Cloetta (OM:CLA B) Profit Margin Surges to 8.3%, Reinforcing Value Narrative

Reviewed by Simply Wall St

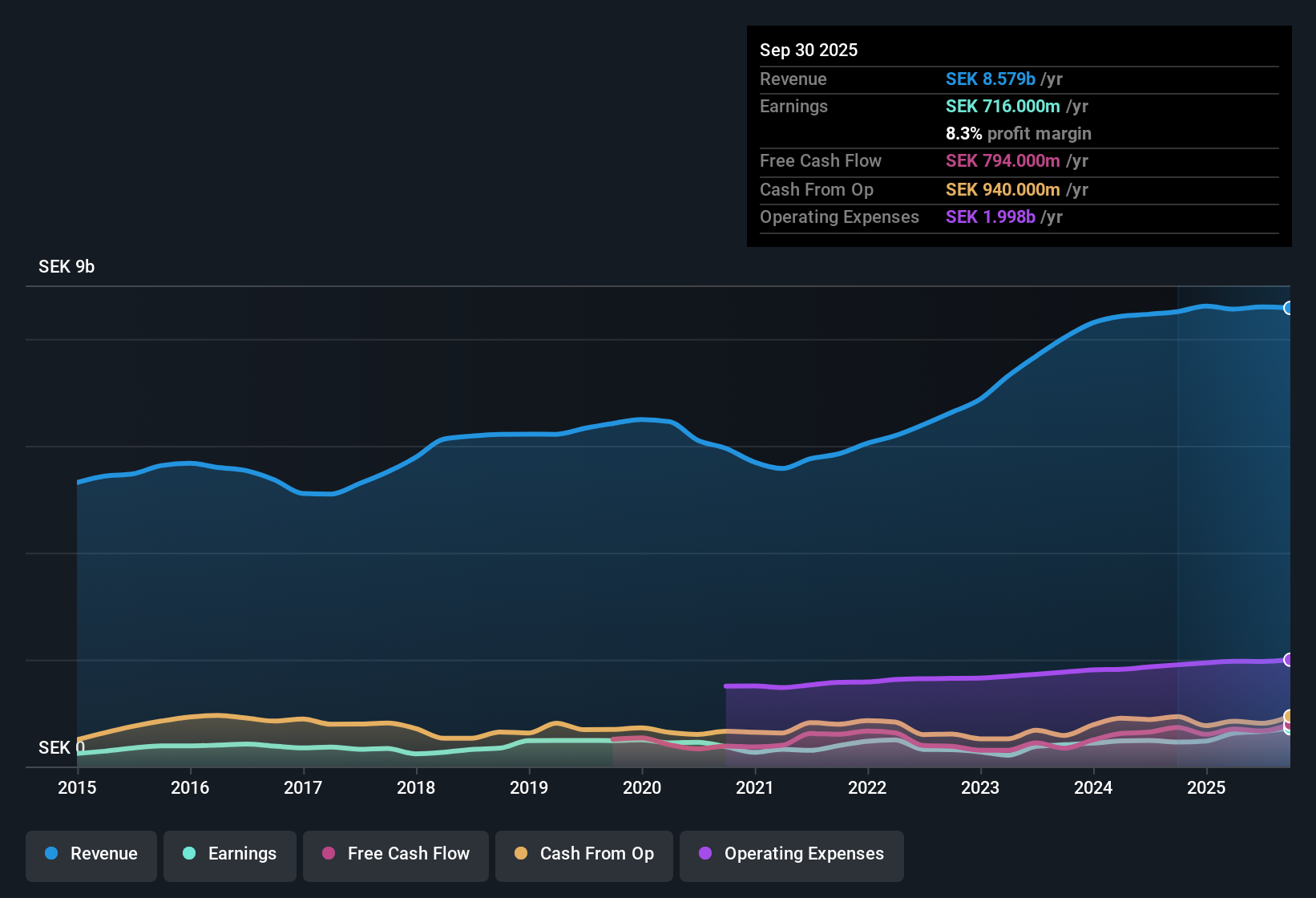

Cloetta (OM:CLA B) delivered standout earnings results this year, with EPS jumping 56.7% compared to its historical average of 14.3% annual growth over the past five years. Net profit margin rose to 8.3%, outpacing last year's 5.4%. However, revenue growth projections of 1.6% per year lag the broader Swedish market's 3.7%. Investors will note that while the company's valuation looks appealing versus industry peers, forecasts now expect earnings to decline by 1.8% per year over the next three years, setting the stage for a more cautious outlook.

See our full analysis for Cloetta.The numbers tell a compelling story, but the real insight comes from weighing them against the narratives circulating in the investing community. Next up, we will see which narratives align with the facts and which may need a fresh look.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Hits 8.3% as Cost Pressures Ease

- Cloetta’s net profit margin increased to 8.3%, climbing above last year's 5.4% and highlighting improved profitability in a competitive market.

- Gains in margin support the view that steady cost management and brand strength have helped offset inflation. Recent market commentary notes that confectionery companies like Cloetta can pass cost increases to consumers more effectively than other sectors.

- Despite margin gains, cost inflation remains a top sector risk, so investors are watching to see whether these improvements persist if input prices rise again.

- Stable profit margins reinforce the thesis that defensive stocks with strong brands, such as Cloetta, can deliver during periods of broader market uncertainty.

Revenue Growth Lags Swedish Market

- Revenue is projected to grow just 1.6% per year for Cloetta, which falls short of the Swedish market's average growth rate of 3.7% per year.

- While reliable sales streams support investor confidence in defensive consumer names, the relatively slow top-line growth means that future upside could be limited without accelerated product innovation or market expansion.

- Sector trends highlight the importance of new launches in health-conscious categories and premiumization to outpace sluggish industry-wide growth.

- Slow forecasted growth creates a potential drag on sentiment if the company cannot pivot successfully or if cost savings no longer boost the bottom line.

Trading at a Discount: 13.7x P/E Versus Peers

- Cloetta is valued at a price-to-earnings ratio of 13.7x, significantly lower than both its industry peers at 22.7x and the wider European food sector at 15.5x.

- This valuation discount is drawing attention, as relative bargains in defensive sectors are rare, especially when paired with stable margins and recognized brands.

- Active investors may see room for the share price ($34.18) to catch up if Cloetta closes the earnings growth gap or delivers on new initiatives.

- If earnings slip as forecasted, however, some caution that the stock could remain undervalued while yielding lackluster total returns, even at this attractive multiple.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Cloetta's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Cloetta’s muted revenue growth and expected near-term earnings decline highlight concerns about finding steady upside in a slow-moving market segment.

If you want alternatives with consistent top-line expansion, discover stable growth stocks screener (2082 results) for companies that reliably deliver strong results across changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CLA B

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives