AAK (OM:AAK) Margin Decline Raises Fresh Concerns on Dividend Sustainability Narrative

Reviewed by Simply Wall St

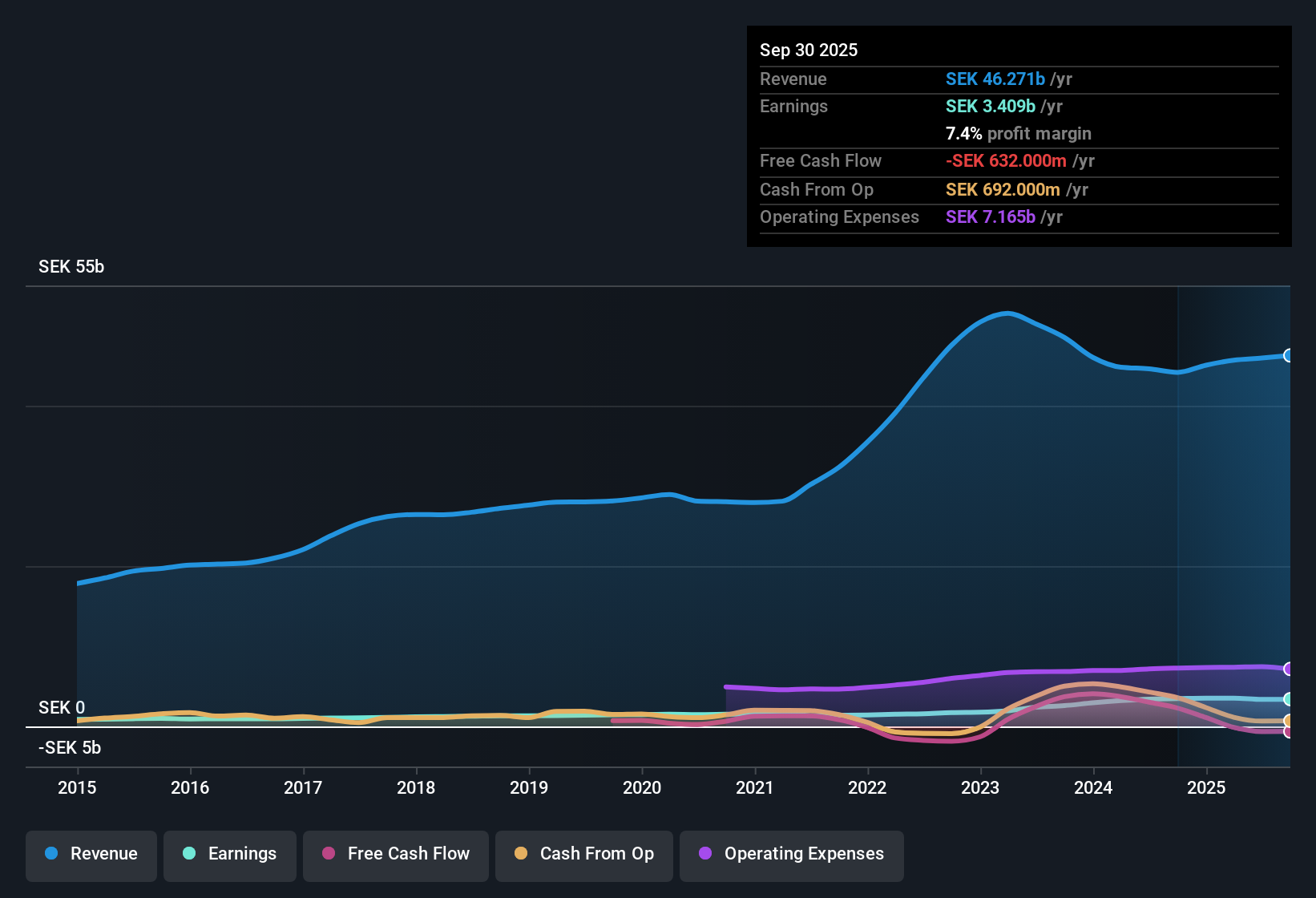

AAK AB (publ.) (OM:AAK) reported revenue forecasted to grow 4.4% per year, topping the Swedish market’s 3.6%. Earnings are projected to increase at 11.1% annually, although this trails the Swedish market’s expected 12.3% growth. Net profit margins came in at 7.3%, slipping slightly from 7.6% the year before. Over the past five years, average annual profit growth averaged a strong 23.7% despite negative growth in the most recent period, highlighting a track record of high-quality earnings.

See our full analysis for AAK AB (publ.).Now, let’s see how these results compare to the prevailing narratives in the market. Some perspectives may get reinforced while others could face new questions.

See what the community is saying about AAK AB (publ.)

Margin Pressures and Optimization Drive

- Net profit margins slipped to 7.3%, down from 7.6% the year prior, even as average annual profit growth over the last five years held strong at 23.7%. This highlights AAK’s ability to generate high-quality earnings despite recent softness.

- Analysts' consensus view emphasizes how operational efficiency investments, such as production process enhancements and the Fit-to-Win cost initiative (targeting SEK 300 million in annualized savings by mid-2026), are expected to offset margin pressures and underpin earnings resilience.

- Consensus narrative notes that while recent margin compression poses challenges, cost-saving programs and innovation investments are positioned to drive higher margins and long-term stability.

- Despite internal gains, persistent volume declines and sustainability risks could still threaten margin progression. This makes the success of these initiatives critical for the bullish case.

Curious if margin gains will hold up or fade as the market changes? Get the consensus narrative and see what analysts expect for AAK.

📊 Read the full AAK AB (publ.) Consensus Narrative.

Valuation: Discount to Peers, Premium to Industry

- AAK trades at a price-to-earnings ratio of 20.9x versus a peer average of 25.7x, suggesting an attractive discount to direct competitors. However, it stands more expensive than the broader European food industry average P/E of 15.9x.

- Analysts' consensus view considers this relative valuation dynamic pivotal as it positions AAK as a growth-focused company that commands a sector premium yet offers some value relative to peers.

- The current share price of SEK 271.80 sits below both the analyst average price target of 303.63 and the DCF fair value of 322.37. This creates a potential upside if the company delivers on growth and efficiency targets.

- Consensus narrative highlights that future margin expansion and diversification efforts are key to justifying the higher sector multiple while also closing the gap to fair value estimates.

Dividend Sustainability Faces Scrutiny

- While AAK’s consistent revenue and profit growth strengthen its investment appeal, the EDGAR summary flags risks tied to the sustainability of its dividend, particularly as profit margins have declined year-over-year.

- Analysts' consensus view outlines how ongoing investments in operational optimization and restructuring require significant upfront costs, putting ongoing pressure on free cash flow and dividend stability. These investments are considered vital for long-term profit growth.

- Consensus narrative points out that if anticipated productivity gains from these initiatives stall or market conditions worsen, both net margins and dividend payouts could face renewed challenges.

- Notably, walking away from lower-margin contracts to protect pricing power may support long-term margin resilience but could also restrict top-line and payout growth in the near term.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AAK AB (publ.) on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle others may have missed? Share your analysis and shape your own perspective in just a few minutes. Do it your way.

A great starting point for your AAK AB (publ.) research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

AAK’s declining net margins and pressure on dividend sustainability raise questions about its ability to deliver consistently reliable income for shareholders.

If dependable payouts matter most to you, check out these 1979 dividend stocks with yields > 3% to find companies with more stable yields and healthier profit trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AAK

AAK AB (publ.)

Develops and sells plant-based oils and fats in Sweden and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives