- Sweden

- /

- Oil and Gas

- /

- OM:TETY

Tethys Oil AB (publ) (STO:TETY) Stock Catapults 79% Though Its Price And Business Still Lag The Industry

Tethys Oil AB (publ) (STO:TETY) shares have had a really impressive month, gaining 79% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.1% over the last year.

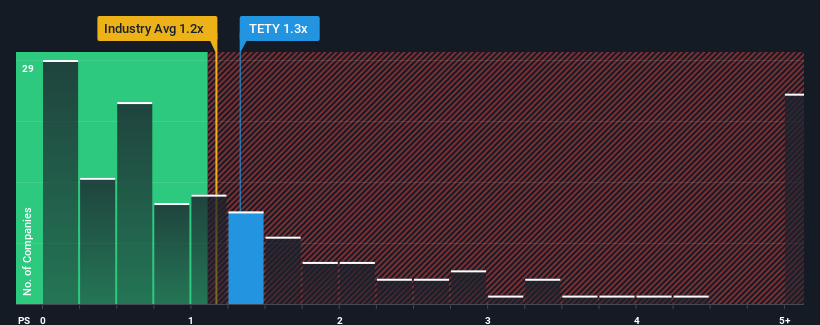

In spite of the firm bounce in price, Tethys Oil's price-to-sales (or "P/S") ratio of 1.3x might still make it look like a strong buy right now compared to the wider Oil and Gas industry in Sweden, where around half of the companies have P/S ratios above 8.9x and even P/S above 24x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Tethys Oil

What Does Tethys Oil's Recent Performance Look Like?

Tethys Oil could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Tethys Oil's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Tethys Oil?

The only time you'd be truly comfortable seeing a P/S as depressed as Tethys Oil's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. Even so, admirably revenue has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 7.3% each year as estimated by the lone analyst watching the company. Meanwhile, the broader industry is forecast to expand by 0.3% per year, which paints a poor picture.

In light of this, it's understandable that Tethys Oil's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Tethys Oil's P/S Mean For Investors?

Shares in Tethys Oil have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Tethys Oil maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Having said that, be aware Tethys Oil is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tethys Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TETY

Tethys Oil

Explores for and produces oil and natural gas properties in the Sultanate of Oman.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives