- Sweden

- /

- Medical Equipment

- /

- OM:ARJO B

Arjo (OM:ARJO B) Margins Narrow as One-Off Loss Challenges Quality Narrative

Reviewed by Simply Wall St

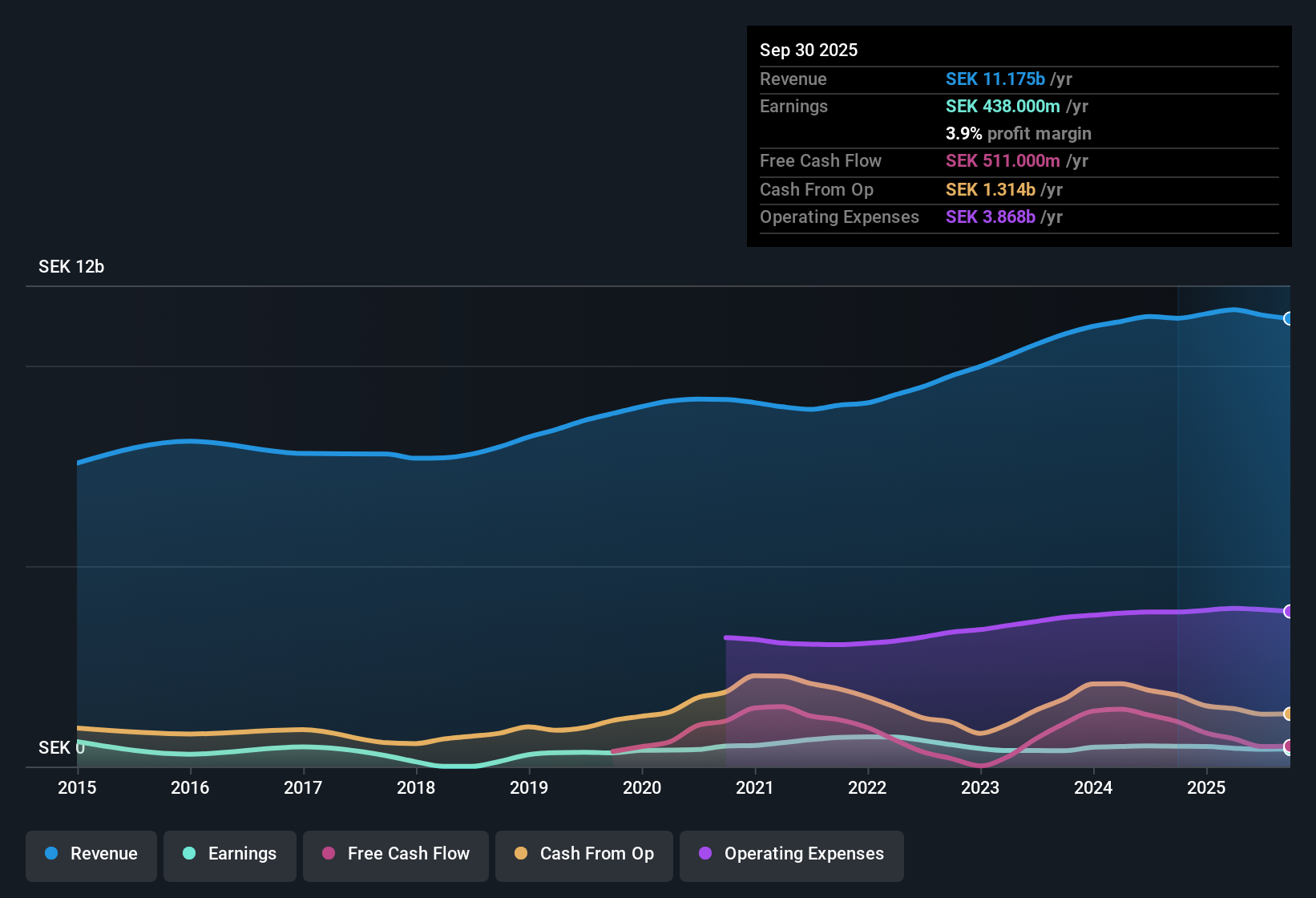

Arjo (OM:ARJO B) reported revenue growth forecasts of 3.7% per year, which comes in just above the Swedish market’s projected 3.6% annual rate. While EPS is set to accelerate strongly with a 25.09% annual earnings growth forecast over the next three years, net profit margins narrowed to 3.8% from 4.6% last year and earnings have declined by 8% per year over the past five years. With the current share price trading at SEK30.36, well below the estimated fair value of SEK75.32, investors are closely watching if the company can deliver the expected turnaround in light of recent one-off losses that impacted reported profitability.

See our full analysis for Arjo.The next section puts Arjo’s earnings performance in context with the most widely followed market narratives, highlighting where the data supports popular views and where it may challenge them.

See what the community is saying about Arjo

Margins Target 7.7% by 2028

- Analysts are projecting net profit margins to improve from the current 3.8% to 7.7% over the next three years, almost doubling current profitability even after a year affected by a one-off SEK169 million non-recurring loss.

- According to the analysts' consensus view, margin expansion is expected to come from recurring revenue channels and cost efficiency measures. However, critics highlight that persistent operational volatility, including tariff exposure and ongoing restructuring, could make it difficult for Arjo to consistently achieve these higher margin levels.

- Consensus narrative notes that demographic trends and cost control should support stronger margins. Yet, recent operational disruptions and sensitivities to price increases may pressure the sustainability of the projected gains.

- What is surprising is the significant margin jump expected, despite recent restructuring and exceptional items impacting earnings predictability.

Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

Cash Conversion Drops to 46.7%

- Operating cash conversion fell sharply to 46.7% in Q2 2025, down from 69.7% the previous year, as higher inventories and working capital tied up more cash even as the order book expanded.

- Bears argue that weakening cash flow, combined with delayed order fulfillment in certain key markets and increased working capital requirements, undercuts Arjo’s ability to finance future growth without additional debt and challenges the quality of forecasted profit growth.

- Critics highlight that these pressures on cash generation, if sustained, will limit flexibility to invest in product launches or market expansion, heightening execution risk.

- The speed of deterioration in cash conversion is especially notable, raising concerns about whether current earnings translate effectively into available funds.

Valuation Gap Widens Against Peers

- At a price-to-earnings ratio of 19.2x, Arjo trades at a substantial discount both to the industry average of 29.5x and its peers at 45x. Its SEK30.36 share price is significantly below the DCF fair value estimate of SEK75.32 and analyst target of SEK37.25.

- According to the analysts' consensus view, this valuation gap could offer upside as Arjo delivers on revenue and margin expansion. There is debate over whether current risks, such as uncertain cash flows and nonrecurring costs, warrant such a deep discount compared to sector benchmarks.

- Consensus narrative suggests that if Arjo achieves the forecasted profit growth and improved margins, re-rating toward peer multiples or closing the gap to DCF fair value and target price could occur.

- On the other hand, if operational headwinds persist, the low multiple may simply reflect justified skepticism about earnings quality and sustainability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Arjo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your perspective and build your own narrative in just a few minutes with Do it your way.

A great starting point for your Arjo research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite forecasts for revenue and margin recovery, Arjo’s recent drop in cash conversion and ongoing operational volatility raise real questions about earnings quality and reliability.

If choppy cash flow worries you, use our stable growth stocks screener (2090 results) to focus on companies showing steady revenue and earnings through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ARJO B

Arjo

Develops and sells medical devices and solutions for patients for clinical and financial outcomes for healthcare in Europe, Asia, Latin America, Africa, and Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives