Stock Analysis

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Scandi Standard AB (publ) (STO:SCST) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Scandi Standard

What Is Scandi Standard's Debt?

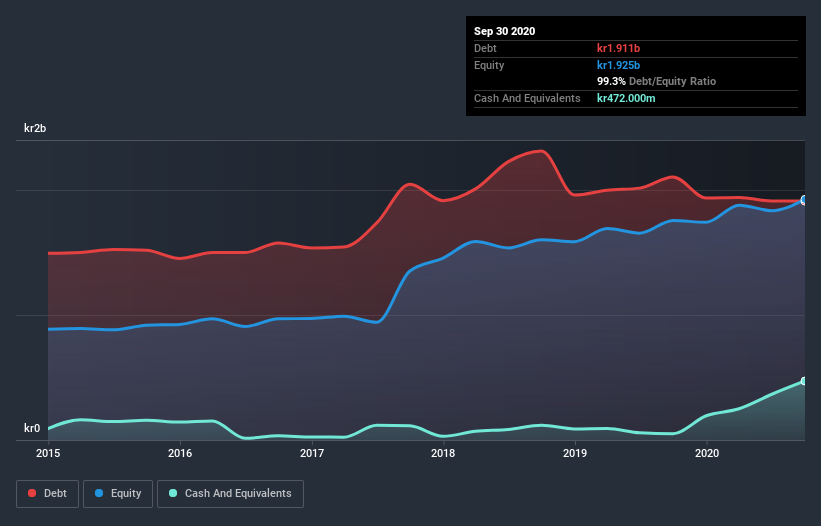

You can click the graphic below for the historical numbers, but it shows that Scandi Standard had kr1.91b of debt in September 2020, down from kr2.10b, one year before. However, it also had kr472.0m in cash, and so its net debt is kr1.44b.

How Healthy Is Scandi Standard's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Scandi Standard had liabilities of kr2.20b due within 12 months and liabilities of kr2.58b due beyond that. On the other hand, it had cash of kr472.0m and kr1.08b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr3.22b.

This deficit is considerable relative to its market capitalization of kr4.51b, so it does suggest shareholders should keep an eye on Scandi Standard's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With a debt to EBITDA ratio of 2.3, Scandi Standard uses debt artfully but responsibly. And the alluring interest cover (EBIT of 7.5 times interest expense) certainly does not do anything to dispel this impression. The bad news is that Scandi Standard saw its EBIT decline by 13% over the last year. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Scandi Standard can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Scandi Standard actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Scandi Standard's EBIT growth rate and level of total liabilities definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. We think that Scandi Standard's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Scandi Standard has 1 warning sign we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Scandi Standard, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Scandi Standard is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:SCST

Scandi Standard

Produces and sells chilled, frozen, and ready-to-eat chicken products in Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, rest of Europe, and internationally.

Good value with proven track record.