David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Arcoma AB (STO:ARCOMA) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Arcoma

What Is Arcoma's Debt?

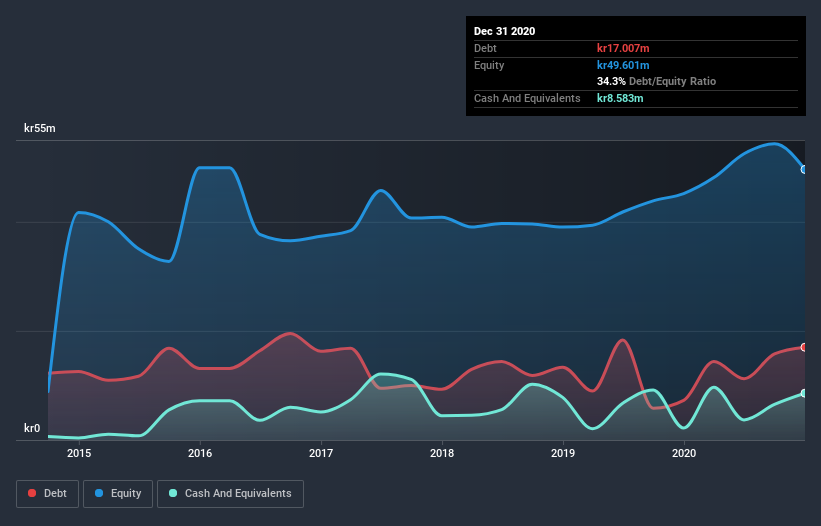

The image below, which you can click on for greater detail, shows that at December 2020 Arcoma had debt of kr16.4m, up from kr7.27m in one year. On the flip side, it has kr8.58m in cash leading to net debt of about kr7.86m.

A Look At Arcoma's Liabilities

We can see from the most recent balance sheet that Arcoma had liabilities of kr42.7m falling due within a year, and liabilities of kr2.71m due beyond that. Offsetting this, it had kr8.58m in cash and kr23.8m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr13.0m.

Since publicly traded Arcoma shares are worth a total of kr285.7m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 1.1 and interest cover of 7.0 times, it seems to us that Arcoma is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. In fact Arcoma's saving grace is its low debt levels, because its EBIT has tanked 61% in the last twelve months. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Arcoma can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last two years, Arcoma burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

While Arcoma's conversion of EBIT to free cash flow makes us cautious about it, its track record of (not) growing its EBIT is no better. But its not so bad at managing its debt, based on its EBITDA,. We should also note that Medical Equipment industry companies like Arcoma commonly do use debt without problems. Taking the abovementioned factors together we do think Arcoma's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Arcoma that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Arcoma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:ARCOMA

Arcoma

Develops, produces, and provides radiology solutions and digital x-ray systems worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives