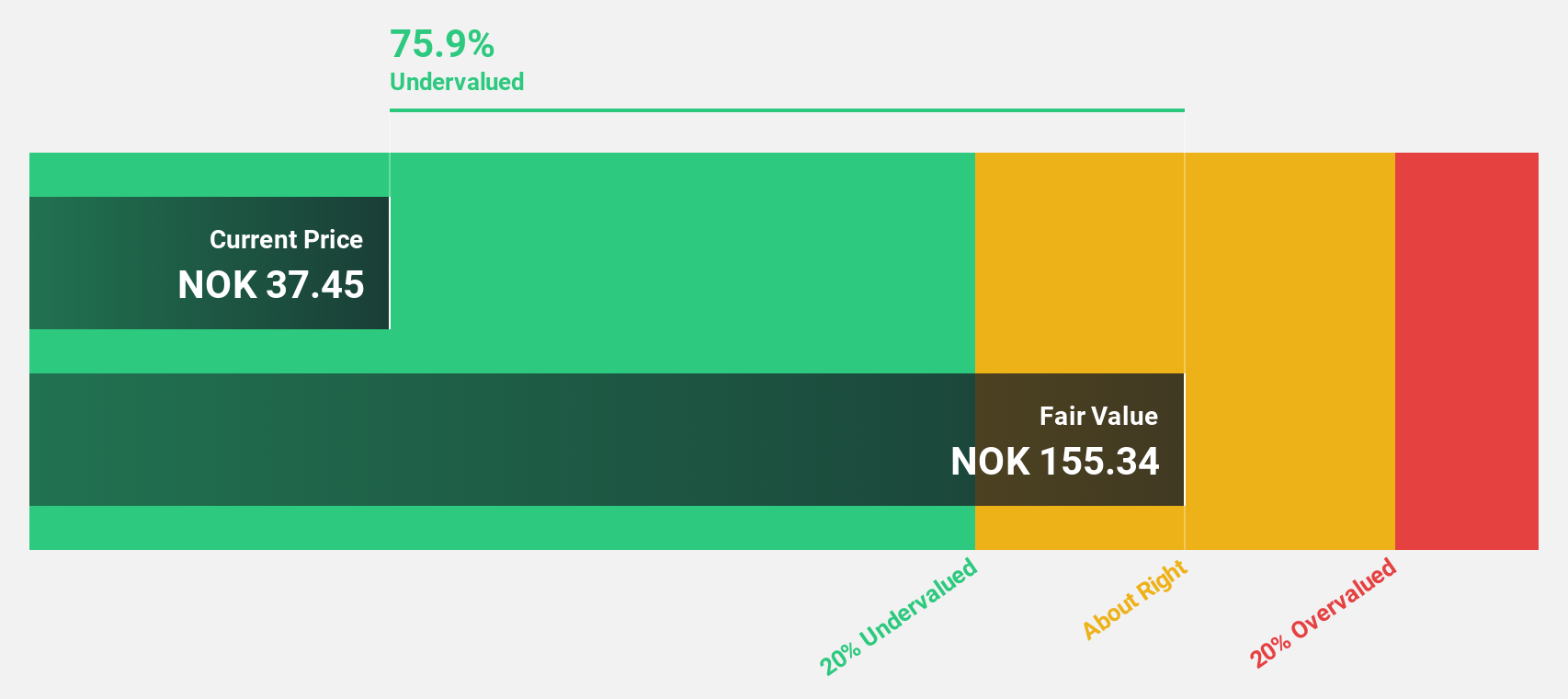

Sats (OB:SATS)

Overview: Sats ASA operates fitness and training services across Norway, Sweden, Denmark, and Finland with a market cap of NOK7.59 billion.

Operations: The company generates revenue from its Personal Services - Others segment, totaling NOK5.29 billion.

Estimated Discount To Fair Value: 37.4%

Sats ASA is trading at NOK 37.7, significantly below its estimated fair value of NOK 60.21, suggesting it may be undervalued based on cash flows. Despite a high debt level, earnings are expected to grow significantly at 23% annually over the next three years, outpacing both Norwegian market averages and revenue growth forecasts of 6.7%. Recent buybacks and a NOK 127 million dividend affirm Sats's commitment to returning value to shareholders.

- The analysis detailed in our Sats growth report hints at robust future financial performance.

- Dive into the specifics of Sats here with our thorough financial health report.

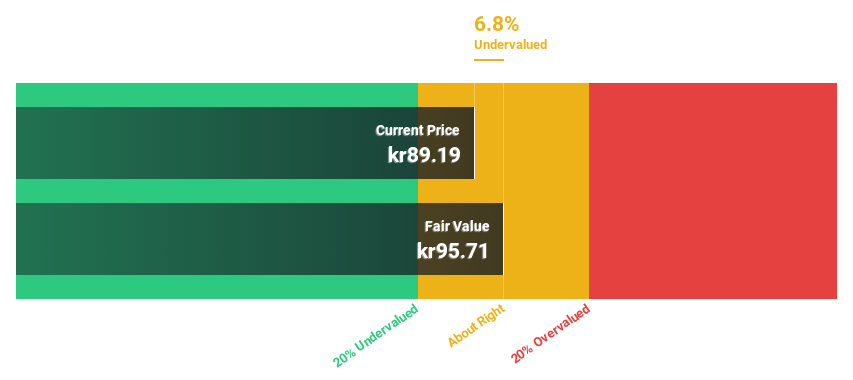

Asker Healthcare Group (OM:ASKER)

Overview: Asker Healthcare Group AB supplies medical products and solutions to support patient care, with a market cap of SEK37.84 billion.

