Investors signalled that they were pleased with Maha Energy AB (publ)'s (STO:MAHA A) most recent earnings report. This reaction by the market reaction is understandable when looking at headline profits and we have found some further encouraging factors.

View our latest analysis for Maha Energy

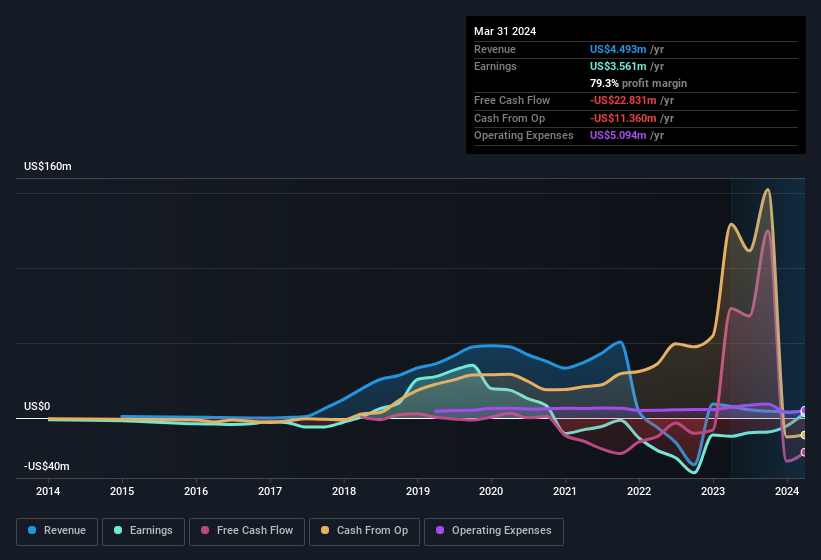

The Impact Of Unusual Items On Profit

For anyone who wants to understand Maha Energy's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by US$5.9m due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Maha Energy took a rather significant hit from unusual items in the year to March 2024. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Maha Energy's Profit Performance

As we mentioned previously, the Maha Energy's profit was hampered by unusual items in the last year. Based on this observation, we consider it possible that Maha Energy's statutory profit actually understates its earnings potential! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. At Simply Wall St, we found 2 warning signs for Maha Energy and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of Maha Energy's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MAHA A

Maha Capital

Engages in the exploration, development, and production of oil, natural gas, and minerals sectors in Brazil, the United States, and Oman.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives