- Sweden

- /

- Medical Equipment

- /

- NGM:POLAR

How Much Have PolarCool (NGM:POLAR) Shareholders Earned On Their Investment Over The Last Year?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the PolarCool AB (publ) (NGM:POLAR) share price is down 20% in the last year. That contrasts poorly with the market return of 18%. Because PolarCool hasn't been listed for many years, the market is still learning about how the business performs. In the last ninety days we've seen the share price slide 20%.

Check out our latest analysis for PolarCool

PolarCool recorded just kr678,848 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that PolarCool will significantly advance the business plan before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

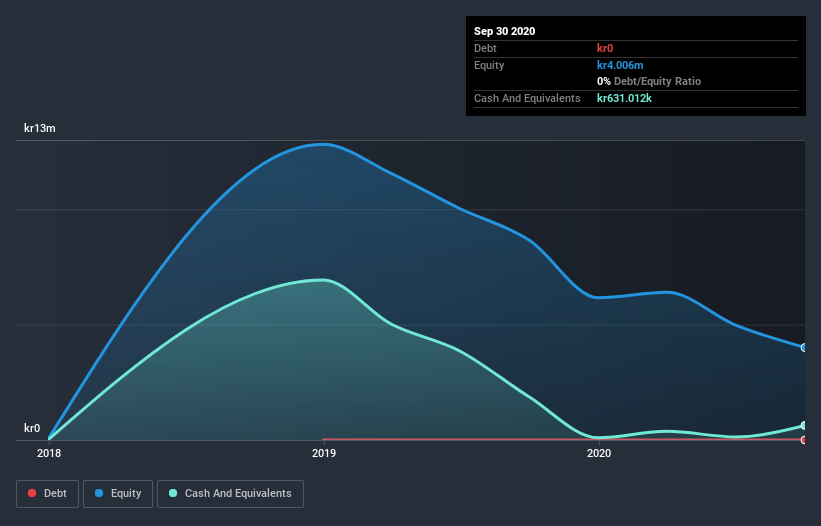

Our data indicates that PolarCool had kr6.5m more in total liabilities than it had cash, when it last reported in September 2020. That makes it extremely high risk, in our view. But since the share price has dived 20% in the last year , it looks like some investors think it's time to abandon ship, so to speak. You can see in the image below, how PolarCool's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between PolarCool's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that PolarCool's TSR, at 16% is higher than its share price return of -20%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're happy to report that PolarCool are up 16% over the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 18%. Unfortunately the share price is down 20% over the last quarter. It may simply be that the share price got ahead of itself, and its quite possible it will keep moving in the right direction, especially if the business continues to deliver good financial results. It's always interesting to track share price performance over the longer term. But to understand PolarCool better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for PolarCool (of which 3 make us uncomfortable!) you should know about.

But note: PolarCool may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading PolarCool or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:POLAR

PolarCool

A medical device company, develops, markets, and sells products for sports medicine.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives