Don't Race Out To Buy Midsona AB (publ) (STO:MSON B) Just Because It's Going Ex-Dividend

Midsona AB (publ) (STO:MSON B) stock is about to trade ex-dividend in 3 days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. Meaning, you will need to purchase Midsona's shares before the 8th of May to receive the dividend, which will be paid on the 14th of May.

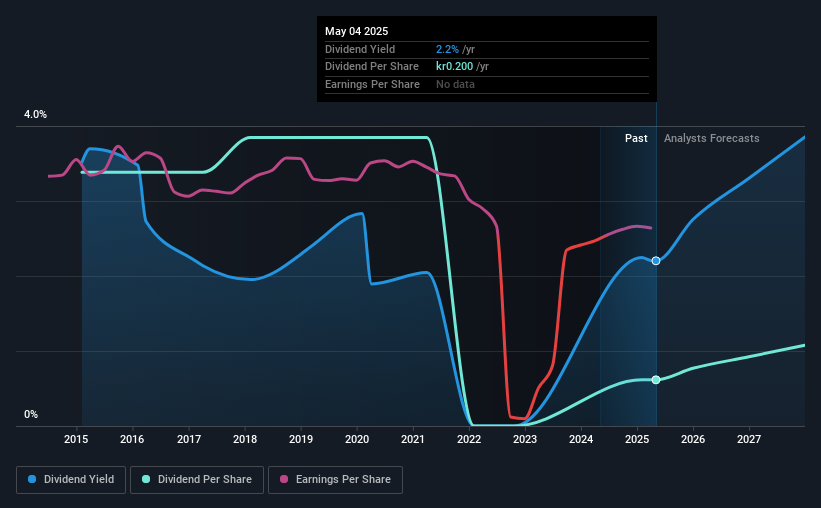

The company's upcoming dividend is kr00.20 a share, following on from the last 12 months, when the company distributed a total of kr0.20 per share to shareholders. Looking at the last 12 months of distributions, Midsona has a trailing yield of approximately 2.2% on its current stock price of kr09.08. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Midsona can afford its dividend, and if the dividend could grow.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Its dividend payout ratio is 77% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. We'd be worried about the risk of a drop in earnings.

Check out our latest analysis for Midsona

Click here to see how much of its profit Midsona paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Midsona's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 34% a year over the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Midsona's dividend payments per share have declined at 16% per year on average over the past 10 years, which is uninspiring. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

The Bottom Line

Is Midsona an attractive dividend stock, or better left on the shelf? Earnings per share have been declining and the company is paying out more than half its profits to shareholders; not an enticing combination. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're on the fence about its dividend prospects.

With that being said, if dividends aren't your biggest concern with Midsona, you should know about the other risks facing this business. For example - Midsona has 1 warning sign we think you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MSON B

Midsona

A consumer goods company, provides organic and consumer health products, and health food products in Sweden, Denmark, Finland, Norway, France, Spain, Germany, Rest of Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives