Scandi Standard (OM:SCST) Margin Narrowing Undercuts Bullish Narrative Despite Strong Long-Term Growth Forecasts

Reviewed by Simply Wall St

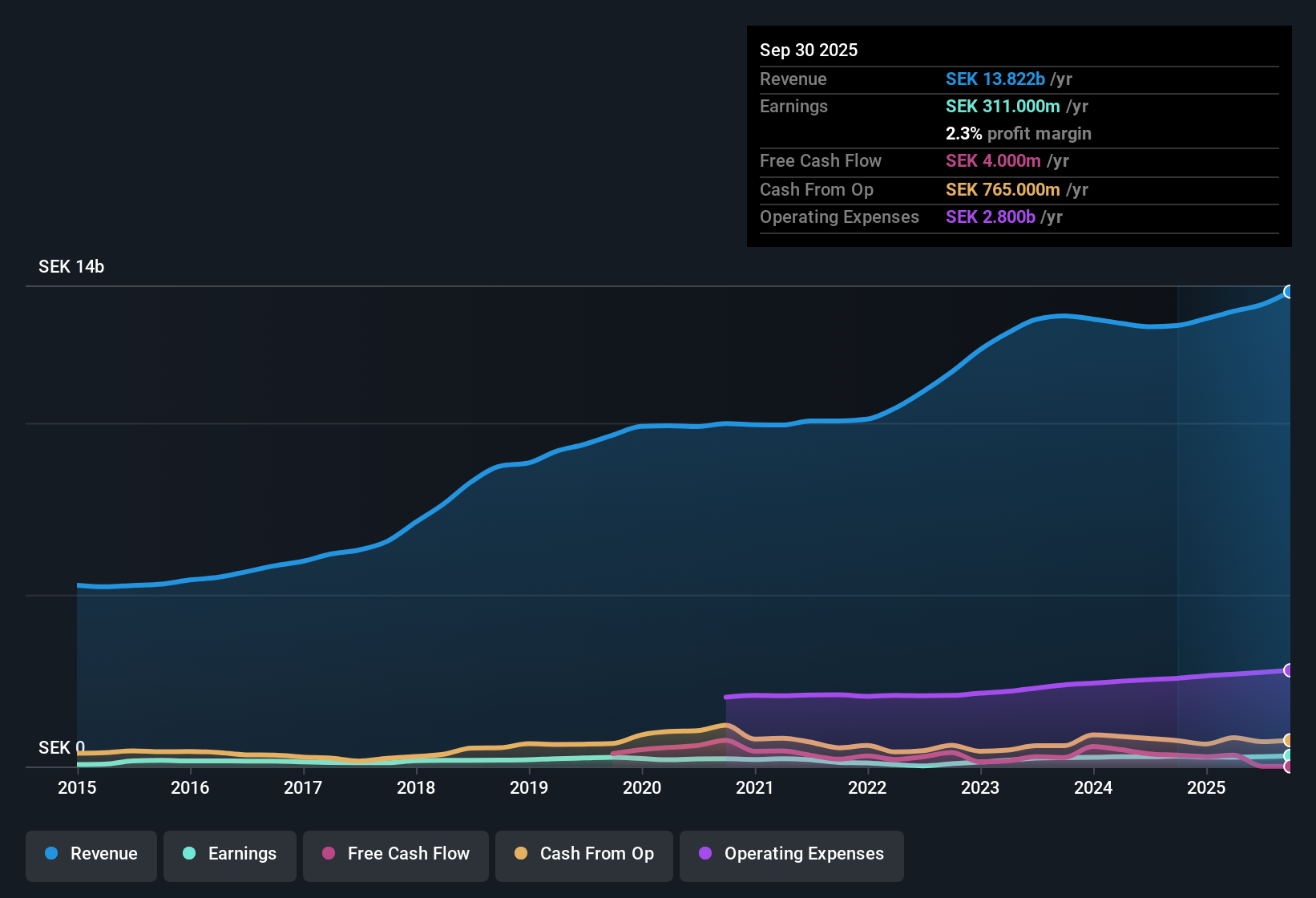

Scandi Standard (OM:SCST) reported earnings that have grown 16.4% annually over the past five years, but recent growth has slowed as earnings increased just 0.7% over the last year. The company’s current net profit margin of 2.1% is slightly lower than last year’s 2.2%. Looking forward, analysts expect annual earnings growth of 19.8% and revenue to climb by 4.4% per year, outpacing the Swedish market forecast of 3.6% per year.

See our full analysis for Scandi Standard.Now we will see how these figures match up against the narratives that dominate investor sentiment and where the latest results might challenge expectations.

See what the community is saying about Scandi Standard

Margin Targets Rise Despite Input Pressures

- Forecasts expect profit margins to climb from 2.1% today to 3.2% within three years, signaling room for operational efficiency and margin expansion despite recent margin softness.

- Analysts' consensus view suggests that this target is achievable due to several factors:

- Capacity expansions underway in Lithuania and the Netherlands, which, if executed well, could support higher efficiency and buffer against rising feed and input costs.

- Ongoing market leadership and premium pricing strategies help counterbalance regulatory and cost headwinds. However, any missteps or significant regulatory changes could quickly tighten margins.

Premium to Fair Value Sparks Pricing Debate

- The current share price of SEK 95.4 trades well below the DCF fair value estimate of SEK 236.11, but remains 17.7% above the consensus analyst price target of SEK 81.0, putting valuation debate front and center.

- Analysts' consensus view frames this as both an opportunity and a caution:

- Despite underlying business improvements, the market price reflects higher expectations than analysts believe are justified by near-term earnings projections and the required PE compression to 12.2x by 2028.

- Investors will need conviction that net margins and revenue trajectory can outperform, or risk downside if growth or cost assumptions fall short.

PE Ratio Undercuts Peers but Not the Industry

- Scandi Standard’s Price-to-Earnings ratio of 21.9x offers a discount to the peer average of 25.4x, but is still notably higher than the wider European food industry average of 15.9x. This underscores a nuanced position in the valuation landscape.

- Analysts' consensus view notes that this dual discount and premium sends mixed signals:

- The peer discount supports the case for stability and less downside risk compared to immediate competitors, as long as growth forecasts hold up.

- The premium to the broader food sector, however, highlights how much of Scandi Standard’s future is already priced in. Any stumble in forecast delivery could see this premium quickly erode.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Scandi Standard on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spotted a different angle in the results? Take just a few minutes to share your view and build your own narrative. Do it your way.

A great starting point for your Scandi Standard research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Scandi Standard’s share price premium, combined with uncertain margin sustainability and analyst valuation concerns, signals potential risks if forecasts are not met.

If you’re wary of paying too much for earnings momentum, prioritize value by searching for stocks trading at attractive prices using these 876 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SCST

Scandi Standard

Produces and sells chilled, frozen, and ready-to-eat chicken products in Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, rest of Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives