- Sweden

- /

- Medical Equipment

- /

- NGM:PHI

Here's Why Phase Holographic Imaging PHI (NGM:PHI) Can Afford Some Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Phase Holographic Imaging PHI AB (publ) (NGM:PHI) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Phase Holographic Imaging PHI

How Much Debt Does Phase Holographic Imaging PHI Carry?

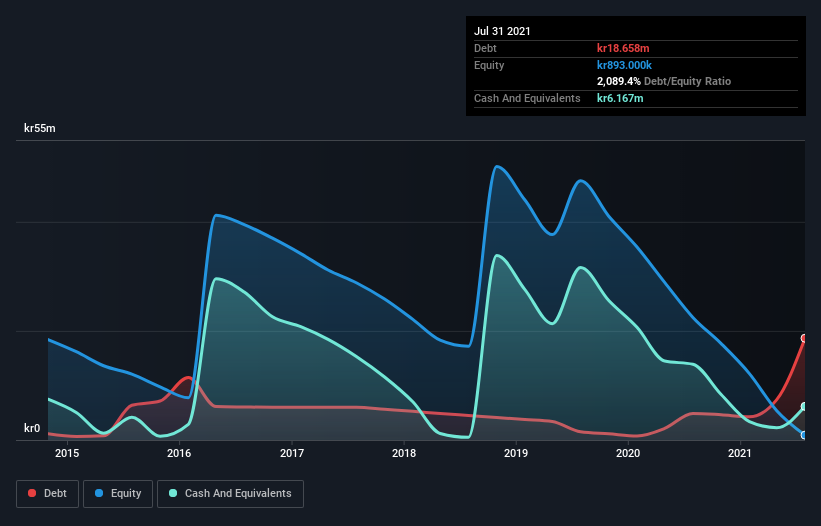

As you can see below, at the end of July 2021, Phase Holographic Imaging PHI had kr18.7m of debt, up from kr4.88m a year ago. Click the image for more detail. However, it does have kr6.17m in cash offsetting this, leading to net debt of about kr12.5m.

A Look At Phase Holographic Imaging PHI's Liabilities

Zooming in on the latest balance sheet data, we can see that Phase Holographic Imaging PHI had liabilities of kr7.44m due within 12 months and liabilities of kr18.7m due beyond that. Offsetting these obligations, it had cash of kr6.17m as well as receivables valued at kr3.56m due within 12 months. So it has liabilities totalling kr16.4m more than its cash and near-term receivables, combined.

Of course, Phase Holographic Imaging PHI has a market capitalization of kr318.8m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. When analysing debt levels, the balance sheet is the obvious place to start. But it is Phase Holographic Imaging PHI's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Phase Holographic Imaging PHI wasn't profitable at an EBIT level, but managed to grow its revenue by 76%, to kr5.9m. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Even though Phase Holographic Imaging PHI managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost kr21m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through kr22m of cash over the last year. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 5 warning signs for Phase Holographic Imaging PHI (3 are significant!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:PHI

Phase Holographic Imaging PHI

A medical technology company, develops and markets non-invasive time-lapse imaging instruments in Sweden and internationally.

Worrying balance sheet with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026