Operations: The company generates revenue from its segments as follows: West at SEK7.79 billion, Central at SEK2.82 billion, and North (including East) at SEK5.44 billion.

Estimated Discount To Fair Value: 11.1%

Asker Healthcare Group is trading at SEK98.79, slightly below its estimated fair value of SEK111.08, indicating potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 24.51% annually over the next three years, surpassing Swedish market averages despite slower revenue growth of 11.6%. However, a high debt level remains a concern. Recent changes in company bylaws support long-term performance-based investment strategies through Class C shares issuance and reclassification.

- Our growth report here indicates Asker Healthcare Group may be poised for an improving outlook.

- Navigate through the intricacies of Asker Healthcare Group with our comprehensive financial health report here.

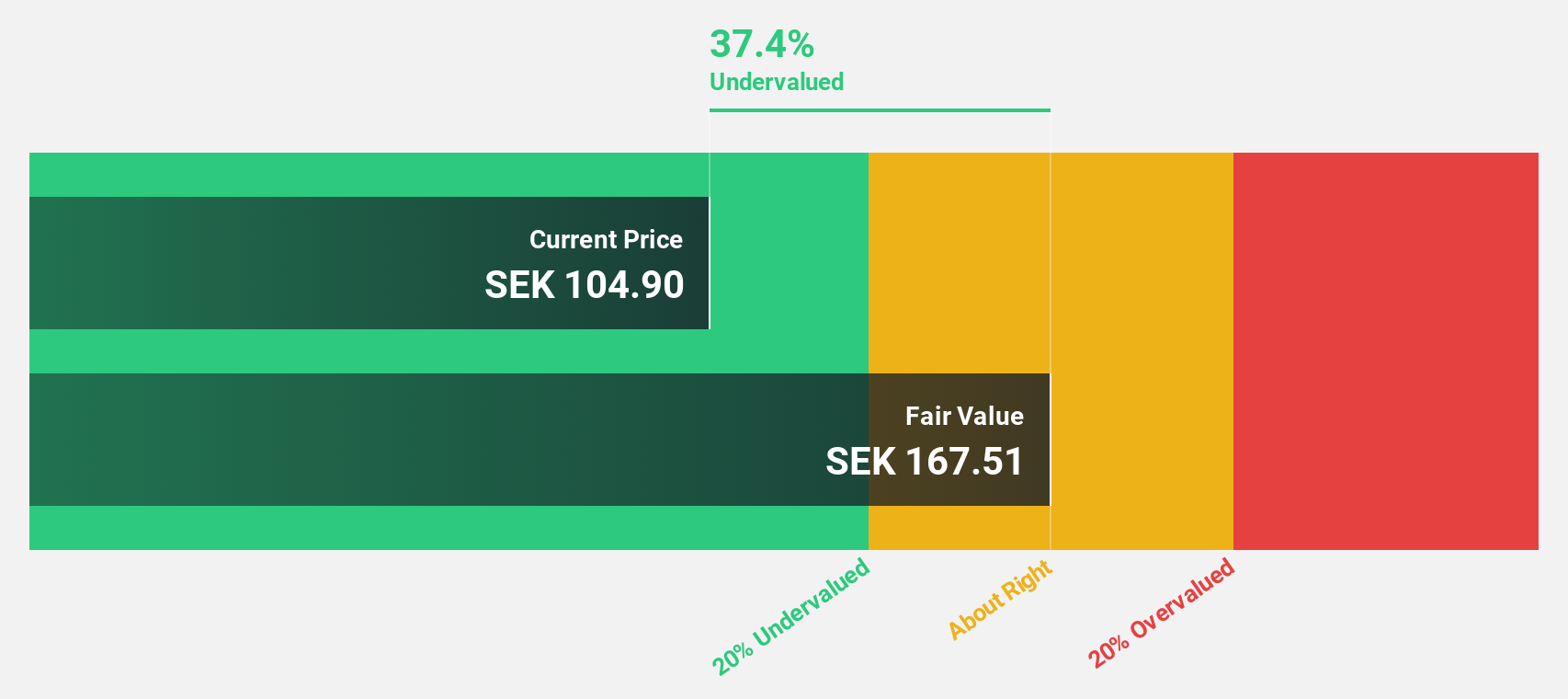

BioGaia (OM:BIOG B)

Overview: BioGaia AB is a healthcare company that develops, manufactures, markets, and sells probiotic products for gut, oral, and immune health across various global regions with a market cap of SEK10.57 billion.

Operations: BioGaia's revenue segments include Pediatrics, generating SEK1.08 billion, and Adult Health, contributing SEK352.62 million.

Estimated Discount To Fair Value: 37.6%

BioGaia is trading at SEK104.5, well below its estimated fair value of SEK167.51, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 29.3% to 19.9%, earnings are expected to grow significantly at 21.32% annually over the next three years, outpacing Swedish market averages. However, the dividend coverage by free cash flows remains weak, and recent board changes may influence future strategic directions without materially impacting current financial results.

- Our comprehensive growth report raises the possibility that BioGaia is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in BioGaia's balance sheet health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 212 Undervalued European Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

BioGaia

A healthcare company, develops, manufactures, markets and sells probiotic products for gut, oral, and immune health in Europe, the Middle East, Africa, the United States, the Asia-Pacific, Australia, and New Zealand.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives